MY Stock MarketDetailed Quotes

3255 HEIM

- 23.900

- 0.0000.00%

15min DelayPre-Opening Auction Nov 27 16:54 CST

7.22BMarket Cap17.00P/E (TTM)

0.000High0.000Low0Volume0.000Open23.900Pre Close0.00Turnover24.49452wk High0.00%Turnover Ratio302.10MShares19.87952wk Low1.406EPS TTM3.27BFloat Cap26.894Historical High18.67P/E (Static)136.62MShs Float0.199Historical Low1.28EPS LYR0.00%Amplitude1.28Dividend TTM18.12P/B100Lot Size5.36%Div YieldTTM

HEIM Stock Forum

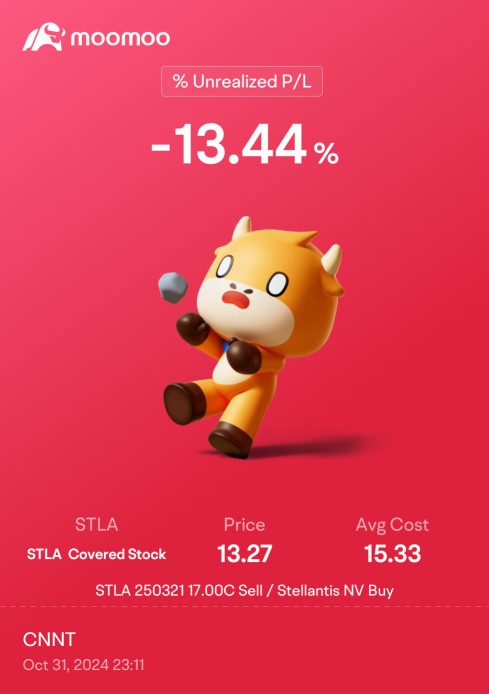

Spookiness can happen any time, not just on Halloween. Spookiness in my stock market journey is aplenty since I entered this house of terror in June 2024. Here are my list of trips and traps, that still send chills down my spine and have me freeze in fear whenever I think back about it.

Do you dare to walk with me down this eerie dark memory lane? Don't say I didn't warn you...

1) Manual (t)errors

Careless mistakes or being controlled by a malevolent force? I still can...

Do you dare to walk with me down this eerie dark memory lane? Don't say I didn't warn you...

1) Manual (t)errors

Careless mistakes or being controlled by a malevolent force? I still can...

Unsupported feature.

Please use the mobile app.

26

14

Click Here: TYNKR LAB™

Bursa Malaysia remained on a downward trajectory by midday, with $FTSE Bursa Malaysia KLCI Index (.KLSE.MY)$ falling by 6.93 points, or 0.42%, to 1,634.60. This decline was attributed to profit-taking activities in selected heavyweights, including major banks, as well as weaker regional market sentiment. The market opened 2.48 points lower at 1,639.05, fluctuating between a high of 1,643.08 and a low of 1,634.12 th...

Bursa Malaysia remained on a downward trajectory by midday, with $FTSE Bursa Malaysia KLCI Index (.KLSE.MY)$ falling by 6.93 points, or 0.42%, to 1,634.60. This decline was attributed to profit-taking activities in selected heavyweights, including major banks, as well as weaker regional market sentiment. The market opened 2.48 points lower at 1,639.05, fluctuating between a high of 1,643.08 and a low of 1,634.12 th...

+1

4

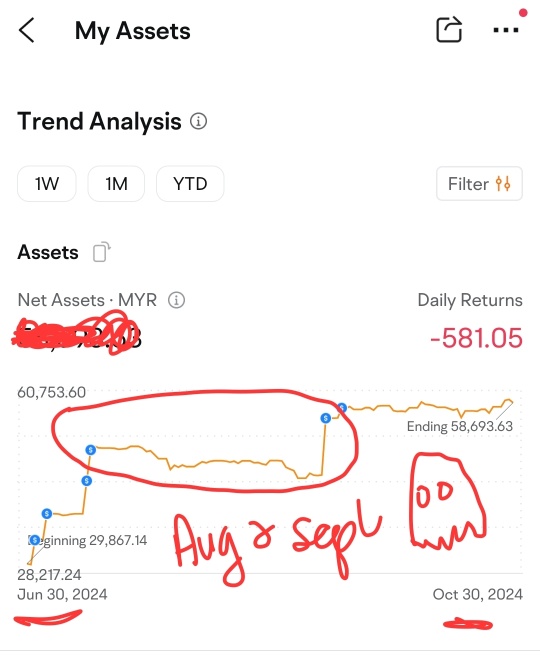

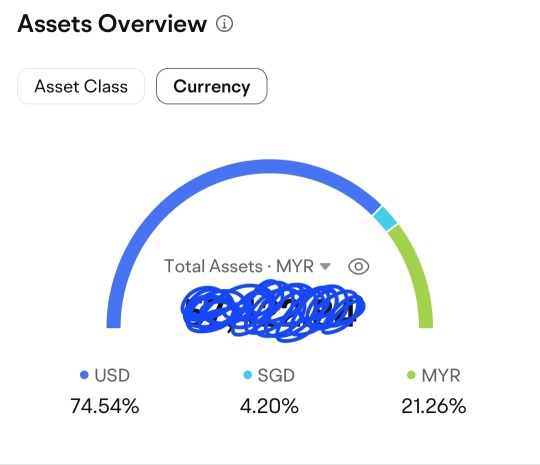

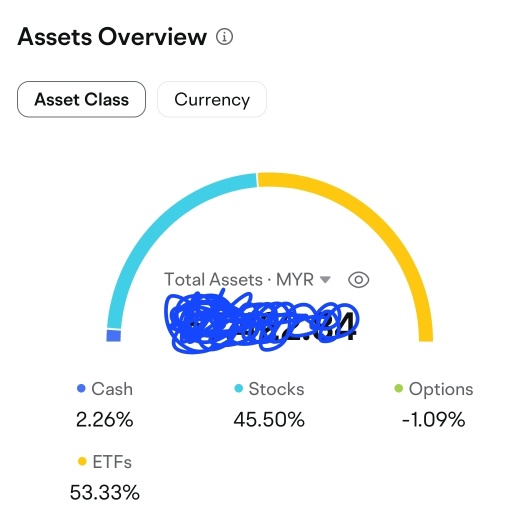

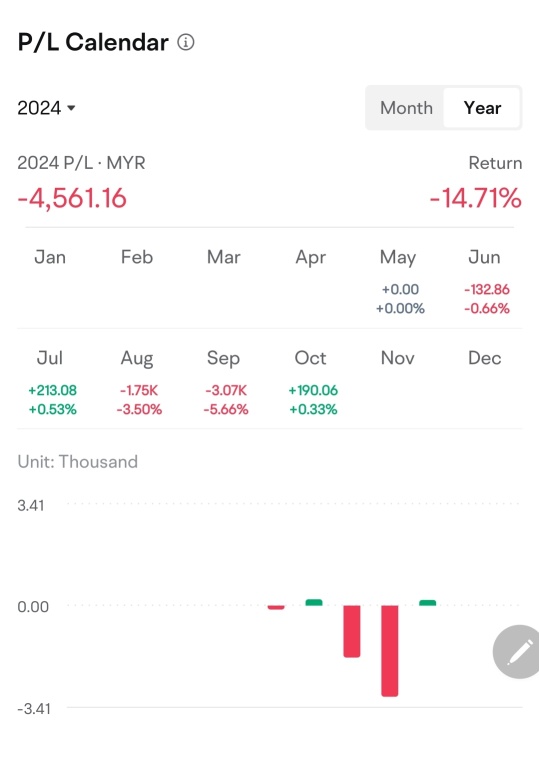

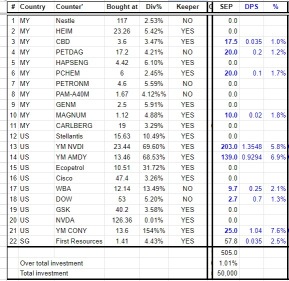

Started my investing journey in June, so it's my 5th month now. Time flies, and I didn't feel it at all because the journey was pretty engaging.

Rough start - mistakes made and USD devaluation set me back -8% from my total capital injection (no withdrawal made).

I insisted not to inject any new capital until and unless I prove to myself I can beat the market.

Over time, the strategy and tactics I want to deploy became clearer to me.

1) My safe haven is my MY ...

Rough start - mistakes made and USD devaluation set me back -8% from my total capital injection (no withdrawal made).

I insisted not to inject any new capital until and unless I prove to myself I can beat the market.

Over time, the strategy and tactics I want to deploy became clearer to me.

1) My safe haven is my MY ...

loading...

28

17

$HEIM (3255.MY)$

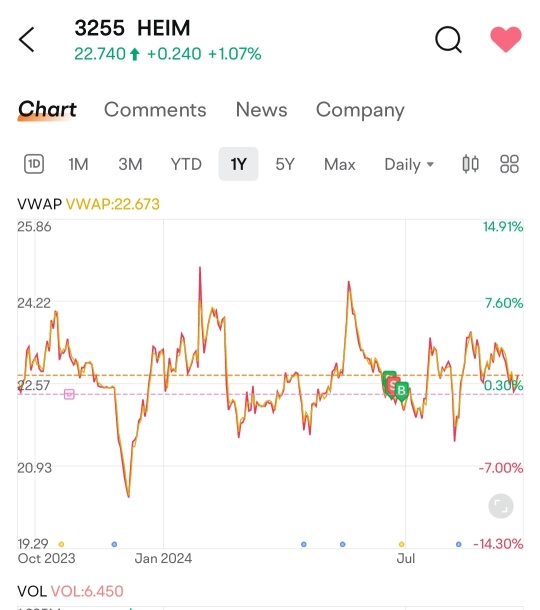

wow, first time up so much. more than a dollar.

wow, first time up so much. more than a dollar.

3

Click Here: TYNKR LAB™

U.S. stock markets closed lower, with $Dow Jones Industrial Average (.DJI.US)$ falling by 0.44% to 33,585.00. The day’s losses were driven by declines in key sectors such as healthcare and aerospace, with $Merck & Co (MRK.US)$ down 1.70%, $Boeing (BA.US)$ losing 1.55%, and $Amazon (AMZN.US)$ declining 1.52%. Meanwhile, technology stocks managed to post gains, with $Salesforce (CRM.US)$ rising 0.51% and $Chevron (CVX.US)$ climbing ...

U.S. stock markets closed lower, with $Dow Jones Industrial Average (.DJI.US)$ falling by 0.44% to 33,585.00. The day’s losses were driven by declines in key sectors such as healthcare and aerospace, with $Merck & Co (MRK.US)$ down 1.70%, $Boeing (BA.US)$ losing 1.55%, and $Amazon (AMZN.US)$ declining 1.52%. Meanwhile, technology stocks managed to post gains, with $Salesforce (CRM.US)$ rising 0.51% and $Chevron (CVX.US)$ climbing ...

+1

5

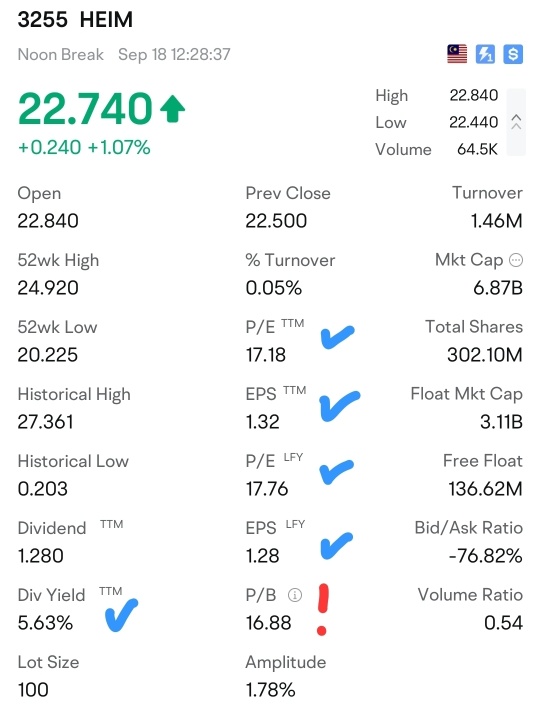

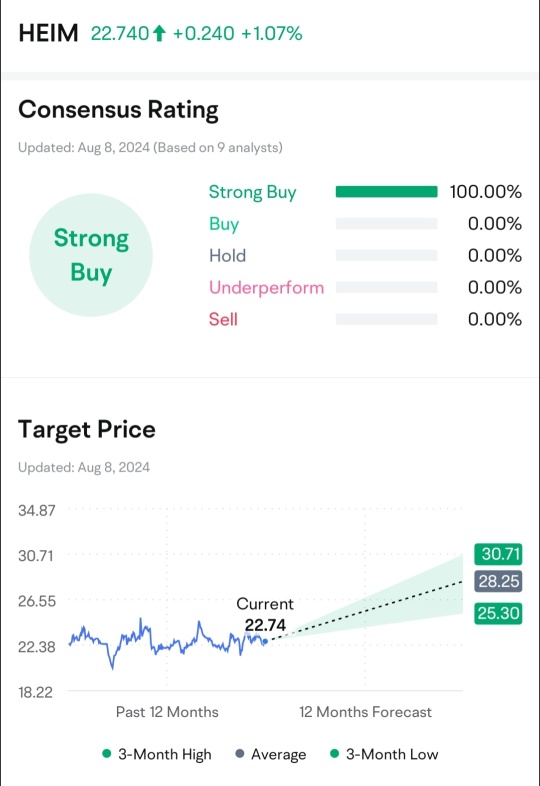

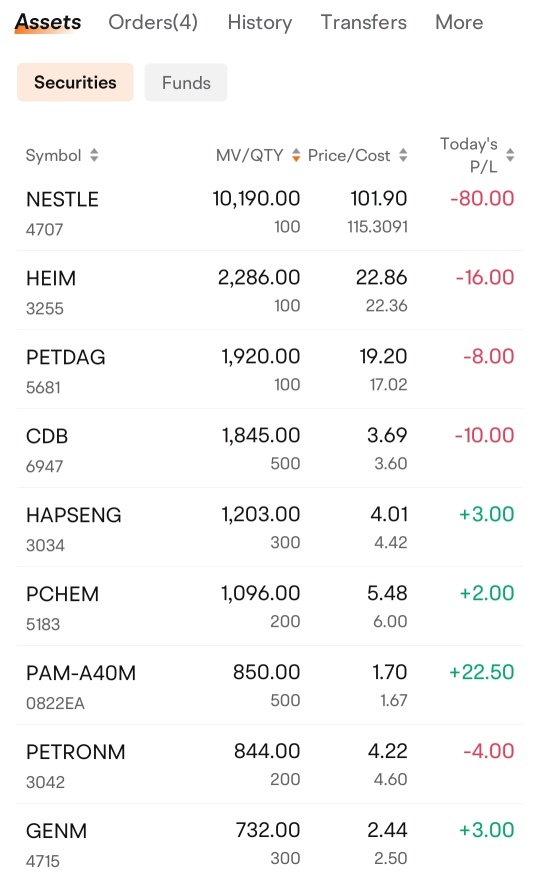

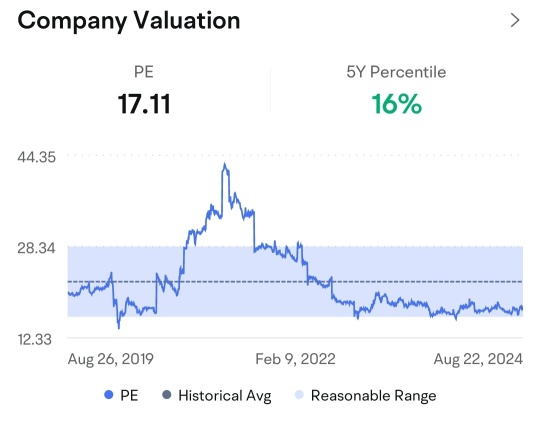

Why I bought $HEIM (3255.MY)$

1) Strong indicators - dividend, PE, EPS

2) Reasonable price at the time of purchase

3) Favourable analyst rating

4) Solid net profit and EPS growth

5) Market leader (Carlsberg at #2)

6) Innovation - reflected in their sales and profit margin compared to Carlsberg. All of its 1.35b sales is from MY, where Carlsberg's 1.23b sales is from MY and SG

7) Duopoly situation

There are threats out there nonetheless:

1) Illegal beers from the borde...

1) Strong indicators - dividend, PE, EPS

2) Reasonable price at the time of purchase

3) Favourable analyst rating

4) Solid net profit and EPS growth

5) Market leader (Carlsberg at #2)

6) Innovation - reflected in their sales and profit margin compared to Carlsberg. All of its 1.35b sales is from MY, where Carlsberg's 1.23b sales is from MY and SG

7) Duopoly situation

There are threats out there nonetheless:

1) Illegal beers from the borde...

+3

18

2

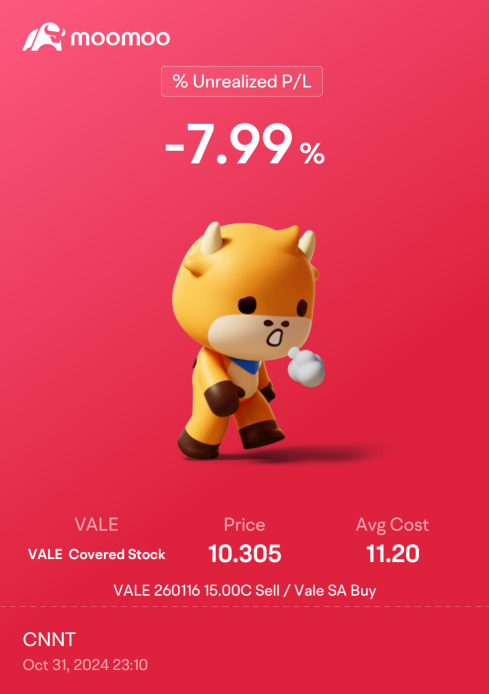

My current investment philosophy is buying and holding good-dividend paying stocks (and most recently ETF was added to the portfolio) and has sound fundamentals (but I did make some judgement errors, as you will see in my list below).

This philosophy is temporary as it is born out of my awareness about my so very little stock market knowledge. As I evolve over time, I will 'upgrade' my philosophy. But as of now, I choose to err on the side ...

This philosophy is temporary as it is born out of my awareness about my so very little stock market knowledge. As I evolve over time, I will 'upgrade' my philosophy. But as of now, I choose to err on the side ...

26

8

After a rationalisation exercise in July, my cleaned up and trimmed down MY portfolio looks much better now. If you have not already observed, I have a bias for established companies that pays consistent dividends.

Upon further contemplation, I need to do another round of rationalisation when the time and price are right, to switch out some counters that are over-valued, low profit margin and eroding EPS such as Nestle, Petron and PERDAG, for income-generating ones...

Upon further contemplation, I need to do another round of rationalisation when the time and price are right, to switch out some counters that are over-valued, low profit margin and eroding EPS such as Nestle, Petron and PERDAG, for income-generating ones...

loading...

14

3

1

$HEIM (3255.MY)$ is the second MY share I owned. Its seems to be undervalued, has strong EPS and pays good dividend. Not many major red flags but the profit margin did reduce sharply in 2023.

What do you think is the outlook of this stock?

What do you think is the outlook of this stock?

2

No comment yet

Analysis

Price Target

No Data

Heat List

Overall

Symbol

Latest Price

% Chg

No Data

.

.

6686 : hmm.. looking at your buy and sell point.. I guess you don't have a buy and sell system that you stick firmly to it. I buy based on TA, using stock screener to help me identify good potential stock setting some criteria such as 52week low, more than $1 less than $10, buy or strong buy recommendation, at least 15% dividend and market cap of more than $1B, daily volume more than 1mil. this should help u screen down to just a few stock to buy, part 2 of your tasking is to analyse the history to determine to buy or not, usually there will be the most 2 or maybe none suitable for investment. part 3 is your strategy, what if it falls? when to DCA? when to stop loss? when to buy? when is the best time to buy? etc. if it move up, when to sell? how much to sell? and such.. hopefully u develop your own trading strategy and win some money in future. and don't sell on fear, if u are confident that it will bounce back after u done all your research just stick to it. my longest wait for a recovery is 1 year and it had cut my capital hard but I continue to DCA until I got everything back.

10baggerbamm : everybody who is an Intel shareholder I hope you love president Trump and I hope that he wins for your sake. because there will not be a buyout under the harris administration the doj will make sure of that.

CNNT OP 6686 : Hey, sincere thanks for the concerns and for sharing your approach (i will find time to digest it as it is a lot to take in). These were records from my early days of investing and was just sandboxing, so the Halloween campaign was a good opportunity to turn these bits of info into something entertaining:) Nov will be my 6th month so I'm very cautious now and have learned up TA, FA and paying attention to market info (boy it's almost like a full time job). Less sandboxing, more deliberate decision making. All the best to us in this journey!!

CNNT OP 10baggerbamm : Dude, I'm from the other side of the world, lol, but US stock market is fascinating to play in.

Dude, love is a big word to use on another human being, it should be reserved for people in our life who love us and care about us,, and people who are truly worthy, not some lifelong conman and womaniser who is only manipulating your emotions to get his way. Just an observation from afar. Yes, the system is broken, but it's up to us individually and collectively to do something about it and not let Machiavellians (from any political party, or even civic leaders, business lesders, religious leaders for that matter) gaslight and brainwash you. Look at DJT stock's financials, it's a mess; it's a testimony of the CEO's ability in managing finance, aka the mini economy. Dubious people are everywhere in the corridors of power and money, and he is a clearcut example.

Prayers to you and your country from afar, and for a better tomorrow.

6686 : I took a good look at Nestlé and HEIM, both are at the peak, I won't really recommend them, EC can keep for long term, it's at the valley and may rebounce hard, just awaiting for the right timing, estimated march 2025 when they announce dividend for FY2024. Goodluck!

View more comments...