No Data

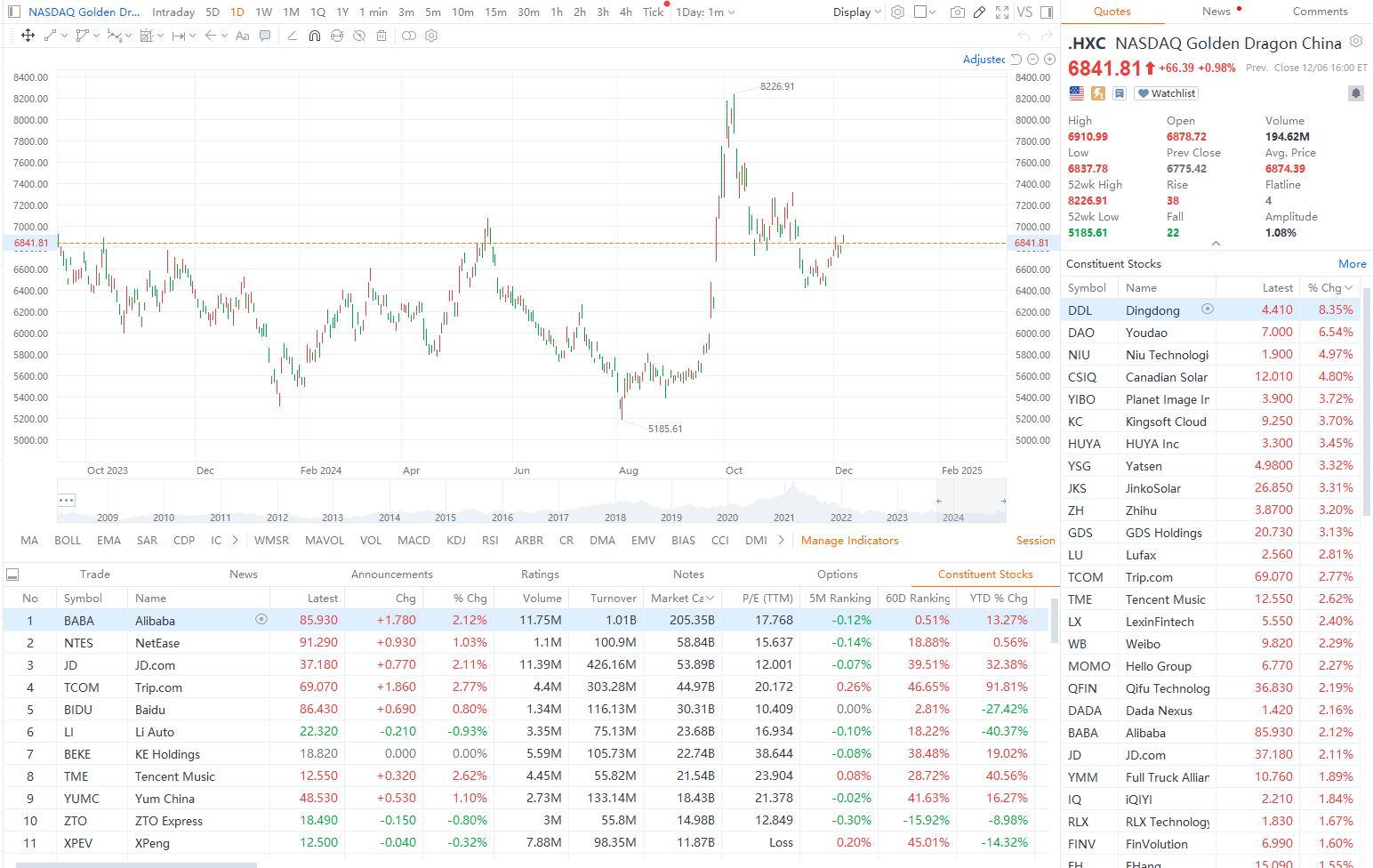

02057 ZTO EXPRESS-W

- 151.300

- -1.100-0.72%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Here's Why ZTO Express (Cayman) Inc. (ZTO) Is a Strong Momentum Stock

Volume increases and prices remain low as the express delivery industry competes to reduce costs. The application of autonomous vehicles and Drones is expected to accelerate next year | Year-end review.

① Since the beginning of the year, the growth rate of express delivery volume has exceeded 20%; the operating situation of "the two logistics giants and one delivery company" in the first 11 months shows volume increase and low prices, with ZTO achieving year-on-year revenue growth per package in Q3. ② Industry insiders say that the growth rate of express delivery volume will still be double-digit in the next 1-2 years. It is expected that next year, Drones and unmanned vehicles will accelerate their application in various express delivery scenarios, further reducing social Logistics costs.

Will Weakness in ZTO Express (Cayman) Inc.'s (NYSE:ZTO) Stock Prove Temporary Given Strong Fundamentals?

[Brokerage Focus] China Post Securities indicates that price competition may benefit the healthy development of the Industry, Bullish on the continuous growth of express company Business volume driving revenue scale.

Jinwu Financial News | According to a research report from Zhongyou Securities, all express companies reported their operational data for November, showing that the overall Business volume continues to maintain high growth, although unit prices have declined year-on-year. Leading companies indicated in their third-quarter reports that they would ensure their market share, which may suggest that moderate price competition will continue, potentially benefitting the long-term health of the Industry. The firm remains Bullish on the continued growth of Business volume among express companies, which will drive revenue scale while improving unit profitability through cost reduction and efficiency enhancement. Current valuations for various express companies are at relatively low levels, with a top recommendation for ZTO Express (02057), followed by S.F. Holding (06936), YTO Express Group, STO Express Co.,Ltd., and with attention on Yunda Holding.

ZTO EXPRESS-W (02057.HK) spent 19.5683 million USD to repurchase 0.983 million shares on December 20.

Gelonghui, December 23rd丨ZTO EXPRESS-W (02057.HK) announced that on December 20, 2024, it spent 19.5683 million USD to repurchase 0.983 million shares, with a repurchase price of 19.3-20 USD per share.

ZTO Express Announces Share Repurchase Strategy

Comments

What does the Central Economic Work Conference discuss?

The conference typically comprises two main components: evaluating the...

During a session led by Premier Li Qiang, The State Council passed a policy document last Friday that seeks to expand export growth through the growing sector of international e-commerce. The...

The Alliance aims to accelerate the implementation of foundation models in the logistics field, and assist the logistics industry to increase efficiency, reduce costs and innovate its business through AI.

$ALIBABA GROUP HOLDING LTD (BABAF.US)$ $Alibaba (BABA.US)$ $BABA-W (09988.HK)$ $ZTO EXPRESS-W (02057.HK)$ $YTO INTL EXP (06123.HK)$ $STO Express Co.,Ltd. (002468.SZ)$ $Deppon Logistics (603056.SH)$