No Data

02669 CHINA OVS PPT

- 5.980

- +0.050+0.84%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Hong Kong stock concept tracking | Peking, Shenzhen real estate market volume hits new high, real estate sector policy effects may gradually emerge (with concept stocks)

Data from the China Real Estate Research Institute shows that as of the 26th of October, the number of second-hand residential housing transactions in Beijing has reached 12,979 units. It is expected that the total number of transactions in October will exceed 0.016 million units, reaching a new high in 19 months; the actual transaction volume is expected to reach 0.025 million units, the highest in the same period in 8 years.

China OVS PPT (02669.HK): Wu Yiting has been appointed as a non-executive director.

On October 25, Geelong announced that China OVS PPT (02669.HK) issued a statement, Ma Fujun decided to resign as a non-executive director of the company, effective from October 25, 2024, due to devoting more time to other personal work. Wu Yiyin has been appointed as a non-executive director of the company, effective from October 25, 2024.

[Brokerage Focus] Haitong Int'l points out that the real estate industry policies have recently significantly loosened. It is recommended to pay attention to high-quality companies such as China Res Land (01109).

Jingu Finance News | Haitong Int'l released research reports, according to the sales performance ranking data for January to September 2024 published by Keeray, the sales amount for the top 100 real estate companies reached 2,633.86 billion yuan, a decrease of 36.6% compared to the same period in 23, with the decline expanding by 0.1 percentage point from August; the equity amount reached 2,084.99 billion yuan, down by 36.2% compared to the same period in 23, with the decline remaining flat from August, with an equity ratio of 79%. Looking at the situation in September 2024, the top 100 real estate firms achieved a sales amount of 251.71 billion yuan, up by 0.2% month-on-month, and down by 37.7% year-on-year.

Zhongtai Securities: The property bullish policy will continue to be introduced, bullish on the sector's performance in the fourth quarter.

zhongtai Securities released research reports stating that recently, real estate high-frequency data has continued to decline, weakening even compared to August in the peak season. In the short term, the industry's fundamentals are difficult to bottom out, but looking ahead to the fourth quarter, there is a high probability of continued bullish policies related to real estate being introduced. zhongtai Securities remains bullish on the performance of the real estate sector in the fourth quarter.

Hong Kong stock market concept tracking | Existing home loan interest rate cut imminent, real estate sector accelerates stabilization and valuation repair (with concept stocks)

Industry insiders predict that the specific plan for lowering the interest rates on existing housing loans is unlikely to be introduced before the "National Day" holiday.

HK stock abnormal movement | Property management stocks continue to rise, unprecedented strength of new real estate policies, institutions point out the sector's allocation value highlights.

Property management stocks continue to rise. As of the time of publication, Shimao Services (00873) rose by 7.58% to HK$0.71; CG Services (06098) rose by 5.64% to HK$4.68; Sunac Services (01516) rose by 4.85% to HK$1.73.

Comments

The sales volume of China's top 100 real estate companies fell 13% MoM in April. Chinese developers took the lead to decline. $KWG GROUP (01813.HK)$ and $AGILE GROUP (03383.HK)$ plummeted...

UOB KH report.

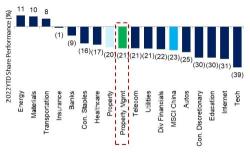

MSCI China now trades at an undemanding 12-month forward PE of 10.2x, or a 37.0% discount to Emerging Asia. This steep discount is unwarranted and they expect valuation to normalise in 2H23, backed by additional policy support. However, a significant rerating is only possible if credit growth accelerates; hence, their index target is at 74 points for now, implying 12.0x target PE. They prefer exposure to automobiles, co...

2023 outlook will be righter because of soothing property,Covid beta,(after 2-years roller-coaster ride).

Here are a few reasons:

1.most have changed in a good way for long term,For example ,rapid move into independence, non-resi, decline of excessive profitability);

even the headwinds (less new-home GFA, slower VAS) are useful to distinguish consolidators;

2.intact biz nature: asset-light wi...

Analysis

Price Target

No Data

No Data

103540795 : 18800soon.. 19000