JP Stock MarketDetailed Quotes

6146 Disco

- 40510.0

- -510.0-1.24%

20min DelayNot Open Dec 13 15:30 JST

4.39TMarket Cap52.32P/E (Static)

41080.0High40120.0Low3.05MVolume41020.0Open41020.0Pre Close123.36BTurnover68850.052wk High3.55%Turnover Ratio108.38MShares31730.052wk Low964.74EPS TTM3.48TFloat Cap68850.0Historical High52.32P/E (Static)85.87MShs Float493.3Historical Low774.26EPS LYR2.34%Amplitude355.00Dividend TTM10.06P/B100Lot Size0.88%Div YieldTTM

Disco Stock Forum

Stocks to Watch

Abbott Laboratories (ABT US) $Abbott Laboratories (ABT.US)$

Daily Chart -[BULLISH ↗ **]ABT US is currently holding above short term ascending trendline support. As long as price is holding above 117.30 support, a further push higher towards 1st resistance at 123.80 then next resistance at 131.20 is expected. Technical indicators are advocating for a bullish scenario as well.

Altern...

Abbott Laboratories (ABT US) $Abbott Laboratories (ABT.US)$

Daily Chart -[BULLISH ↗ **]ABT US is currently holding above short term ascending trendline support. As long as price is holding above 117.30 support, a further push higher towards 1st resistance at 123.80 then next resistance at 131.20 is expected. Technical indicators are advocating for a bullish scenario as well.

Altern...

+3

31

4

2

US Market Key Charts (S&P, US Dollar, Gold)

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ *]We stay bullish as long as price holds above 5815 support level. We expect price to push towards 5930 resistance level. A 4 hour candlestick closing above 5930 resistance level would open next push towards 5990 resistance level. Technical indicators are mixed, with prices holding above 21-EMA period.

Alternatively: A 4 hour candlestick c...

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ *]We stay bullish as long as price holds above 5815 support level. We expect price to push towards 5930 resistance level. A 4 hour candlestick closing above 5930 resistance level would open next push towards 5990 resistance level. Technical indicators are mixed, with prices holding above 21-EMA period.

Alternatively: A 4 hour candlestick c...

27

4

US Market Key Charts (S&P, US Dollar, Gold)

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ **]We continue to maintain a bullish directional bias as price continues to hold above 5850 support level. We expect prices to push towards 5940 resistance level. Technical indicators are leaning towards a bullish scenario.

Alternatively: A 4 hour candlestick closing below 5850 support could open next drop towards 5810 support...

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ **]We continue to maintain a bullish directional bias as price continues to hold above 5850 support level. We expect prices to push towards 5940 resistance level. Technical indicators are leaning towards a bullish scenario.

Alternatively: A 4 hour candlestick closing below 5850 support could open next drop towards 5810 support...

17

2

Market News

【United States】

Data from the U.S. Census Bureau shows that in July, new housing starts in the United States fell by 6.8% month-over-month, with an annualized rate dropping to 1.238 million units. This figure is lower than the market expectation of 1.33 million units and marks the largest decline since March. This contrasts with the revised 1.1% increase from the previous month.

US Jobless Claims, Business Activity Keep Economy On Gradual...

【United States】

Data from the U.S. Census Bureau shows that in July, new housing starts in the United States fell by 6.8% month-over-month, with an annualized rate dropping to 1.238 million units. This figure is lower than the market expectation of 1.33 million units and marks the largest decline since March. This contrasts with the revised 1.1% increase from the previous month.

US Jobless Claims, Business Activity Keep Economy On Gradual...

4

1

1

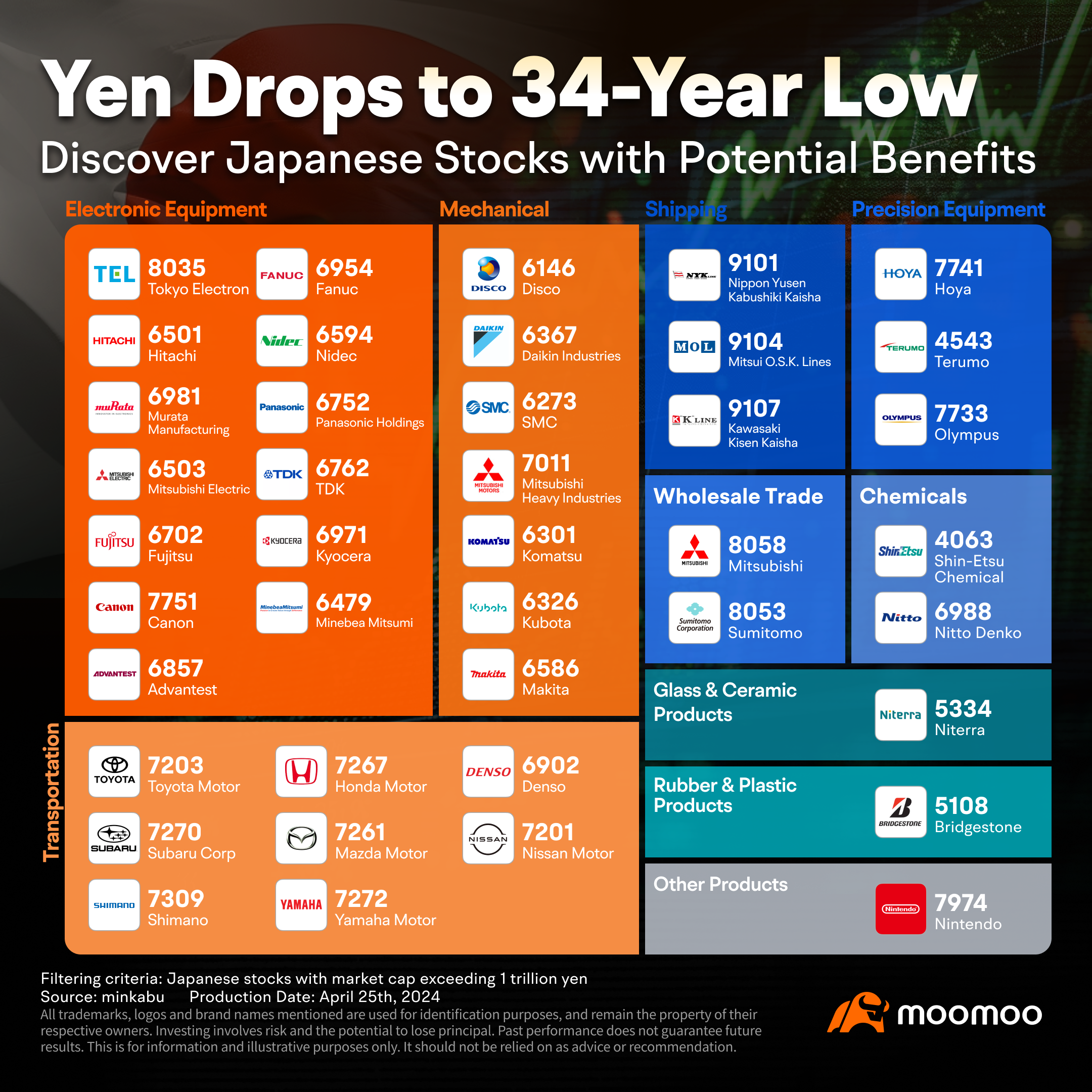

At the beginning of this year, Japanese stocks briefly led the global market, breaking a 34-year-old record high. However, the continuous depreciation of the yen has recently hindered their upward momentum. Unlike the strong surge seen from last year to earlier this year, Japanese stocks are now facing accumulating uncertainties. After reaching a historic high, the Nikkei 225 Index has been consolidating sideways for quite a while, fl...

14

15

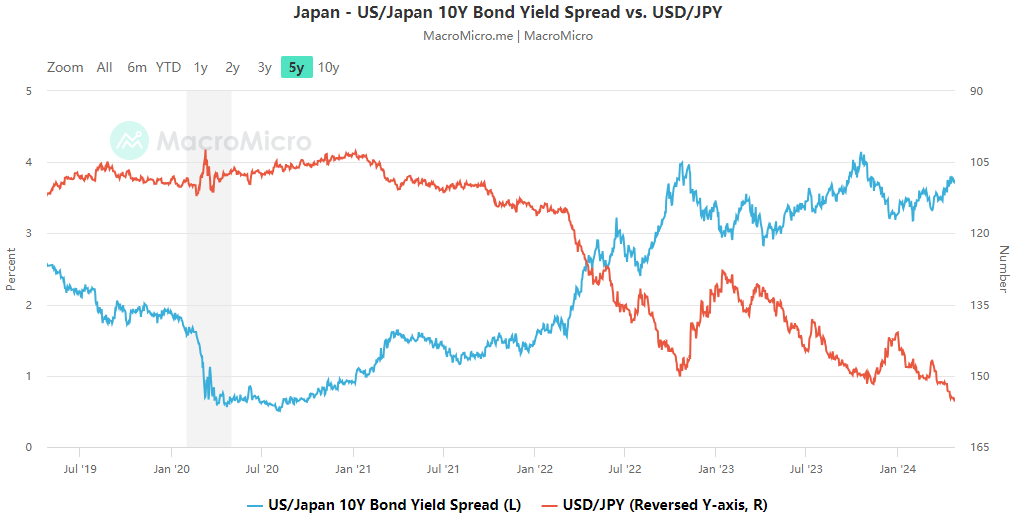

Betting on the yen's strengthening became a favored strategy over the past year as the Bank of Japan(BOJ) was set to wrap up an eight-year period of negative interest rates in the face of rising inflation. Yet, rather than appreciating, the yen continued to weaken subsequent to theend of negative interest rates.

On April 24th, the Japanese yen continued its slump against the US dollar, breaching the key level of 155 fo...

On April 24th, the Japanese yen continued its slump against the US dollar, breaching the key level of 155 fo...

+1

58

83

Since last year, the Japanese stock market has started to rise sharply, 📈attracting the attention of global investors. 🔥 However, I used to mostly focus on the U.S. Market and did not pay much attention to it. ![]()

Later, when I had learned more about the Japanese market was from the group mates' chat about "When will Moomoo be listed on the Japanese stock market? The Japanese stock market has been doing well lately."![]() Previous...

Previous...

Later, when I had learned more about the Japanese market was from the group mates' chat about "When will Moomoo be listed on the Japanese stock market? The Japanese stock market has been doing well lately."

4

1

2

Columns Besides Buffett's Favored Japan Trading Firms, Others with Nearly 55% Surge Are Drawing Attention

Following the BOJ's recent departure from negative interest rates and its first rate hike in 17 years, Berkshire Hathaway is planning to issue yen-denominated bonds globally once again. Daiwa Securities strategist Atsuko Ishitoya suggests this may lead to increased investment in Japanese trading firms.

Alongside Buffett, Wall Street giants like Goldman Sachs Asset Management are eyeing Japan, favorin...

Alongside Buffett, Wall Street giants like Goldman Sachs Asset Management are eyeing Japan, favorin...

+5

15

2

13

This year, Japan's market has hit historic milestones, with the Nikkei 225 scaling a 34-year peak and the Bank of Japan hiking interest rates, turning the page on the last chapter of global negative interest rates.

The Japanese stock market's record-breaking run has brought the "Seven Samurai" stocks into the spotlight for global investors. Coined by Bruce Kirk, a Goldman Sachs Japan strategist, the term draws...

The Japanese stock market's record-breaking run has brought the "Seven Samurai" stocks into the spotlight for global investors. Coined by Bruce Kirk, a Goldman Sachs Japan strategist, the term draws...

+6

25

43

Inflation in Singapore declined from a peak in September 2022 to 3.4% by February 2024. Despite a slight rise in February, above January's 2.9%, this was mainly due to increased costs during the Lunar New Year, including higher airfares, holiday expenses, and rising food prices. The Singapore Central Bank has kept its monetary policy steady for the third time in a row, expecting inflation to ease later in the year, suggesting potent...

+1

12

16

No comment yet

103677010 : noted

103425615 : good

山芭佬 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

105489590 : k