No Data

6902 Denso

- 2214.5

- +9.5+0.43%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Personal blogger Ikio Miyao: DX will evolve in 2025 - 7 perspectives 【FISCO Social Reporter】

The following is a comment written by Mr. Ikuo Miho, a personal blogger of Fisco Social Reporter (operating the blog "IA Workshop").

The New York market continued to decline on the 30th [New York market - close].

[NYDow·NASDAQ·CME (Table)] NYDOW; 42,573.73; −418.48 NASDAQ; 19,486.79; −235.24 CME225; 39,435; −555 (compared to the major exchange) [NY Market Data] The NY market continued to decline on the 30th. The Dow average closed down 418.48 dollars at 42,573.73 dollars, and the Nasdaq closed down 235.24 points at 19,486.79. Profit-taking Sell continued toward the year-end, leading to a significant drop after the market opened.

ADR Japanese stock rankings - mixed highs and lows, Chicago is up 210 yen from Osaka at 39,700 yen.

Japanese stocks of ADR (American Depositary Receipt), in comparison with the Tokyo Stock Exchange (calculated at 1 dollar = 157.88 yen), saw increases in Japan Post Holdings <6178>, Toyota Motor <6201>, Mitsubishi UFJ Financial Group <8306>, Tokyo Electron <8035>, Mitsubishi Corporation <8058>, Denso <6902>, etc. while Japan Post Bank <7182>, JAPAN TOBACCO INC <2914>, Nidec <6594>, Toyota Motor <7203>, Bridgestone Corporation Unsponsored ADR <5108>, Honda Motor Co., Ltd <7267>, etc. declined.

The U.S. stock market is mixed, with little movement after the holiday (26th).

"Chicago Nikkei Average Futures (CME)" (26th) MAR24O 39340 (in USD) H 39830 L 39205 C 39800, compared to the Osaka Exchange +310 (evening comparison +100) Vol 2560 MAR24O 39250 (in JPY) H 39730 L 39110 C 39700, compared to the Osaka Exchange +210 (evening comparison +0) Vol 10140 "Overview of American Depositary Receipts (ADR)" (26th) In the ADR market, compared to the Tokyo Stock Exchange (1 USD = 157.88 JPY).

The New York market on the 26th was mixed.

[NYDow・Nasdaq・CME (Table)] NYDOW; 43,325.80; +28.77 Nasdaq; 20,020.36; −10.77 CME225; 39,700; +210 (compared to Osaka Securities Exchange) [NY Market Data] The NY market on the 26th exhibited mixed results. The Dow Inc average closed up $28.77 at $43,325.80, while the Nasdaq finished down 10.77 points at $20,020.36. The unexpected decrease in unemployment Insurance claims led to selling due to aversion to rising long-term interest rates.

Nikkei Average Contribution Ranking (At Close) - The Nikkei Average continues to rise, with SoftBank Group and Toyota contributing approximately 66 yen in total.

As of the close on the 26th, the number of Nikkei average constituent stocks that rose and fell was 199 stocks increasing, 22 stocks decreasing, and 4 stocks unchanged. On the 25th, overseas markets were closed due to the Christmas holiday in major markets. The exchange rate moved slightly in the early 157 yen range against the dollar. In the absence of significant trading materials, the Tokyo market opened with small movements. The Nikkei average, starting at the previous day's closing level, was buoyed by the consecutive rise of Toyota Motor Co. [7203] and various observations of Buybacks in the Futures, increasing its margin.

Comments

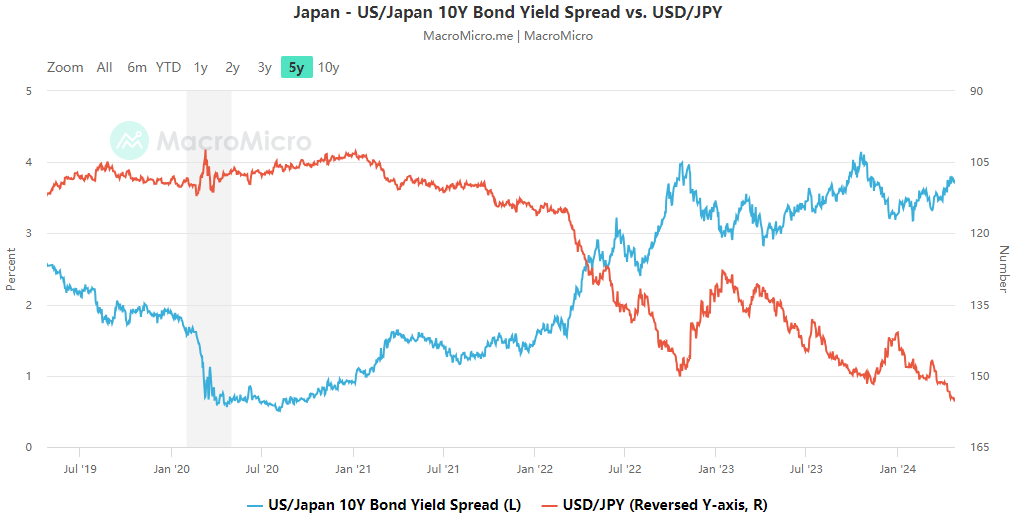

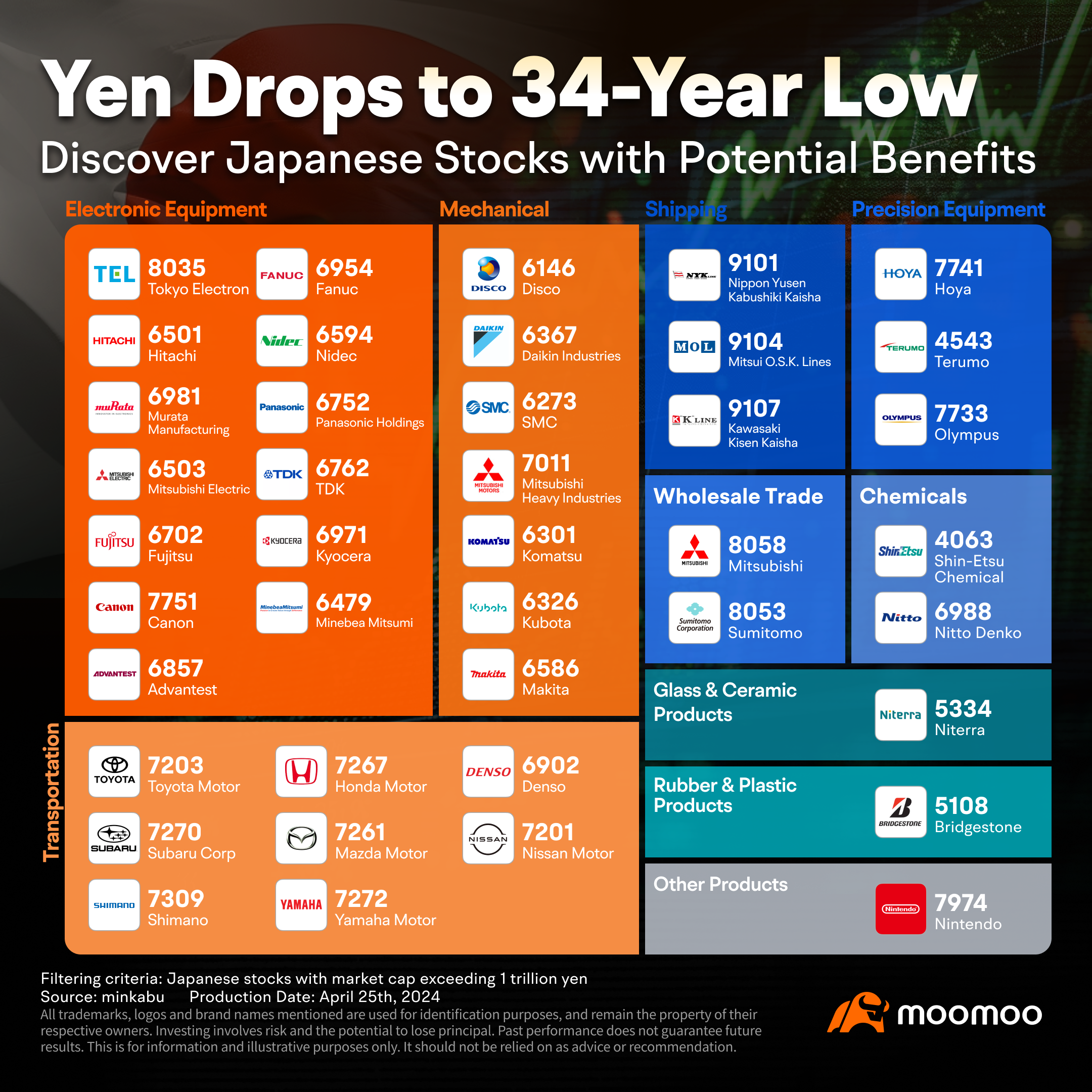

On April 24th, the Japanese yen continued its slump against the US dollar, breaching the key level of 155 fo...

Alongside Buffett, Wall Street giants like Goldman Sachs Asset Management are eyeing Japan, favorin...