No Data

601088 China Shenhua Energy

- 42.10

- +1.87+4.65%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Hong Kong stock concept tracking | Coal prices continue to remain high, institutions are bullish on the coal sector's interest rate arbitrage trade (including concept stocks)

With the continuous implementation of repurchase, shareholding, refinancing, and other mmf tools such as SFISF, arbitrage trade is expected to continuously deepen the value of coal dividends.

Hong Kong stock unusual movement | Coal industrial concept strengthened during the trading session, institutions predict that the price of hot media will gradually recover by the end of the year, energy demand may remain high in the short term.

Coal stocks strengthened during the session. As of the time of this report, china coal energy (01898) rose 3.65%, reaching HK$9.65; china shenhua energy (01088) increased by 3.36%, reaching HK$33.8; southgobi (01878) went up 2.61%, reaching HK$3.93; china qinfa (00866) climbed 2.17%, reaching HK$1.41.

Most coal industrial concept stocks rose against the market trend, with china shenhua energy (01088) increasing by 2.7%. Institutions expect that in the fourth quarter, the price of thermal coal will gradually recover by the end of the year.

Jinwu Finance News | Most coal industrial concept stocks are rising against the market trend, with kinetic dev (01277) up 3.6%, china shenhua energy (01088) up 2.7%, china coal energy (01898) up 1.93%, and yankuang energy (01171) up 1.2%. Jianyin International Research Reports indicate that driven by increased seasonal heating demand and a decrease in inventory days for china power, the bank expects thermal coal prices to gradually recover by the end of the fourth quarter. For next year, based on improved economic conditions and nationwide coal production control, the bank anticipates a moderate increase of 5% in thermal coal prices, reaching 905 yuan per ton.

[Brokerage Focus] Jefferies predicts that China's demand for thermal coal will increase by 4.9% year-on-year in 2025.

Golden Finance News | CIMB International issued research reports, stating that driven by the seasonal increase in heating demand and the reduction of inventory days of China Power Corporation, the bank expects thermal coal prices in the fourth quarter to gradually recover by the end of the year. For next year, based on improved economic conditions and nationwide coal production control, the bank expects thermal coal prices to moderately rise by 5%, reaching 905 yuan per ton. Considering the recent performance of coal prices lower than expected, the forecasted thermal coal prices for 2024F and 2025F are respectively lowered to 865 yuan/ton and 905 yuan/ton, 21% and 25% lower than previous forecasts. The bank points out, thermal power generation

Coal: can be both offensive and defensive, act according to timing.

The sector has investment value and there are also stage-specific trade opportunities.

Intelligence Hong Kong stock connect capital trend statistics (T+2) | December 3rd

Capital trend of Stock Connect on December 3rd.

Comments

Cars: $LI AUTO-W (02015.HK)$ $GEELY AUTO (00175.HK)$ $BYD COMPANY (01211.HK)$

Conventional Electricity: $CHINA RES POWER (00836.HK)$ $HUANENG POWER (00902.HK)$ $CKI HOLDINGS (01038.HK)$

Shipping: $COSCO SHIP HOLD (01919.HK)$ $OOIL (00316.HK)$

Coal: $CHINA SHENHUA (01088.HK)$ $YANKUANG ENERGY (01171.HK)$ $YANCOAL AUS (03668.HK)$

Home Appliances: $MIDEA GROUP (00300.HK)$ $HAIER SMARTHOME (06690.HK)$ $HISENSE HA (00921.HK)$

Investment: $CITIC SEC (06030.HK)$ $CHINA CINDA (01359.HK)$

���������...

There was HKD351.6 million, HKD326.1 million and HKD160.6 million Southbound Trading net outflow from $MEITUAN-W (03690.HK)$ , $CHINA SHENHUA (01088.HK)$ and $CHINA MOBILE (00941.HK)$ .

For $SH->HK Connect (GangGuTong.HK)$ , $TENCENT (00700.HK)$ was the most active stock with ...

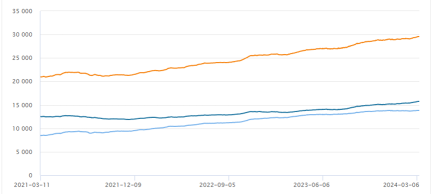

Southbound trading has been crucial in stabilizing Hong Kong’s stock market amid geopolitical risks.

BOCI expects strong demand from Mainland investors for Hong Kong stocks to continue due to attractive valuations and high dividend yields.

The volume of southbound trading is projected to grow from RMB289.4 billion in 2023 to RMB600 billion f...