No Data

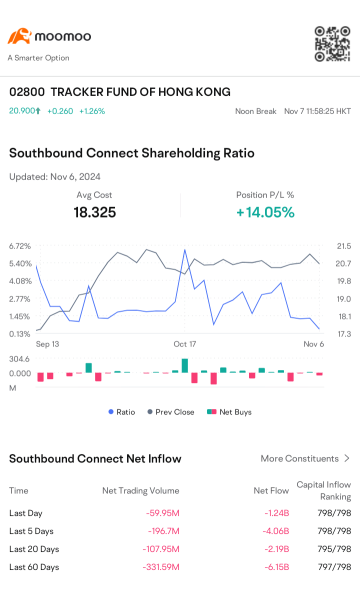

02800 TRACKER FUND OF HONG KONG

- 19.790

- +0.080+0.41%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Capital Trends | Beishui sold more than 2.4 billion Hong Kong dollars in tracker fund of hong kong and continued to increase positions in Xiaomi and Tencent

Track the latest trends of southbound funds.

The three major Hong Kong stock indexes continued to show a volatile trend, with the lithium battery and golden industrial concept sectors performing prominently.

① Why have international gold prices strengthened? ② What news has stimulated the strength of consumer electronics stocks? ③ Has the short sell ratio in the Hong Kong stock market shown a decline?

A-shares and Hong Kong stocks are up, with the gem rising more than 1%, led by photovoltaics, chips, and non-ferrous metals.

PV concept stocks in A-shares rose at the beginning of the market, Suzhou Good-Ark Electronics hit the limit up, Sungrow Power Supply, Deli Technology rose more than 6%, Ginlong Technologies, Suzhou Maxwell Technologies, and Orise Technology quickly followed the upward trend.

Hong Kong stocks morning report on November 19: Hong Kong Exchanges and Clearing is preparing various optimization measures for mutual market access. Goldman Sachs predicts a 15% increase in the MSCI China Index by 2025.

① The Hong Kong Stock Exchange stated that it is preparing multiple optimization measures for mutual connectivity. ② S.F. Holding plans to issue 0.17 billion H shares through an IPO in Hong Kong. ③ Goldman Sachs expects the MSCI Chinese Index to rise by 15% by 2025. ④ Xiaomi's revenue in the third quarter increased by approximately 30% year-on-year.

Beishui trends | Beishui's net purchase volume was 13.551 billion, domestic funds aggressively bought Hong Kong ETF all day, continuing to increase holdings in Alibaba (09988) and other network technology stocks.

On November 18, in the Hong Kong stock market, the net buy volume of Beishui was 13.551 billion Hong Kong dollars, with a net buy volume of 7.864 billion Hong Kong dollars through the Shanghai-Hong Kong Stock Connect and a net buy volume of 5.687 billion Hong Kong dollars through the Shenzhen-Hong Kong Stock Connect.

60% of the 'rebound fruit' has been eroded, who is currently increasing their holdings in Hong Kong stocks in the opposite direction?

Since October 8th, the once "unrivaled globally" Hong Kong stock market has retraced nearly 60% of the gains from the rebound trend from September 24, 2024 to October 7, 2024.