No Data

3436 SUMCO

- 1172.5

- +12.5+1.08%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

SUMCO To Go Ex-Dividend On December 27th, 2024 With 6 JPY Dividend Per Share

December 26th (Japan Standard Time) - $SUMCO(3436.JP)$ is trading ex-dividend on December 27th, 2024.Shareholders of record on December 31st, 2024 will receive 6 JPY dividend per share. The ex-

JP Movers | Honda Motor Rose 12.22%, Leading Nikkei 225 Components, Honda Motor Topped Turnover List

Market sentiment was stable today as Nikkei 225 components continued to trade sideways, with Honda Motor(7267.JP) being the top gainer today, rising 12.22% to close at 1432.5 yen. In addition, the top loser was Toho(9602.JP),falling 6.19% to end at 6217.0 yen.

Sanwa Technos Research Memo (2): For the interim period ending in March 2025, there will be a decrease in sales and profits, but each stage's profits will exceed the Financial Estimates.

For the second quarter of the fiscal year ending in March 2025, the consolidated performance showed a revenue of 69,426 million yen, which is a 21.9% decrease compared to the same period last year. Operating profit decreased by 52.1% to 1,650 million yen, ordinary profit decreased by 54.6% to 1,681 million yen, and the net profit attributable to shareholders of the parent company decreased by 58.7% to 1,271 million yen. Despite these decreases in revenue and profit, each profit stage exceeded the forecasted figures.

Express News | [Change Report] TIAA-CREF Investment Management, LLC reports a decrease in shareholding of SUMCO (3436.JP) to 6.97%.

Nikkei average contribution ranking (before closing) - the Nikkei average has significantly risen for four consecutive days, with Advantest contributing approximately 91 yen.

As of the close on the 12th, the number of rising and falling stocks in the Nikkei average was 180 stocks up, 42 stocks down, and 3 stocks unchanged. The Nikkei average rose significantly for the fourth consecutive day. It finished the morning session at 39,881.10 yen, up 508.87 yen (+1.29%) from the previous day (with an estimated Volume of 0.9 billion 90 million shares). The U.S. stock market on the 11th was mixed. The Dow Inc was down 99.27 dollars at 44,148.56 dollars, while the Nasdaq closed up 347.65 points at 20,034.89.

Yokan HD, Casio, ETC (additional) Rating

Upgraded - Bullish Code Stock Name Brokerage Firm Previous After ------------------------------------------------------------- <3291> Iida GHD Morgan Stanley "Underweight" "Equal Weight" <9021> JR West Japan SMBC Nikko "3" "2" <9502> Chubu Electric Mizuho "Hold" "Buy" Downgraded - Bearish Code Stock Name Brokerage Firm Previous After ------------------------

Comments

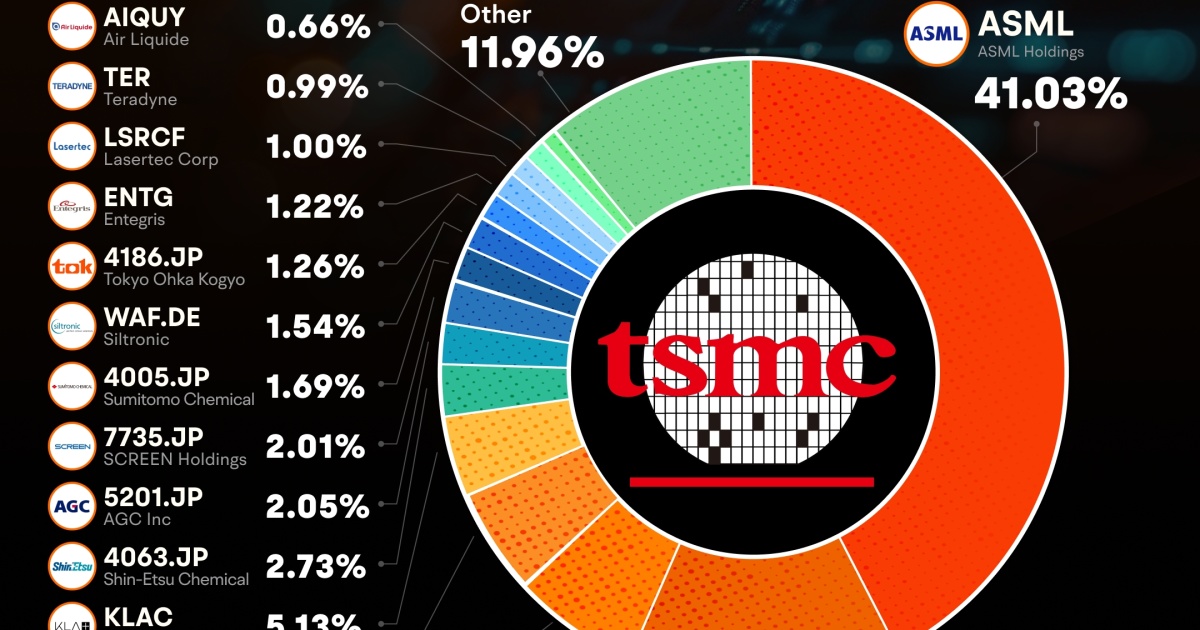

Equipment Suppliers:

$ASML Holding (ASML.US)$: A leadin...

No Data