No Data

601998 China CITIC Bank Corporation

- 6.60

- -0.16-2.37%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

China CITIC Bank Updates on Interim Dividend

China CITIC Bank Corporation will distribute a mid-term dividend of 1.847 yuan for every 10 shares on January 15, 2025.

China Citic Bank Corporation (00998) announced that it will distribute a mid-term dividend of RMB 1.847 per 10 shares for the six months ending on June 30, 2024 on January 15, 2025.

Rare! This rural commercial bank is offering a 5-year fixed deposit interest rate of 1.5%, which is lower than the 1.55% level of state-owned banks. It is referred to as a "case" in the industry.

①Recently, Wuxiang Rural Commercial Bank adjusted the deposit execution interest rates, lowering the execution interest rates for personal fixed-term deposits of two years, three years, and five years to 1.5%, with the five-year execution interest rate being lowered below the lowest level of the state-owned banks' published rates. ②The phenomenon of the aforementioned rural commercial bank reducing rates beyond the mid- to long-term levels of state-owned banks is still considered an isolated case.

China CITIC Bank Approves Key Resolutions at 2024 Meeting

China CITIC Bank Strengthens Leadership With New Nomination

China Citic Bank Corporation (00998): Fu Yamin nominated as a candidate for non-executive director.

China Citic Bank Corporation (00998) announced that Crown Holdings Limited, as a shareholder holding more than 3% of the voting shares of the bank...

Comments

$MEITUAN-W (03690.HK)$

$BIDU-SW (09888.HK)$

$BABA-W (09988.HK)$

$CHINA VANKE (02202.HK)$

$CITIC SEC (06030.HK)$

$CITIC BANK (00998.HK)$

$ZHONGLIANG HLDG (02772.HK)$

$BYD COMPANY (01211.HK)$

$HTSC (06886.HK)$

$SHK PPT (00016.HK)$

$ICBC (01398.HK)$

$HSBC HOLDINGS (00005.HK)$

$PING AN (02318.HK)$

$JD-SW (09618.HK)$

$ANTA SPORTS (02020.HK)$

Click here for Top Trending Posts

Mini handle or pullback, this type of pattern provide me safe entry point.

$Apple (AAPL.US)$ $Bank of America (BAC.US)$ $American Express (AXP.US)$ $Coca-Cola (KO.US)$ $CHERVON (02285.HK)$ $The Kraft Heinz (KHC.US)$ $Moody's (MCO.US)$ $DaVita (DVA.US)$ $CITIC BANK (00998.HK)$

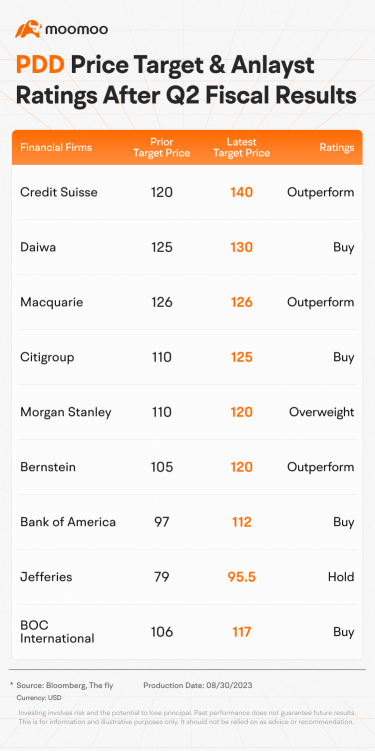

According to the earnings report, $PDD Holdings (PDD.US)$'s Q2 revenue was RMB 52.281 billion, a YoY increase of 66%, while operating profit was RMB 12.719 billion, a YoY increase of 46%. Adjusted net income was RMB 15.269 billion, a YoY increase of 42%. These figures exceeded...

DBS: China banking sector: Jun total social financing grew 9%, new increment above expectation - Alpha Edge Investing

$Ping An Bank (000001.SZ)$ $CCB (00939.HK)$ $CITIC BANK (00998.HK)$ $ABC (01288.HK)$ $ICBC (01398.HK)$ $PSBC (01658.HK)$ $BANKCOMM (03328.HK)$ $CM BANK (03968.HK)$ $BANK OF CHINA (03988.HK)$ $China Merchants Bank (600036.SH)$ $Agricultural Bank Of China (601288.SH)$ $Bank Of Communications (601328.SH)$ $Industrial and Commercial Bank of China (601398.SH)$ $Postal Savings Bank Of China (601658.SH)$ $China Everbright Bank (601818.SH)$ $China Construction Bank Corporation (601939.SH)$ $Bank Of China (601988.SH)$ $China CITIC Bank Corporation (601998.SH)$ $CEB BANK (06818.HK)$

Analysis

Price Target

No Data

No Data

每天都在學習中 : Bullish on Alibaba.$BABA-W (09988.HK)$ Buy around $90 on dips.