No Data

03160 ChinaAMC MSCI Japan Hedged to USD ETF

- 20.960

- +0.040+0.19%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Despite the absence of Overseas investors, a solid development is underway.

The Nikkei Average rebounded, finishing at 39,130.43 yen, up by 93.58 yen (with an estimated Volume of 1.7 billion 60 million shares). Buoyed by the previous day's rise in U.S. tech stocks, buying began early, pushing the Nikkei Average up to 39,180.59 yen shortly after the open. However, with European and American investors entering the Christmas holiday, market participation was low, leading to a shift to a negative trend due to position adjustments, with the index dropping to 38,927.16 yen during the middle of the morning session. The afternoon session saw a market environment characterized by strong stagnation.

The Nikkei average rebounded as trading became sparse with the Christmas holidays approaching.

On the 24th, the US Stocks market continued to rise. The Dow Inc average increased by 390.08 points to 43,297.03, while the Nasdaq finished trading up 266.25 points at 20,031.13. There was caution over rising long-term interest rates, leading to mixed results after the opening. With a shortened trading session on the day before the Christmas holiday, technology stocks continued to be bought, boosting the stock market. Anticipation of a Christmas rally from the 24th through the end of the year aided this rise, and as the day progressed, the gains were expanded at the close. Following the rise in US stocks,

Higasitetukou, Mitsui Sumitomo, etc. (additional) Rating.

Upgraded - Bullish Code Stock Name Securities Company Previous After --------------------------------------------------------- <9025> Konoike Transport Mizuho "Hold" "Buy" <6460> Sega Sammy HD Daiwa "2" "1" Downgraded - Bearish Code Stock Name Securities Company Previous After --------------------------------------------------------- <4

Canon Inc-Spons Adr, Espec, etc. [List of stocks from the newspaper]

*Canon Inc-Spons Adr <7751> re-enters the ArF lithography equipment market, aiming to gain Share through miniaturization (Nikkei Industrial Daily page 1) -○ *Espec <6859> launches aggressive strategies for Semiconductors, continuously introducing contract measurement services (Nikkei Industrial Daily page 1) -○ *Nippon Steel <5401> believes in 'presidential approval' for the acquisition of United States Steel, statement made for final decision (Nikkei Industrial Daily page 3) -○ *Sumitomo Chemical <4005> sells polarizing film to two Chinese companies, targeting large LCDs, to local companies in spring next year (Nikkei Industrial Daily page 3) -○ *Mitsubishi Corporation <8058> diverse workforce.

The impact of rising U.S. tech stocks is limited, leading to a shift towards value stocks.

The Nikkei Average fell. It closed at 39,036.85 yen, down 124.49 yen (Volume estimated at 1.8 billion and 40 million shares). Following the rise in US stocks the previous day, buying began to lead, and shortly after the opening, it increased to 39,245.75 yen. However, with the Christmas holiday approaching, the movements of Overseas investors were sluggish, and there was no active push for higher prices. Subsequently, the focus shifted to profit-taking rebalance movements, and by the end of the first half, it dropped to 38,995.76 yen, approaching the key level of 39,000 yen.

The Nikkei average fell back, continuing a lack of direction as the Christmas holiday approaches.

On the 23rd, the US Stocks market continued to rise. The Dow Inc average increased by 66.69 points to 42,906.95 dollars, and the Nasdaq closed up by 192.29 points at 19,764.88. Caution was exercised due to the deterioration of the Consumer Confidence Index, leading to mixed results after the opening. Following the retreat of expectations for rapid interest rate cuts by the Federal Reserve, long-term Gold rates rose, causing the Dow Inc to decline. However, as high-tech Stocks were purchased in anticipation of a Santa Claus rally, the Nasdaq remained strong, expanding its gains towards the end of the trading session, benefiting the overall market.

Comments

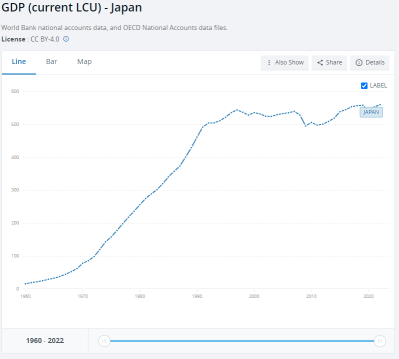

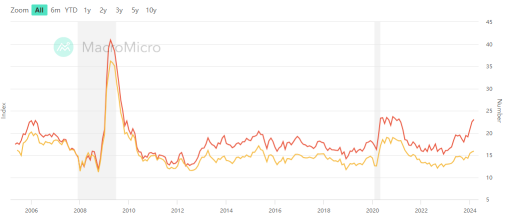

The Japanese stock market has experienced a significant narrative shift, with robust and enticing performance since 2023. The Nikkei Index has recorded its largest gains since 1989, consistently benefiting from growing corporate profits, enhanced capital efficiency, and supportive policy environments for market liquidity. As of today, the Nikkei 225 index closed up 0.5%, at 40,109.23 points, marking the fi...