No Data

601939 China Construction Bank Corporation

- 8.41

- -0.03-0.36%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

[Brokerage Focus] Morgan Stanley states that the CSRC encourages state-owned Insurance to invest 30% of new premiums in A-shares, expecting domestic Silver to become a major investment choice.

Jinwu Financial News | Morgan Stanley has released a report stating that the China Securities Regulatory Commission encourages large state-owned insurance companies to invest 30% of new premiums in A-shares, believing that the attractive dividend yield and stable payout ratio of Bank Of China will likely become a main investment choice for state-owned insurance companies. More rational and long-term policies, along with the support of the credit cycle, should support the sustainable development of the financial market and the ideal performance of bank stocks. The bank believes that several factors will continue to drive the performance of China Mainland Banking stocks, including a potentially more constructive view of banks' Operation Indicators in the market; expanded fiscal policy support, which buffers the tail risks of bank credit quality; in the credit cycle.

Hong Kong stocks are moving unusually | China Mainland Banking stocks are rising across the board as listed Banks have been intensively distributing dividends recently. Institutions indicate that the Sector still has upward valuation potential.

China Mainland Banking stocks are all on the rise. As of the time of publication, Postal Savings Bank Of China (01658) is up 3.08%, priced at 4.68 Hong Kong dollars; Industrial And Commercial Bank Of China (01398) is up 2.21%, priced at 5.09 Hong Kong dollars; China CITIC Bank Corporation (00998) is up 2.23%, priced at 5.49 Hong Kong dollars.

Are Banks under pressure from interest margins looking to Overseas for profits? The 2025 annual plan reveals that Overseas Business may become a new highlight.

① The Industrial And Commercial Bank Of China stated that efforts should be made to explore a second growth curve for Overseas Operation; ② For companies going global, it means that both upstream and downstream industries are venturing overseas together, which means more Chinese enterprises are setting up factories and operating locally.

The Banks wealth management market welcomes a "big year": the existing scale reaches 29.95 trillion, and the number of investors is 0.125 billion.

The year 2024 is a significant year for the Banks' wealth management market in our country, with scale and users continuing to maintain a steady growth trend.

Banks are "short of money," and the yield on interbank certificates of deposit has surpassed that of 10-year government bonds, with the scale of maturing certificates of deposit nearing 6 trillion in the first quarter.

① The recent abnormal situation of banks lacking liabilities is also related to the outflow of non-bank deposits caused by the new self-regulation rules at the end of November 2024. ② The funding situation this morning has improved significantly compared to the past two days, but it remains relatively tight.

The AUM of private banking has grown against the trend; high-end clients are the future of Banks.

In 2024, amid narrowing interest margins and weak income in the banking industry, one Indicator continues to "skyrocket." Data from the corporate early warning system shows that China's private banks...

Comments

hodling these forever ❤️

and use dividends to buy more 😁

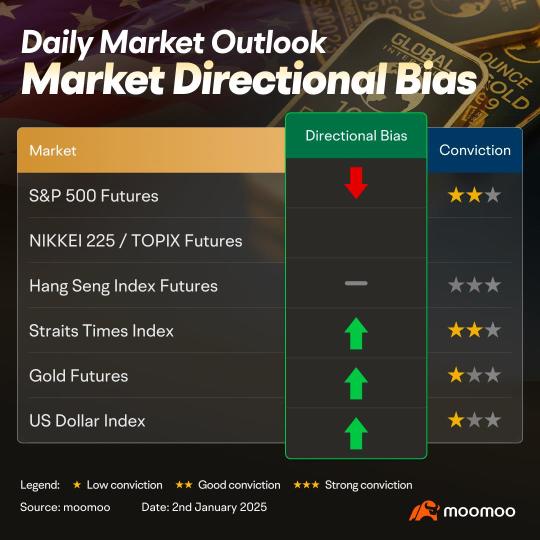

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$ (4 Hour Chart) -[BEARISH ↘ **]We turn bearish as price has dropped past previous support levels. As long as price stays below 5985 resistance level, we expect price to continue dropping towards support level at 5870. Technical indicators are advocating for a bearish scenario as well.

Alternatively: A 4 hour candlesti...

🔥Re-lending and Swap Facility: The People’s Bank of China launched initiatives to support stock buybacks and provide liquidity for invest...

105716756 : Have been doing this for Almost a decade. Initially holding 120000 shares to now more than 350000 shares.

933199333 : Smart.. Deserve to be rich.