No Data

3436 SUMCO

- 1353.5

- -52.0-3.70%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Nikkei average significantly continued to decline, strongly aware of caution towards the upcoming Trump administration.

On the 12th, the US stock market fell. The Dow Jones Industrial Average closed at 43,910.98, down 382.15 points, and the Nasdaq closed at 19,281.40, down 17.36 points. With cautious sentiment near record highs, the market was mixed after the opening. Lack of new buying factors, profit-taking sales pressure due to temporary high achievement, and the market turned lower. Throughout the day, concerns about the improvement in economic outlook and the easing speculation of interest rate cuts against the background of rising long-term interest rates, the market remained soft. To be continued tomorrow.

Rating [security companies rating]

Upgrade - Bullish Security company name changes before and after --- <2413> EMURIE UBS "Sell" "Neutral" <9983> First retail JP Morgan "Neutral" "Overweight" <9021> JR West Japan SBI "Hold" "Buy" <1893> GOYO Kensetsu Hana "Hold" "Slightly bullish" Downgrade - Bearish code

November 11th [Today's Investment Strategy]

[FISCO Selected Stocks] [Material Stock] Mitsui Metal <5706> 4827 yen (11/8) Engaged in functional materials, electronic materials, nonferrous metal refining, resource development, precious metal recycling, etc. The performance forecast for the fiscal year ending March 2025 has been revised upward. Operating profit is expected to be 56 billion yen (an increase of 76.7% compared to the previous period). It has been raised by about 19% from the previous forecast. In the first half, the sales volume of major products in the functional materials division increased, and there was an improvement in inventory factors associated with the volatility of nonferrous metal prices due to the trend of a weak yen.

Keep an eye on Mitsui Gold and Keihan HD, while SUMCO and Hamamatsu Photonics are sluggish.

On the US stock market last weekend on the 8th, the dow jones industrial average rose by 259.65 points to 43,988.99, the nasdaq composite index rose by 17.32 points to 19,286.78, and the Chicago Nikkei 225 futures were down 365 yen from the Osaka day session to 39,135 yen. The exchange rate is 1 dollar = 152.60-70 yen. In today's Tokyo market, Ice Style <3660> saw its first quarter operating profit double compared to the same period last year, Kaken Pharmaceutical <4521> saw its first-half operating profit increase by 3.5 times compared to the same period last year, and the first-half operating profit increased by 26.

SoftBank, upward revision on 25/3, operating profit 950 billion yen ← 900 billion yen

SoftBank <9434> announced a revision to its financial estimates for the fiscal year ending in March 2025. The revenue has been upwardly revised from 6.2 trillion yen to 6.35 trillion yen, and the operating profit from 900 billion yen to 950 billion yen. The strong performance of its subsidiary, the leading smart phone payment provider PayPay, as well as the recovery of its mobile business, have contributed to this. [Positive evaluation] <9735> secom co midterm | <4521> Kaken Pharmaceutical midterm <7733> Olympus midterm | <8362> Fukui Bank revision <9005> Tokyu midterm | <4

Sumco Corporation Faces Challenging Nine Months in 2024

Comments

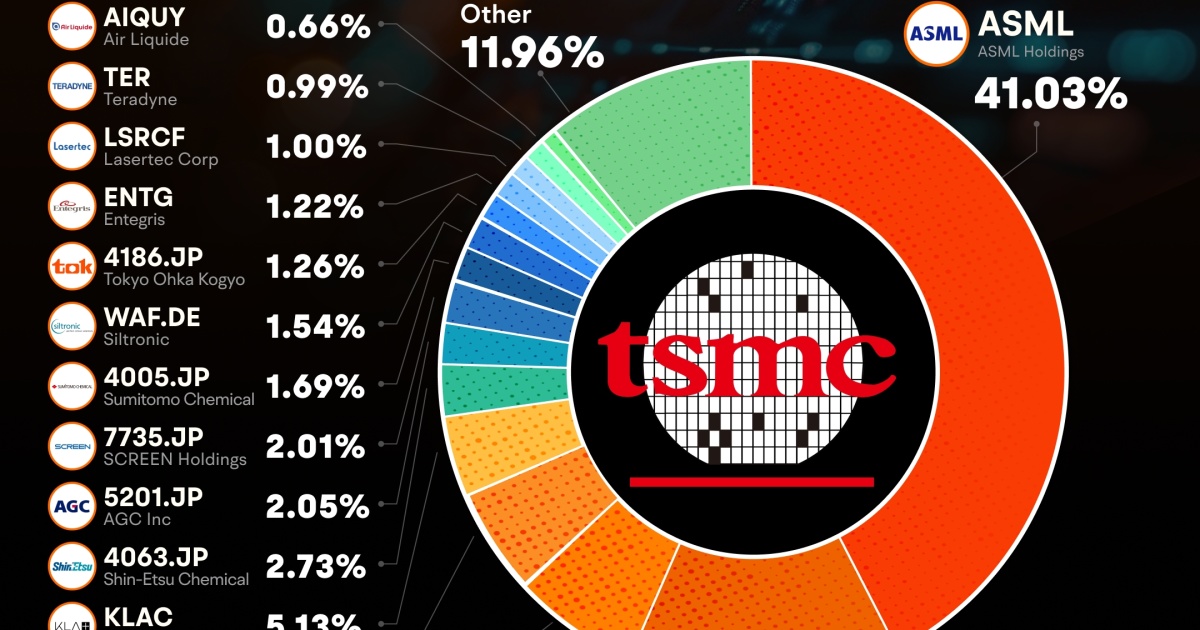

Equipment Suppliers:

$ASML Holding (ASML.US)$: A leadin...

Analysis

Price Target

No Data

No Data