No Data

01798 DATANG RENEW

- 2.070

- -0.020-0.96%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

China Datang Corporation Renewable Power (HKG:1798) Hasn't Managed To Accelerate Its Returns

Tianfeng: How will government debt relief in 2025 affect the Eco-friendly Concept public utility industry?

Debt restructuring is expected to relieve the pressure of receivables for eco-friendly enterprises, primarily through: issuing new Bonds to pay off corporate debts; alleviating government debt pressure, optimizing the pace of fiscal spending; and improving the business environment to create a positive cycle of economic development.

Selected announcements | Ping An Insurance's original premium income in the current year is nearly 800 billion yuan; GANFENGLITHIUM's Goulamina spodumene project phase one has officially gone into production.

In the first 11 months, New China Life Insurance accumulated original insurance premium income of 163.1663 billion yuan, a year-on-year increase of 2.2%; Ideal Autos granted a total of 3.94697 million restricted stock units.

Datang Renewable Power's November Power Generation Slides 17%

DATANG RENEW (01798.HK): In November, the total electricity generation was 2.7773 million megawatt-hours, a decrease of 16.60% year-on-year.

On December 13, Gelonghui reported that DATANG RENEW (01798.HK) announced that, according to preliminary Statistics, the group completed a power generation of 2.7773 million megawatt-hours in November 2024, a decrease of 16.60% compared to 2023. Among them, the completed wind power generation was 2.5297 million megawatt-hours, a decrease of 19.43% compared to 2023; the photovoltaic generation was 0.2476 million megawatt-hours, an increase of 29.97% compared to 2023. As of November 30, 2024, the group had accumulated a total power generation of 28.7502 million megawatt-hours in 2024, compared to 20.

Express News | China Datang Corp Renewable Power - Power Generation for Nov on CONSOL Basis 2.8 Mln Mwh

Comments

China Datang Corporation Renewable Power's (HKG:1798) Earnings Growth Rate Lags the 13% CAGR Delivered to Shareholders

China Datang Corporation Renewable Power's (HKG:1798) Earnings Growth Rate Lags the 13% CAGR Delivered to Shareholders

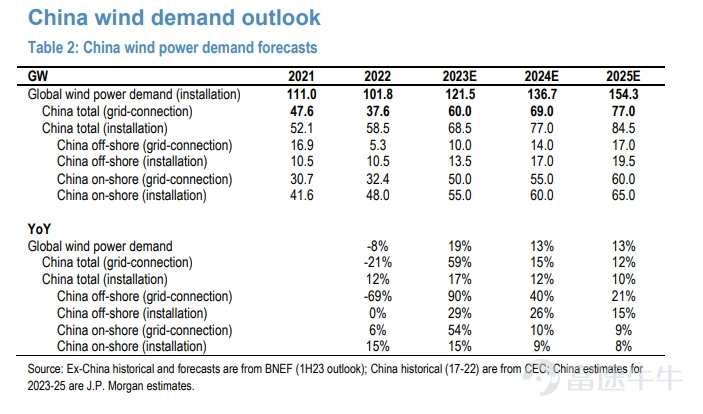

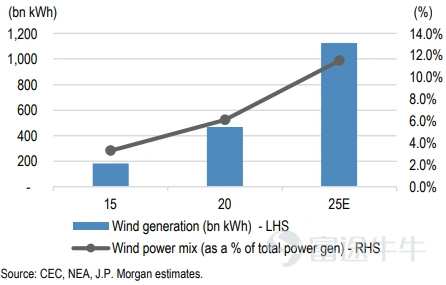

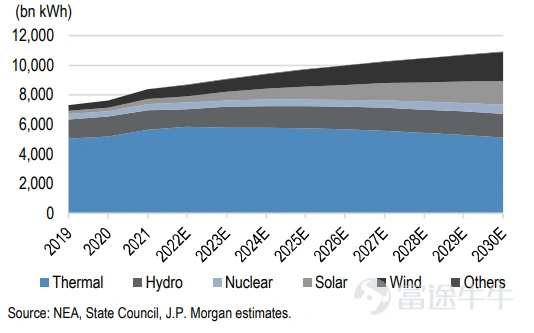

1. The demand for wind power continues to grow. Longyuan and Datang New Energy will achieve 20-25% profit growth in the first half of 2023, which is basically in line with market expectations.

2. Hydropower is less affected by the weather than expected. In the long run, the weak second quarter performance may provide an entry point for hydropower operators.

3. The construction of nuclear power units is accele...

1. Strong 1Q23 results driven by higher generation and lower financing costs.

During 1Q23, Datang Renewable (DTR, or the "Company") recorded total power generation of 8,736 GWh (+24.7% yoy), among which wind generation was 8,209 GWh (+22.7% yoy) and solar generation was 527 GWh (+68.6% yoy). The higher generation in 1Q23 was primarily due to better...