No Data

02331 LI NING

- 18.340

- +1.100+6.38%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

The Dining, Alcoholic Beverages, and Sporting Goods sectors have all shown strong performance. The report from the China Consumer Association shows that over 60% of consumers believe the consumption environment is getting better.

Jinwu Financial News | The Consumer Sectors, including Dining, Alcoholic Beverages, and Sporting Goods, are showing strong performance. In the Dining Sector, JIUMAOJIU (09922) rose by 6.01%, XIABUXIABU (00520) increased by 4.65%, SHANGHAI XNG (03666) grew by 4.17%, HAIDILAO (06862) rose by 2.95%, and HAILUNSI (09869) increased by 2.42%. In the Alcoholic Beverages Sector, BUD APAC (01876) rose by 6.37%, CHINA RES BEER (00291) increased by 5.07%, TSINGTAO BREW (00168) grew by 4.99%, and DYNASTY WINES (00828) rose by 3.

The sportswear Sector faced slight pressure with 361 DEGREES (01361) dropping by 3.49%. Morgan Stanley expects that industry discounts will begin to improve starting in the second quarter.

Jingwu Financial News | The sportswear Sector is slightly under pressure, with 361 DEGREES (01361) down 3.49%, TOPSPORTS (06110) down 2.34%, CHINA DONGXIANG (03818) down 2.30%, ANTA SPORTS (02020) down 2.14%, YUE YUEN IND (00551) down 1.76%, HONMAGOLF (06858) down 1.49%, LI NING (02331) down 1.24%, and XTEP INT'L (01368) down 1.09%. Morgan Stanley published a research report indicating that the demand for sportswear in China has shown mild improvement since the beginning of the year, and industry discounts are expected to decline from the second...

Zhiyuan Hong Kong Stock Short Selling Statistics | March 12

Hong Kong stock short-selling Statistics | March 12.

Hong Kong stocks moved | Sporting Goods stocks rose across the board, with strong support from domestic Sports Industry policies. The textile and apparel Sector is expected to welcome a recovery opportunity.

Stocks of Sporting Goods collectively rose; as of the time of writing, POU SHENG INT'L (03813) increased by 8.47%, trading at HKD 0.64; TOPSPORTS (06110) rose by 7.3%, trading at HKD 3.97; LI NING (02331) gained 4.84%, trading at HKD 18.64.

[Brokerage Focus] CITIC SEC: The textile and apparel Sector is expected to迎来修复性机会 in 2025.

Jinwu Financial News | CITIC SEC stated that with the gradual clarification of the consumer environment and policy expectations, the textile and apparel Sector is expected to welcome a recovery opportunity in 2025. At the same time, in the face of the uncertainty of the consumer environment over the past two years, some sub-sectors and leading companies are still actively seeking change. The firm recommends proactively grasping the following six major investment lines and key companies: ① Transformation of new retail formats; ② Brand momentum entering an upward cycle; ③ Recovery of the consumer environment driving operational recovery; ④ Core advantages solidified, external disturbances such as tariffs gradually taking effect, while dividend yields remain attractive; ⑤ The inventory destocking in the outdoor manufacturing industry is nearing its end, and Order performance is expected to recover with certainty.

Domestic demand stocks are rising broadly as the government's work report draws attention to measures to expand domestic demand. China has doubled its support for the replacement of consumer goods.

Jinwu Financial News | Domestic demand stocks generally showed an upward trend today. TINGYI (00322) rose 2.63%, reporting HKD 12.48; NONGFU SPRING (09633) stock price increased by 2.42%, to HKD 36.05; China Resources Beverage (02460) was up 1.31%, reporting HKD 13.9. In the field of domestic consumption stocks, Shenzhou International Group Holdings Limited Unsponsored ADR (02313) rose 1.64%, to HKD 58.9; LI NING (02331) increased by 1.18%, reporting HKD 17.2; ANTA SPORTS (02020) rose 0.17%, reporting HKD 90.45; XTEP INT'L (01

Comments

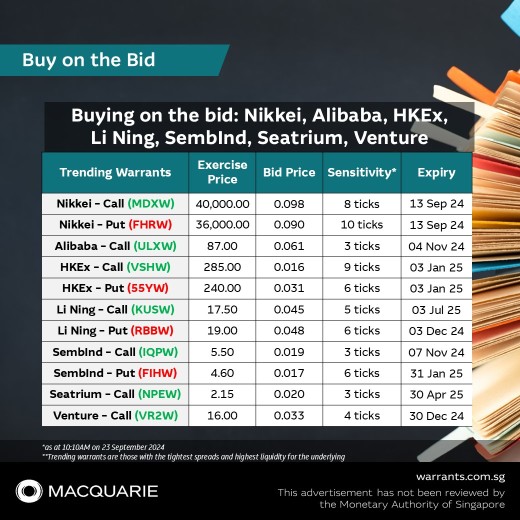

📌 Nikkie Call, MDXW

$NKY 40000MBeCW241213 (MDXW.SG)$

📌 Nikkie Put, FHRW

$NKY 36000MBePW241213 (FHRW.SG)$

📌 HKEx Call, VSHW

$HKEx MB eCW250103 (VSHW.SG)$

📌 HKEx Put, 55YW

$HKEx MB ePW250103 (55YW.SG)$

📌 Li Ning Call, KUSW

$LiNing MBeCW250703 (KUSW.SG)$

📌 Li Ning Put, RBBW

$LiNing MBePW241203 (RBBW.SG)$

📌 SembInd Call, IQPW

$SembInd MBeCW241107 (IQPW.SG)$

���������...

📌 S&P Call, XP5W

$S&P 5800MBeCW241220 (XP5W.SG)$

📌 S&P Put, 5B5W

$S&P 5350MBePW241220 (5B5W.SG)$

📌 Nikkei Call, MDXW

$NKY 40000MBeCW241213 (MDXW.SG)$

📌 Nikkei Put, FHRW

$NKY 36000MBePW241213 (FHRW.SG)$

📌 China Life Call, OHKW

$CLIFE MBeCW250703 (OHKW.SG)$

📌 Li Ning Call, KUSW

$LiNing MBeCW250703 (KUSW.SG)$

📌 Keppel Call, UYEW

$KeppelMBeCW250328 (UYEW.SG)$

���������...

📌 NASDAQ Call, IHJW

$NASDAQ 22000MBeCW241220 (IHJW.SG)$

📌 NASDAQ Put, UUZW

$NASDAQ 18500MBePW241220 (UUZW.SG)$

📌 Nikkei Call, MDXW

$NKY 40000MBeCW241213 (MDXW.SG)$

📌 Nikkei Put, FHRW

$NKY 36000MBePW241213 (FHRW.SG)$

📌 Baidu Call, ULNW

$Baidu MB eCW250204 (ULNW.SG)$

📌 Baidu Put, LCGW

$Baidu MB ePW250402 (LCGW.SG)$

📌 JD .com Call, RYOW

$JD MB eCW250103 (RYOW.SG)$

���������...

0DTE are typically more prevalent in the U.S. stock market, mainly because they are weekly options. Conversely, in the Hong Kong stock market, monthly options are more common. By conventional standards, options that expire within a week are deemed "zero days to expiration" options.

...