No Data

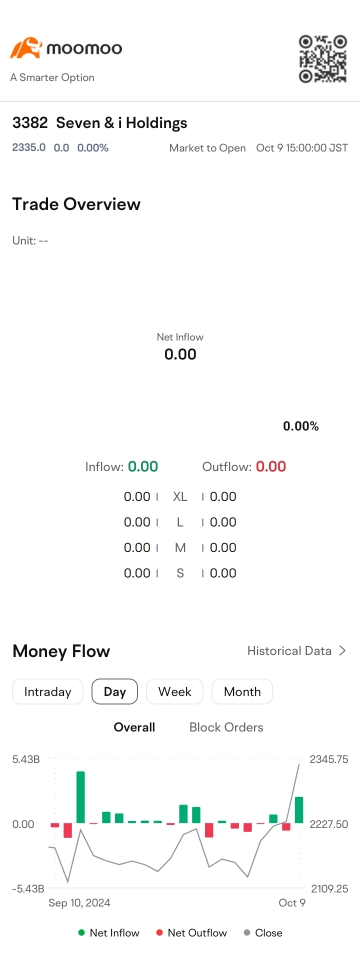

3382 Seven & i Holdings

- 2215.5

- -31.5-1.40%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Market Chatter: Seven & I Says Couche-Tard Understates Antitrust Risk In Takeover Proposal

At the end of the term, Institutions are mainly focused on rebalancing.

The Nikkei Average rebounded for the first time in four trading days, closing at 37,780.54 yen, up 172.05 yen (with an estimated Volume of 1.6 billion shares). Following the rise in the USA market, buying was led by semiconductor stocks and export-related stocks, which temporarily widened gains to 38,115.65 yen. However, at the recent resistance level, conflicting sentiments emerged, and after the initial wave of buying, the market gradually became more stagnated. Advantest <6857>, which started with buying, turned to decline early on, and as the afternoon session began, it widened its losses.

The Nikkei average is up about 213 points, with fast retail, Tokyo Electron, and TDK as the top contributors.

After 12:48 PM on the 25th, the Nikkei average is about 213 yen higher compared to the previous day, hovering around 37,820 yen. In the afternoon session, selling pressure is slightly dominant as trading begins. Subsequently, the market has entered a phase of consolidation. The foreign exchange market remains stable, with the dollar at around 150.60 yen. The contribution of the Nikkei stock average's constituent stocks shows positive contributions from Fast Retailing <9983.T>, Tokyo Electron <8035.T>, and TDK <6762.T> at the top. Negative contributions come from Advantest <6857.T> and 7&I Holdings <33.

The Nikkei average is up about 305 yen, with the rising rates of the adopted stocks including Fujikura, Mitsubishi Estate, Disco, ETC.

On the 25th, at 11:02 AM, the Nikkei average stock price was trading around 37,915 yen, about 305 yen higher than the previous day. At 9:32 AM, it reached a high of 38,115.65 yen, up 507.16 yen. After that, it faced selling pressure as investors waited for a rebound, leading to a tough upward trend. Among the stocks included in the Nikkei average, Fujikura <5803.T>, Mitsubishi Estate <8802.T>, Disco <6146.T>, Screen <7735.T>, and SMC <6273.T> ranked high in percentage increase. On the other hand,

Seven & I Holdings Publishes Two Documents Responding to Misinformation and Detailing Its Constructive Engagement With Alimentation Couche-Tard

The Nikkei average is up about 20 yen, and after the Buy surge, it shows heavy movement in the upper range = 24 days before the market.

On the 24th at around 10:09 AM, the Nikkei Stock Average is trading about 20 yen higher than the previous weekend, around 37,700 yen. At 9:00 AM, it reached 38,841.68 yen, up by 164.62 yen. In the morning, there was some easing of caution regarding the impact on the US economy from the introduction of mutual tariffs starting April 2nd in the US stock market on the 21st local time, resulting in a rebound of the NY Dow Inc and the Nasdaq Composite Index. As a result, buying was prioritized. However, since the previous week also witnessed a heavy upper range, selling in anticipation of a pullback emerged afterward.

Comments

Baker Hughes Company (BKR US) $Baker Hughes (BKR.US)$

Daily Chart -[BULLISH ↗ **]BKR US shaped a bullish exit of ascending channel to the upside. As long as price is holding above near term support at 42.65, a further push higher towards 46.90 resistance is expected. Technical indicators are advocating for a bullish scenario as well.

Alternatively: A daily candlestick closing below 42.65 support level could open drop towards n...

● S&P/TSX 60 Index Standard Futures are trading at 1,444.70, down 0.06% from previous close

● Canada's merchandise trade deficit hit $1.1B in August: Statistics Canada

● Rate cuts have 'barely' improved housing affordability: RBC economist

● Couche-Tard sweetens offer for 7-Eleven owner to $47 billion

● Cameco eyes expan...

【United States】

Data from the U.S. Census Bureau shows that in July, new housing starts in the United States fell by 6.8% month-over-month, with an annualized rate dropping to 1.238 million units. This figure is lower than the market expectation of 1.33 million units and marks the largest decline since March. This contrasts with the revised 1.1% increase from the previous month.

US Jobless Claims, Business Activity Keep Economy On Gradual...

103677010 : noted

102782319 : Noted