No Data

07234 Bosera SZSE Chinext Daily (2x) Leveraged Product

- 4.092

- -0.388-8.66%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Goldman Sachs A-shares 2025 Heavyweight Strategy Outlook: Domestic funds will grasp pricing power! Overweight A-shares before H, industry focus on consumer stocks!

Goldman Sachs believes that compared to Hong Kong stocks, A-shares are more sensitive to policy easing and personal investment capital flows. The first quarter of next year will be a better time to allocate to Hong Kong stocks. In terms of sectors, analysts recommend that investors pay attention to themes such as consumer, emerging markets exporters, specific new technologies, and shareholder return strategies.

gtja: How will the Hong Kong stock market perform after the usa election?

After Trump takes office as president of the usa in 2025, China-US trade may continue to negotiate. Unlike 2018, the Hong Kong stock market has currently priced in, and compared horizontally, the valuation level of the Hong Kong stock is at a low point.

Last week, overseas funds accelerated inflow into Hong Kong stocks. Institutions stated that a "policy window" may be approaching in the near future.

①How much does external liquidity affect the Hong Kong stock market? ②What are the current hold positions strategies for Hong Kong stocks?

Schroder: China is actively promoting economic growth in conjunction with the usa's moderate interest rate cut outlook, improving investment prospects in asia.

Schroders' Chief Investment Officer of Diversified Assets, She Kangru, stated that looking ahead, Schroders remains optimistic about the overall fundamentals of the Asian bonds market, especially after the bond index has undergone adjustments with lower quality companies being excluded, particularly high-yield real estate firms.

China Securities Co.,Ltd.: Now is the most cost-effective time to layout Hong Kong stocks. The technology sector is the most recommended.

CSC Securities stated that after the short-term impact is over, Hong Kong stocks may usher in an upward trend. It is now a very cost-effective time to lay out Hong Kong stocks, with the technology and internet sector being the most recommended.

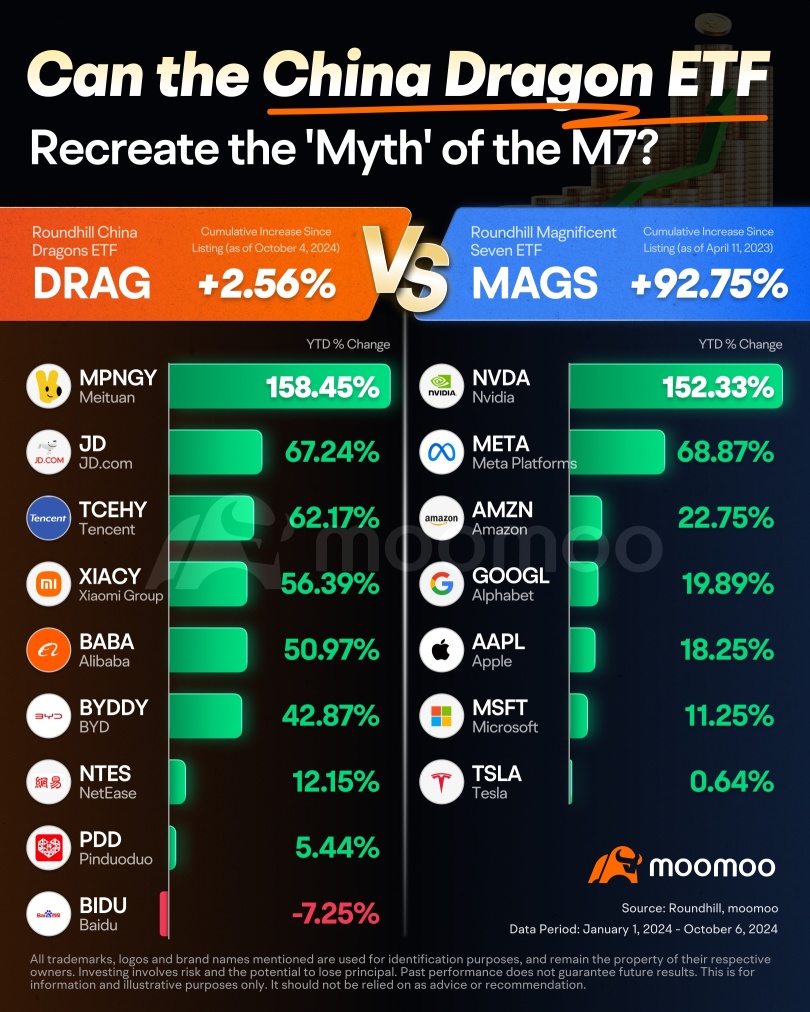

"Smart money" is betting on china becoming a trend: In Q3, the prototype of the "big short" increased shareholding in Alibaba and other Chinese concepts, while the rising fund Keystone established positions in three major etfs.

In the third quarter, the fund under Michael Burry increased its shareholding in Alibaba by 0.045 million shares to nearly 0.2 million shares, doubled its hold positions in jd.com to 0.5 million shares, and increased its shareholding in baidu by 0.05 million shares to 0.125 million shares. At the end of the quarter, it held three Chinese concept stocks valued at 54 million dollars, accounting for 65% of the total fund's stock holdings. Meanwhile, the fund bought corresponding put options for these three Chinese concept stocks to hedge risks.

Comments

Daring Lu : China is the next Super power.