No Data

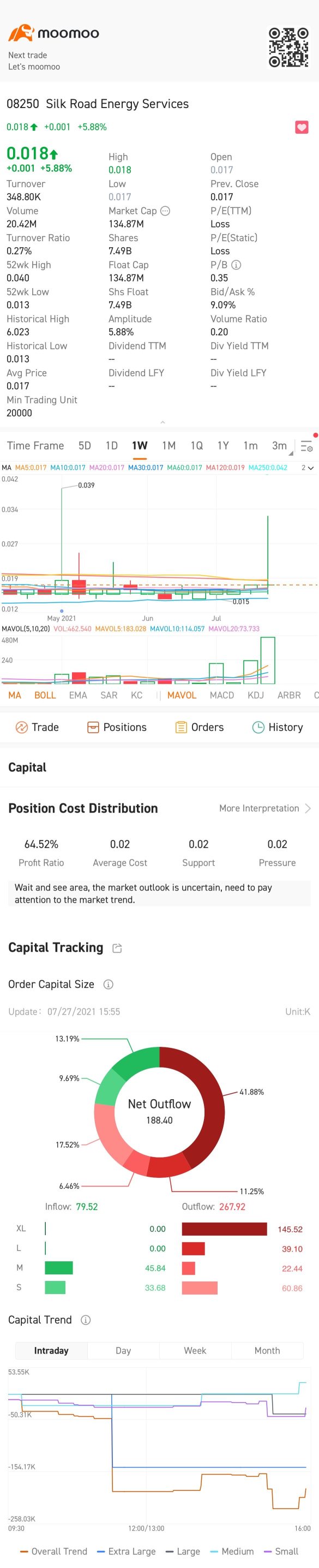

08250 SILK RD ENERGY

- 0.171

- 0.0000.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Market cap management boost + demand release, the value of the coal sector is highlighted.

Prepare for the peak and embrace the winter.

Citic Securities: Market cap management guidelines released, coal sector expected to benefit.

The leading company in the coal industry has more stable performance and is also a component stock of major indices, therefore benefiting more significantly. In addition, some undervalued and net asset value companies are also worth paying attention to.

SILK RD ENERGY: ANNUAL REPORT 2024

The net profit of the top three coal giants declined overall in the first three quarters, with the leader Shenhua seeing a double increase in net profit in the third quarter compared to the previous quarter. | Interpretations

①Affected by the downward trend of coal prices, the performance of coal listed companies in the first three quarters generally declined, but with differentiated performance in Q3; ②Regarding the future trend of coal prices, the industry generally believes that there is hope for a recovery after hitting the bottom, but the magnitude of the increase is limited.

Morgan Stanley Fund: What is the logic behind the rebound of coal?

morgan stanley fund stated in a publication that since late September, various national ministries and commissions have intensively proposed a series of measures to ease monetary policy, stabilize the stock market, and support the real estate market, greatly boosting market confidence.

citic sec: Coal prices are expected to remain stable, and the sector is expected to further rise.

The demand side benefited from the start of winter storage in the north, while the demand from non-power and station traders also remained stable, but compared to the strong pre-holiday inventory, there has been a slight weakening, resulting in some coal mines quoting slightly lower prices.

Comments

Analysis

Price Target

No Data

No Data