No Data

6526 Socionext

- 2530.5

- -123.5-4.65%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Stocks that moved the previous day part 1 Branding, Makino Milling Machine, Weather News, ETC.

Stock Name <Code> 30-day close ⇒ Compared to the previous day, Polaris HD <3010> 184 +1225 has revised its financial estimates for the fiscal year ending March 2025 upwards. Nagao <6239> 1202 +104 has secured a large order from Screen Internal. Hello's <2742> 4625 +425 reported a positive response to its two-digit profit increase for the third quarter. Palemo HD <2778> 123 -10 has seen a 50.9% decrease in operating profit for the cumulative third quarter. Branding <7067> 1638 +300 Japan Asia Investment <

JP Movers | Hino Motors Rose 2.61%, Leading Nikkei 225 Components, IHI Topped Turnover List

Market sentiment was stable today as Nikkei 225 components continued to trade sideways, with Hino Motors(7205.JP) being the top gainer today, rising 2.61% to close at 566.0 yen. In addition, the top loser was Nissan Motor(7201.JP),falling 5.73% to end at 480.0 yen.

Nikkei Average Contribution Ranking (as of noon close) - The Nikkei Average fell, with Advantest and Fast Retailing contributing to a decline of approximately 159 yen.

As of the close 30 days ago, the number of rising and falling stocks in the Nikkei Average was 88 rising, 135 falling, and 2 unchanged. The Nikkei Average fell, ending the morning session at 39,979.68 yen, down 301.48 yen (estimated Volume of 0.7 billion, 58.3 million shares). Last Friday, the Dow Inc in the USA closed down 333.59 dollars at 42,992.21 dollars, while the Nasdaq ended down 298.33 points at 19,722.03 points. With the holiday season approaching, participant numbers are limited.

Three key points to watch in the latter session - soft trend due to the rebound from the end of last week.

In the afternoon trading on the 30th, three points should be noted: ・ The Nikkei index fell, showing a weak trend due to the reaction from the end of last week ・ The dollar-yen exchange rate is holding steady, with US interest rates remaining firm ・ The top contributor to the decline is Advantest <6857>, with First Retailing <9983> in second place. ■ The Nikkei index fell, showing a weak trend due to the reaction from the end of last week. The Nikkei index decreased by 301.48 yen, closing at 39,979.68 yen (estimated Volume 0.7 billion, 58.3 million shares) at the end of the morning trading. Last week's US market's Dow Inc experienced a decline of 333.

The Nikkei average has fallen, showing weak movements due to last weekend's reaction.

The Nikkei average has fallen. It ended the morning session at 39,979.68 yen, down 301.48 yen (estimated Volume 0.7 billion, 58.3 million shares). Last weekend, the USA market's Dow Inc average finished down 333.59 dollars at 42,992.21 dollars, while the Nasdaq closed down 298.33 points at 19,722.03 points. With the year-end and New Year holidays approaching, participation is limited, and China's Indicators were lackluster. Additionally, political instability in Germany and South Korea seems to have influenced some investors' sentiment, leading to the decline. New Year.

Stocks that moved the day before part 1: Wizus, Makino Milling Machine, DeNA, etc.

Ticker Name <Code> Closing Price on the 27th ⇒ Change from Previous Day Okamoto Glass <7746> 258 0 Increased production capacity of Glass polarizers. Became popular temporarily but lost momentum. Wizus <9696> 2420 +220 Reported that a shareholder investment fund proposed privatization. Ateam <3662> 1001 +33 Subsidiary of WCA, which handles web marketing consulting and web marketing operations. KTK <3035> 555 -19 Progress in operating profit for the first quarter versus full-year Financial Estimates.

Comments

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$(4 Hour Chart) -[BULLISH↗ *]We stay slightly bullish as we expect price to push towards 6000 resistance level. A 4 hour candlestick closing above 6000 resistance level would open a push towards 6035 resistance level. Technical indicators have yet to indicate a bullish scenario.

Alternatively: A 4 hour candlesti...

Do you find it

Yes?

No worries!

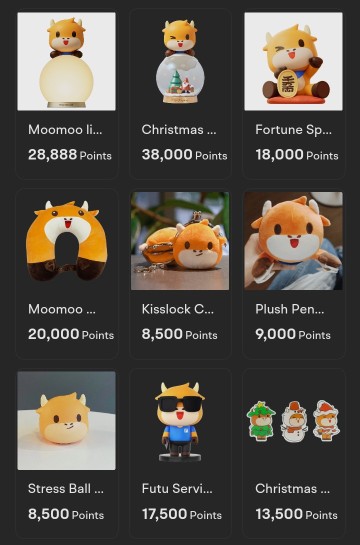

Why not try these methods to get rewards bigger

To get rewards bigger than the yield coupon, Mooers may exchange 400 coins for 1000 MooMoo points.

Let's assume Mooers managed to collect 4000 coins. This would mean that Mooers could exchange f...

The Yokohama-based company is collaborating with Arm Holdings Plc and Taiwan Semiconductor Manufacturing Co., it said in a statement on Wednesday. Its shares jumped as much as 16% shortly after the announ...

Cui Nyonya Kueh :

Musang Siguntang : ???