No Data

01772 GANFENGLITHIUM

- 25.200

- +1.200+5.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Hong Kong stocks market abnormal | Overseas lithium production reduction continuously sends price support signals. Ganfeng Lithium (01772) surged over 5%, Tianqi Lithium Corporation (09696) surged nearly 4%.

Lithium stocks rose in early trading. As of the time of writing, Ganfeng Lithium (01772) was up 4.79% at HK$25.15; tianqi lithium corporation (09696) was up 3.52% at HK$27.95.

Ganfeng Lithium Group Co., Ltd. (SZSE:002460) Stock Rockets 28% As Investors Are Less Pessimistic Than Expected

Express News | JPMorgan Chase & Co's Long Position in H-Shares of Ganfeng Lithium Decreases to 8.61% on Nov 18 From 9.17% - HKEX

New Aluminum Era (301613.SZ): Since 2024, the company has signed long-term supply agreements with CSC Jinling, ganfenglithium, and XCMG new energy fund.

Gelonghui, November 22nd | In the new aluminum era (301613.SZ), at recent investor relations activities, the company actively engaged in product solution exchanges and technical discussions with Contemporary Amperex Technology for new customers since 2023, and passed the Contemporary Amperex Technology's qualified supplier audit in May 2024, expecting to achieve mass production supply of battery pack products within 2024. In addition, since 2024, the company has signed long-term supply agreements with Zhongchuang Xinhang, Ganfeng Lithium, and Xugong New Energy, obtaining multiple designated projects for battery pack and related products.

Is the lithium battery industry chain about to bottom out? Insiders predict that prices are expected to rebound next year, with industry leaders emphasizing global layout | Exclusive coverage of the High Work Lithium Battery Annual Conference.

① At the 2024 High-tech Lithium Battery Annual Conference held yesterday, Zhang Xiaofei, chairman of High-tech Lithium Battery, predicted that the first quarter of next year will be the lowest price point, and in the second quarter of next year, the prices of battery raw materials will begin to rise; ② The future industry will face a more severe competitive landscape and capacity thresholds, and the solution offered by leading enterprises is to expand overseas.

【Industry Trends】China's railroads conduct large-scale trial operation of lithium batteries for the first time; multiple paper companies raise product prices.

For the first time, China's railroads conducted a large-scale trial transportation of lithium batteries on November 19. The first departure of the national railroad trial run of lithium batteries in Chongqing is waiting to depart on the Chongqing Changshou Yuba dedicated railroad (drone photo). Xinhua News Agency reporter Tang Yi captured the scene. On that day, three trains carrying power lithium batteries respectively departed slowly from the Chongqing Changshou Yuba dedicated railroad, Yibin Port in Sichuan, and Guiyang International Land Port. This is the first large-scale trial transportation of power lithium batteries by China's railroads, which will help facilitate the global distribution of domestically produced power lithium battery products. Source: xinhuanet co., ltd. Multiple papermaking companies have recently raised their product prices as factors such as supply and demand improvement have driven the price hikes.

Comments

Fueled by aggressive economic stimulus package, an amazing run-up occurred in China equities ahead of PRC National Day. The streak continued when the market reopened after a one-week break.

On October 8th, 4,976 stocks opened up by 9% or more; only 5 stocks opened down. All in all, benchmark index CSI300 posted a 32% gain in SIX trading DAYs.

The amount of time taken for the US market to rebound 3...

If you are a patient investor and like the idea of being invested in Australia's biggest lithium company who continues...

For resource stocks, $CHALCO (02600.HK)$ declined 3.6%, while $GANFENGLITHIUM (01772.HK)$ and $TIANQI LITHIUM (09696.HK)$ crumple...

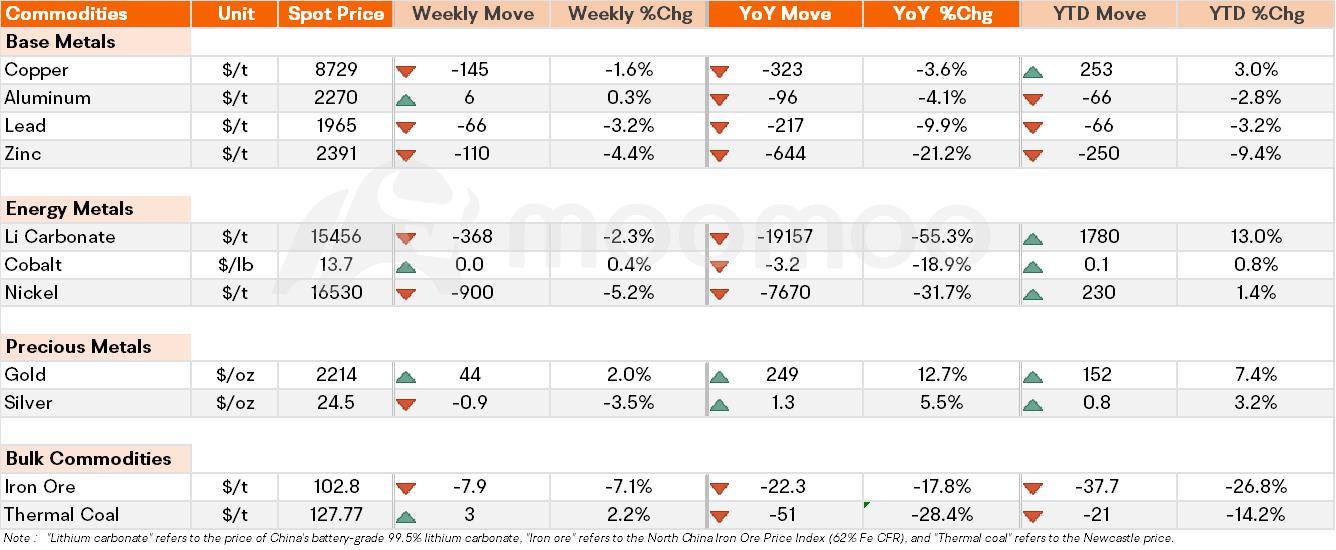

Spot Price Snapshot

Key Price Moves

Gold: On Thursday, the price of gold reached an all-time high and experienced its strongest month in more than three years due to high demand for safe-haven assets and expectati...

Analysis

Price Target

No Data

No Data