No Data

03160 ChinaAMC MSCI Japan Hedged to USD ETF

- 20.900

- +0.220+1.06%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

The Nikkei average rebounded significantly, temporarily recovering to 39,000 yen, but caution regarding Trump 2.0 weighed heavily.

On the 17th, the US stock market rebounded. The Dow Inc rose by 334.70 points to 43,487.83, while the Nasdaq closed 291.91 points higher at 19,630.20. In addition to the International Monetary Fund's (IMF) upward revision of global and domestic economic growth forecasts for 2025, optimistic views on the economy were spreading due to the better-than-expected number of housing starts and industrial production in December, leading to a rise after the opening. With the presidential inauguration set for the 20th, there are expectations for regulatory easing by the next administration and support measures for businesses and the economy.

Nikkei May Rise as Weak Yen Raises Earnings Hopes -- Market Talk

Toyota Industries, Asahi Kasei, etc. [List of stocks and materials from the newspaper]

* Nidec Corporation Sponsored ADR <6594> Maki No TOB, concerns in the Chinese mold industry, impact on supply balance (Nikkan Kogyo, page 1) - ○ * Toyota Industries <6201> aims for 7 times solar power, plans for Tahahama factory by 2035, also considering perovskite (Nikkan Kogyo, page 1) - ○ * Rohm <6963> appoints Mr. Higashi as president, structural reform without shying away from 'pain' (Nikkan Kogyo, page 3) - ○ * Honda <7267> plans to invest 15 billion yen in human resources over 5 years, recruitment of engineers and retraining of overseas talent (Nikkan Kogyo, page 3) - ○ * Mitsubishi Corporation <8058> partnership with JOGMEC and synthesis.

GE Vernova's GE Hitachi Nuclear Energy Joins Coalition Led By Tennessee Valley Authority Seeking $800M For BWRX-300 Small Modular Reactor Deployment In The U.S.

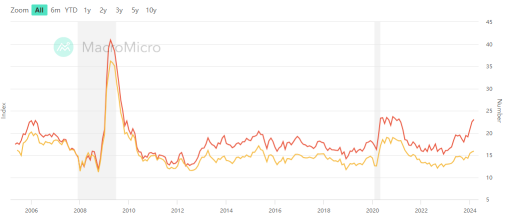

Officials from the Bank of Japan have consecutively sent signals, and over 70% of observers expect an interest rate hike next week.

Among 53 economists, about 74% predict that the Bank of Japan will raise interest rates at the end of its two-day meeting on January 24.

Nikkei May Fall Amid Concerns About Borrowing Costs -- Market Talk

Comments

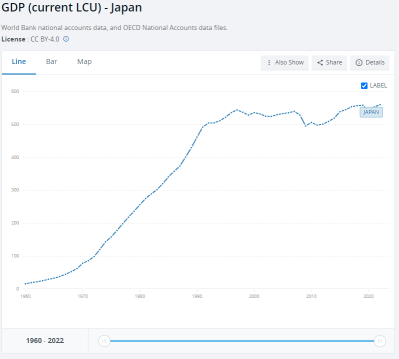

The Japanese stock market has experienced a significant narrative shift, with robust and enticing performance since 2023. The Nikkei Index has recorded its largest gains since 1989, consistently benefiting from growing corporate profits, enhanced capital efficiency, and supportive policy environments for market liquidity. As of today, the Nikkei 225 index closed up 0.5%, at 40,109.23 points, marking the fi...