No Data

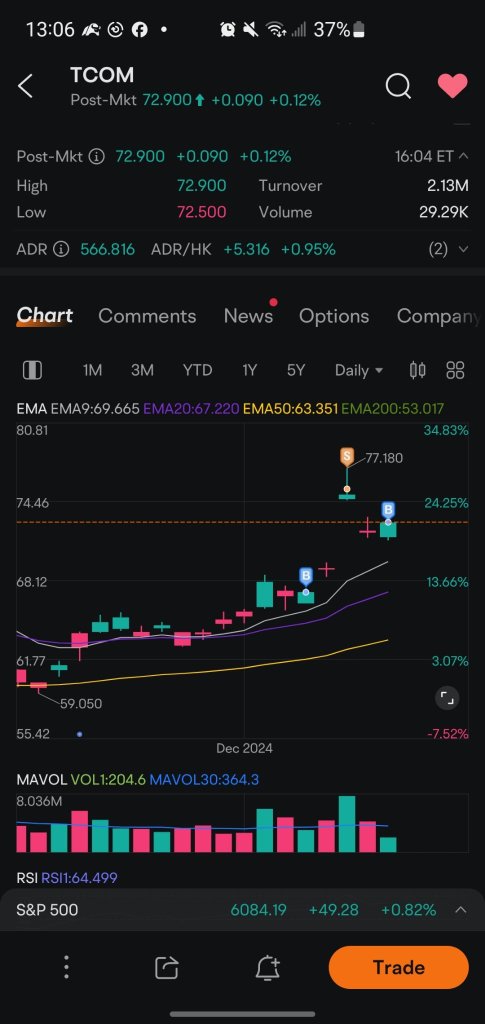

09961 TRIP.COM-S

- 573.500

- -12.500-2.13%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

【Brokerage Focus】CMB International: The introduction of substantial new consumer policies may still be the key driving factor for the structural improvement of valuations in the Internet Plus-Related sector.

Jinwu Finance | Zhao Yin International released the 2025 outlook for the Internet Plus-Related Industry, stating that the introduction of substantial policies to promote Consumer growth may still be the key driving factor for structural valuation improvements in the Sector. Before that, the Sector may maintain volatility, with Shareholder return levels, profit growth rates, and certainty being key supports for valuation. The bank recommends focusing on three main lines: 1) The competitive moat of mature Business and new development space, which may drive both performance and valuation increases: such as the gaming Sector benefiting from the release of new games, local life with further online penetration space in core Business, improvements in advertising effectiveness empowered by AI technology, and new additions brought by GPU cloud services.

The Nasdaq fell to 0.02 million points, Adobe plummeted more than 13%, the China concept Index rose against the trend, and Bitcoin dropped below 0.1 million dollars.

In November, USA PPI inflation exceeded expectations, with the market betting on a pause in interest rate cuts in January next year. The Dow has fallen for six consecutive days, with NVIDIA experiencing the largest drop of 2.5%. Tesla, Meta, Google, and Amazon have moved away from their highs, uranium mining stocks have declined, but Apple reached a new high. Broadcom rose nearly 5% in after-hours trading, and Chinese stocks Baidu and PDD Holdings increased by over 1%. Bond yields in Europe and the USA have risen significantly, and after the European Central Bank cut interest rates, the euro fell to a one-week low, before rebounding. The dollar reached a two-week high, while the offshore yuan once rose over 200 points, breaking through 7.26 yuan. Commodities generally fell, with spot gold down over 2% and spot silver down over 4% during the session.

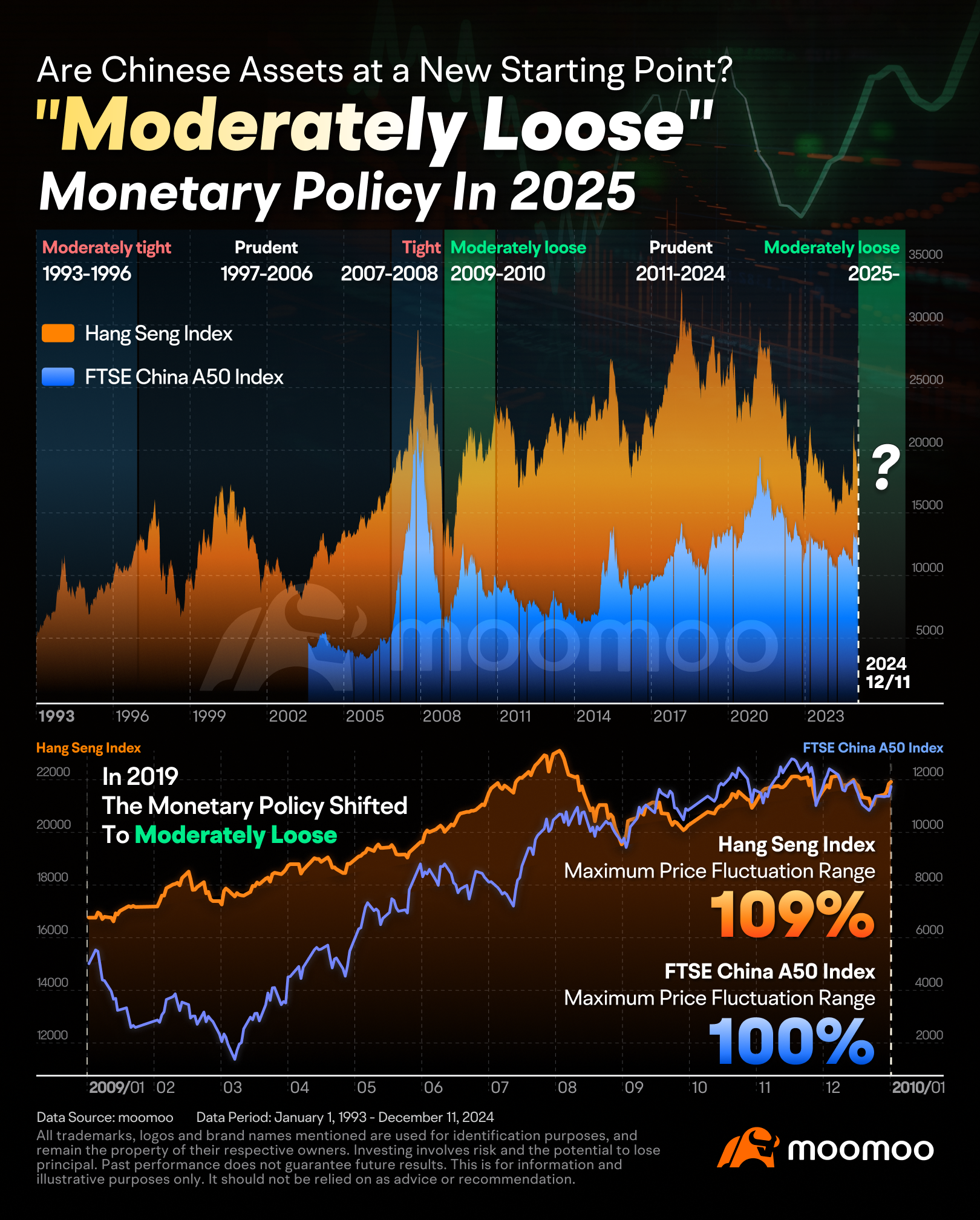

China to Lift Fiscal Spending to Boost Economy

China Central Economic Work Conference: A Key Indicator for Future Market Trends

Travel Is Finally Back — and an Era of Huge Growth Is Upon Us

Top Gap Ups and Downs on Monday: NVDA, BABA, AMD and More

Comments

What does the Central Economic Work Conference discuss?

The conference typically comprises two main components: evaluating the...