No Data

4063 Shin-Etsu Chemical

- 5054.0

- -69.0-1.35%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

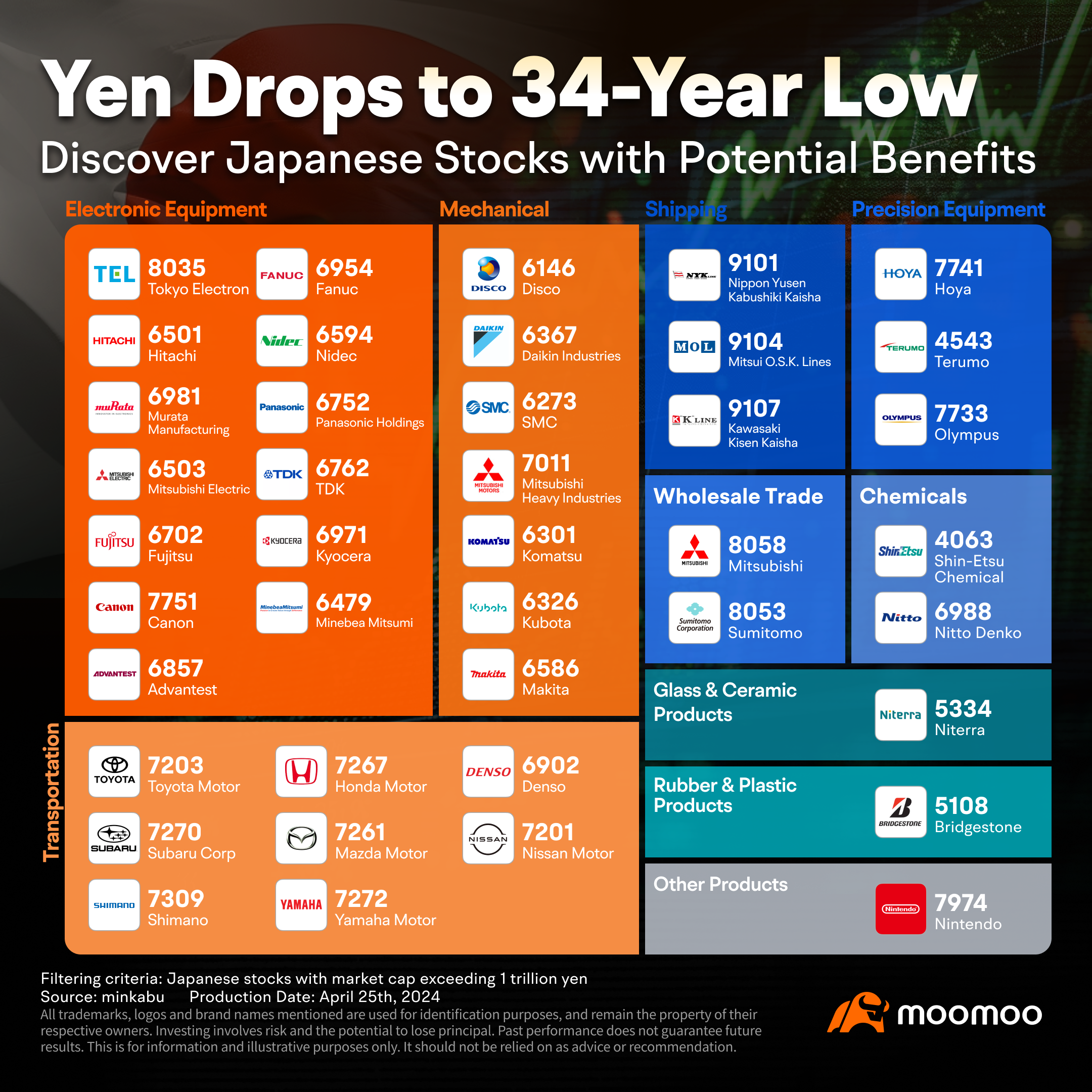

Developments while keeping an eye on the exchange rate.

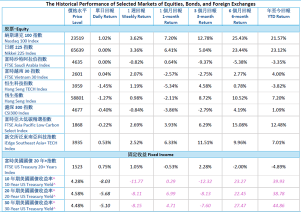

The Nikkei average has fallen for six consecutive trading days. It ended the day at 38,701.90 yen, down 111.68 yen (estimated Volume of 2.7 billion 10 million shares). Following the yen's depreciation after Bank of Japan Governor Kazuo Ueda's press conference, there was buying in export-related stocks, such as Automobiles, and the Nikkei average began to rebound. Towards the end of the morning session, it rose to 39,039.68 yen. However, after Finance Minister Katsunobu Kato expressed concerns over the fluctuations in the foreign exchange market, including speculative movements, it was a trigger for short-term Futures.

Shin-Etsu Chemical to Repurchase Shares and Increases Dividend Payout

Nikkei Average Contribution Ranking (pre-close) ~ The Nikkei Average has fallen for four consecutive days, and SoftBank Group has pushed it down by about 66 yen for one stock.

As of the close on 18 days ago, the number of rising and falling stocks in the Nikkei average was 116 stocks up, 108 stocks down, and 1 stock unchanged. The Nikkei average has declined for four consecutive days. It ended the morning trading at 39,281.06 yen, down 83.62 yen (-0.21%) from the previous day (with an estimated Volume of 1.1 billion 60 million shares). On the 17th, the US stock market fell. The Dow Inc. decreased by 267.58 dollars to 43,449.90 dollars, and the Nasdaq dropped by 64.83 points to 20,109.06.

ADR Japanese stock rankings - general Sell pressure including Yuucho Bank, Chicago down 145 yen compared to Osaka at 39,255 yen.

Japanese stocks of ADR (American Depositary Receipt) compared to the Tokyo Stock Exchange (calculated at 153.48 yen per dollar) include Yu-cho Bank <7182>, SoftBank Group <9984>, Nidec <6594>, Renesas <6723>, Sony Group Corp <6758>, Murata Manufacturing <6981>, DAIKIN INDUSTRIES, LTD. Unsponsored ADR <6367>, all of which have declined, indicating a general trend towards Sell. The clearing price for Chicago Nikkei 225 Futures is down 145 yen from the Osaka daytime price, now at 39,255 yen. The U.S. stock market has fallen. The Dow Inc decreased by 267.58 dollars, now at 43,449.

A sense of stagnation is increasing ahead of the Japan-U.S. financial meeting.

The Nikkei average slightly declined, finishing at 39,457.49 yen, down 12.95 yen (with an estimated Volume of 1.5 billion 20 million shares). Following the trend of technology stocks being bought in the US market last weekend, a portion of semiconductor-related stocks were purchased, and shortly after the market opened, the Nikkei average rose to 39,632.17 yen. However, after breaking the psychological barrier of 39,500 yen, there was a Sell to secure short-term profits, along with the Federal Open Market Committee (FOMC) meeting starting on the 17th and other events on the 18th.

Nikkei Average Contribution Ranking (pre-close) ~ The Nikkei average rebounded, with Advantest and Chugai Pharmaceutical pushing it up by approximately 60 yen.

As of the close of trading 16 days ago, the number of advancing and declining stocks in the Nikkei Average was 108 stocks up, 114 stocks down, and 3 stocks unchanged. The Nikkei Average rebounded, finishing the morning session at 39,533.55 yen, up 63.11 yen (Volume approximately 0.8 billion, 12.46 million shares). Last weekend, the Dow Inc in the USA closed down 86.06 dollars at 43,828.06 dollars, while the Nasdaq finished up 23.88 points at 19,926.72 points. Major corporate earnings were well-received. However, the Dow is influenced by the Federal Reserve Board.

Comments

United States

Goldman Sachs expects US companies to achieve their highest quarterly profits in 3 years, which will ultimately lead to an increase in the performance of US stock market indices.

US Labor Market Losing Steam As Unemployment Rate Climbs To 4.1%

The U.S. Department of Labor reported robust job growth in June, with non-farm payrolls increasing by 206,000, compared to an estimated 190,000. Average hourly earnings rose by 0.3% month-ove...

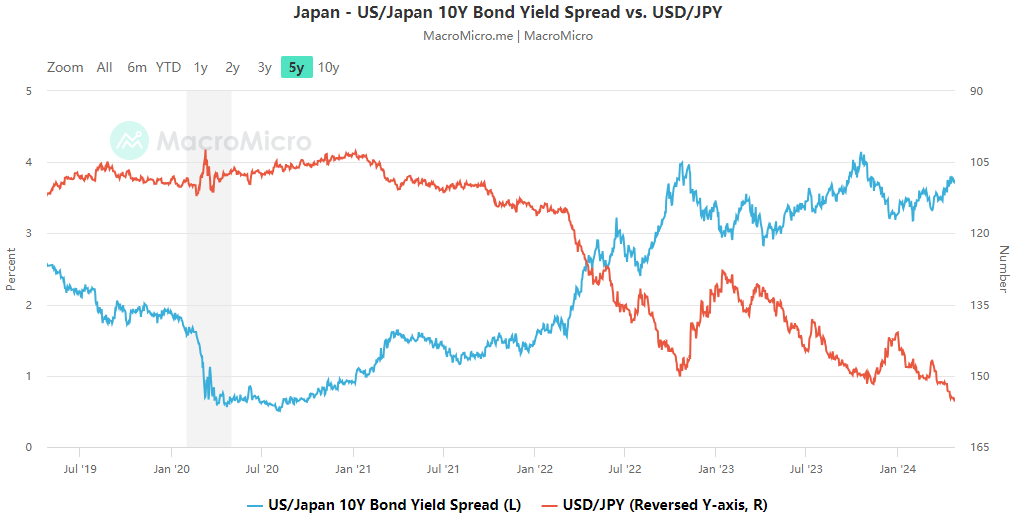

On April 24th, the Japanese yen continued its slump against the US dollar, breaching the key level of 155 fo...

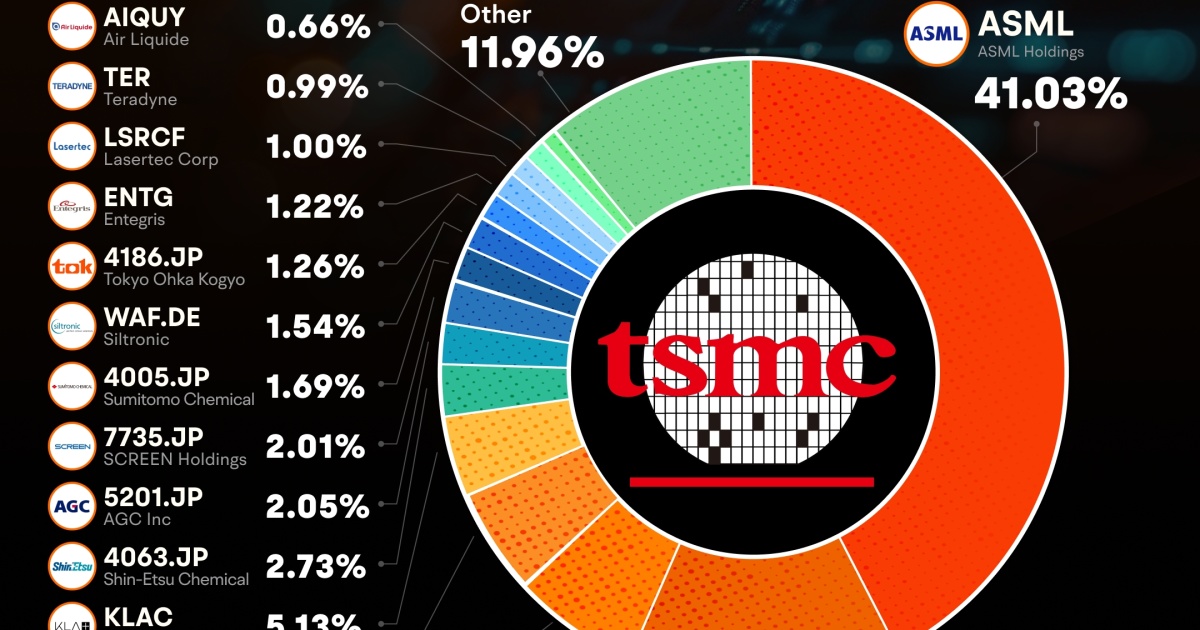

Equipment Suppliers:

$ASML Holding (ASML.US)$: A leadin...