No Data

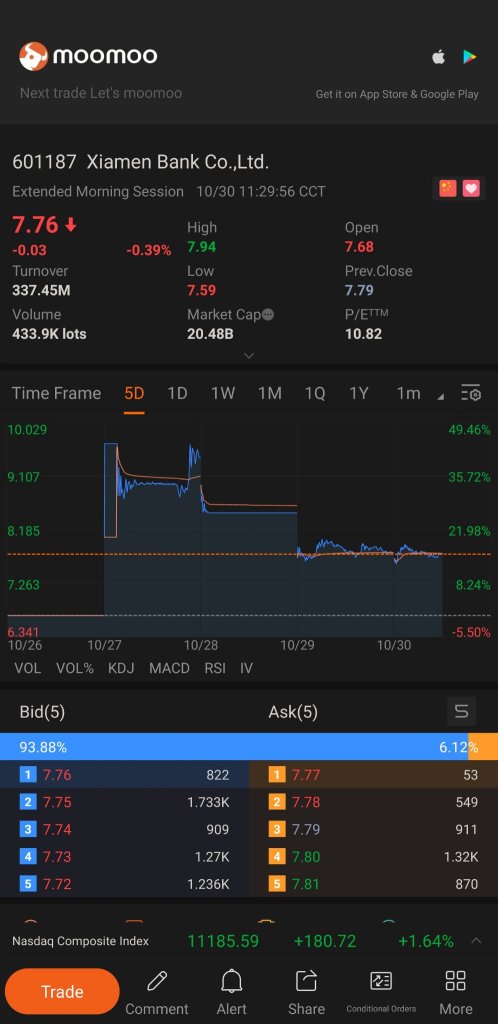

601187 Xiamen Bank Co.,Ltd.

- 5.32

- -0.05-0.93%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Bank of Xiamen: Bank of Xiamen Co., Ltd. Third Quarter Report 2024

Bank of Xiamen Co., Ltd. Third Quarter Report 2024

xiamen bank co.,ltd. (601187.SH): 1.5675 million shares of restricted shares will be lifted on October 28th.

Gelonghui October 22nd, xiamen bank co.,ltd. (601187.SH) announced that the total number of stocks listed this time is 1.5675 million shares. The date of listing for the stocks is October 28, 2024.

Xiamen Bank Co., Ltd. (601187.SH): The issuance of green financial bonds (first tranche) in 2024 is completed.

Xiamen Bank Co., Ltd. (601187.SH) announced on September 13 that, approved by the People's Bank of China, Xiamen Bank Co., Ltd. recently successfully issued the "Xiamen Bank Co., Ltd. 2024 Green Financial Bonds (Series 1)" (hereinafter referred to as "this Bond") on the national interbank bond market. This Bond was booked and filed on September 11, 2024, and was fully issued on September 13, 2024, with a issuance size of 1.5 billion yuan and a term of 3 years fixed rate bonds with a coupon rate of 2.05%. The proceeds from this Bond offering will be used in accordance with applicable laws and regulatory requirements.

A-share listed banks' semi-annual report: 41 banks continue to explore interest rate spreads, 12 banks experience negative growth in net income. The window for another round of interest rate cuts for existing housing loans has opened, posing a potential c

① In the first half of the year, the net interest margin of 41 banks collectively declined, with 9 banks experiencing a decrease of 2% or more in their interest margin compared to the same period last year; there were as many as 12 banks with a negative growth in net income attributable to the parent, an increase of 7 compared to the same period last year. ② Experts believe that the continued narrowing of the net interest margin has put certain pressure on the profitability of banks, and the possible reduction of interest rates for existing housing loans in the near future will further challenge the interest margin of banks and increase operating pressure.

Xiamen Bank Co., Ltd. reported a double decline in half-year performance, with a net interest margin of 1.14%, ranking last among the 23 listed banks that have disclosed their results. -6.94% leads the decline in bank stocks!

In the first half of the year, xiamen bank co.,ltd.'s revenue and net income attributable to shareholders both decreased by 2.21% and 15.03% respectively. The net interest margin narrowed to 1.14%, ranking last among the 23 listed banks that have disclosed their interim reports. Today's closing price of xiamen bank co.,ltd. was 4.96 yuan per share, with a daily decline of 6.94%, leading the decline in banking stocks.

Comments

Analysis

Price Target

No Data

No Data