No Data

03150 Global X Japan Global Leaders ETF

- 68.020

- +0.900+1.34%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

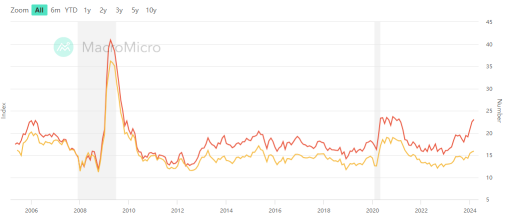

In the afternoon session, there is adjustment of holdings in anticipation of President Ueda's press conference and the outcome of the FOMC.

The Nikkei average fell for the first time in four trading days. It closed at 37,751.88 yen, down 93.54 yen (with an estimated Volume of 1.8 billion 40 million shares). Selling was driven by the weakness in U.S. stocks from the previous day, but buying continued in value stocks such as trading companies due to the influence of famous U.S. investor Warren Buffett, and after the initial selling, there was a quick bounce back. Additionally, when the Bank of Japan's monetary policy meeting decided to maintain the current policy, short-term players also engaged in Futures buying, and just before the morning close, it reached as high as 38,128.58 yen.

Mitsubishi Electric Expands Footprint In China With New FA Systems HQ, Aiming For Agile Localized Operations

Earlier session / Active stocks and traded stocks [Active stocks and traded stocks]

*Daisue Construction <1814> 1962 +157 viewed as a Buy due to a significant Shareholding. *Tanseisha <9743> 1116 +66 continues to be positively received for its forecast of double-digit profit growth and planned dividend increase. *Yamashin Filter <6240> 631 +31 also has pointers such as the quarterly report. *Taiyo Yuden <6976> 2673 +131 is particularly lacking in materials, making short covering a dominant trend. *IHI <7013> 11790 +520 expansion in private aviation engine Components.

SBI Securities (before close) is heavily selling Mitsubishi Corporation, and is heavily buying JX Metal.

Sell Code Stock Name Trade Amount (7011) Mitsubishi Heavy Industries 32,288,442,553 (7012) Kawasaki Heavy Industries 29,556,886,983 (7013) IHI 19,834,076,350 (5803) Fujikura 15,176,795,558 (1570) NEXT FUNDS Nikkei Average Leverage ETF 13,112,340,826 (6146) Disco 12,224,

Bank of Japan Leaves Rates Steady as U.S. Uncertainty Heightens

Express News | BOJ Maintains Short-Term Interest Rate Target at 0.5%

Comments

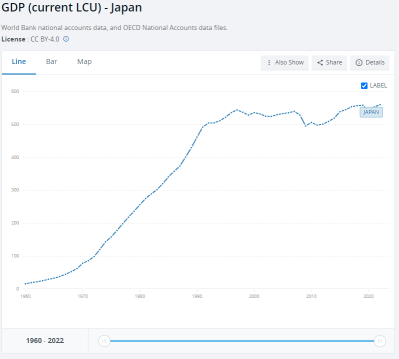

The Japanese stock market has experienced a significant narrative shift, with robust and enticing performance since 2023. The Nikkei Index has recorded its largest gains since 1989, consistently benefiting from growing corporate profits, enhanced capital efficiency, and supportive policy environments for market liquidity. As of today, the Nikkei 225 index closed up 0.5%, at 40,109.23 points, marking the fi...