No Data

6902 Denso

- 2027.0

- +15.0+0.75%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

DENSO MANUFACTURING TENNESSEE, INC., RECOGNIZED FOR WORKPLACE SAFETY RECORD

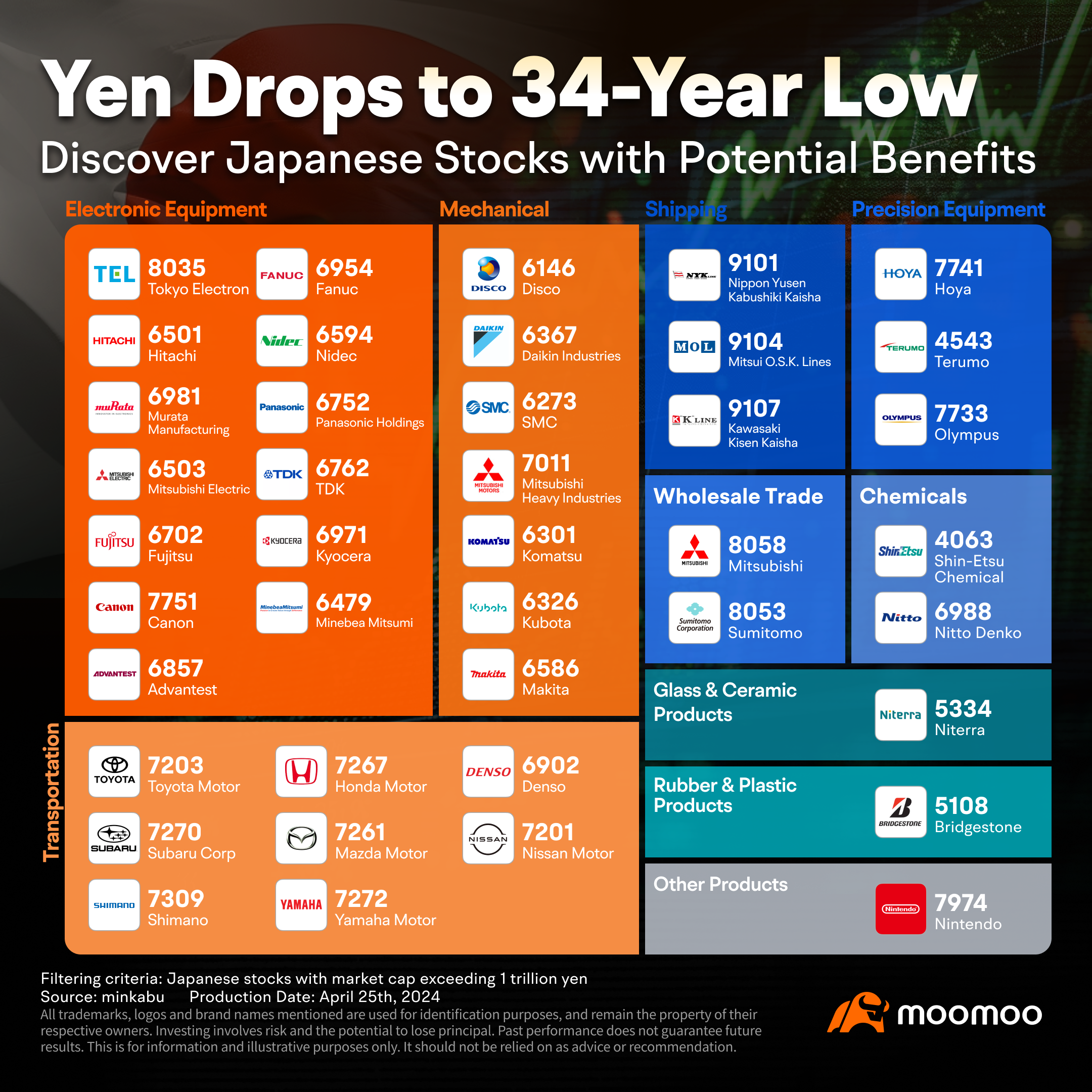

Targeting Autos Components stocks due to the weak yen and Trump's tariff resistance.

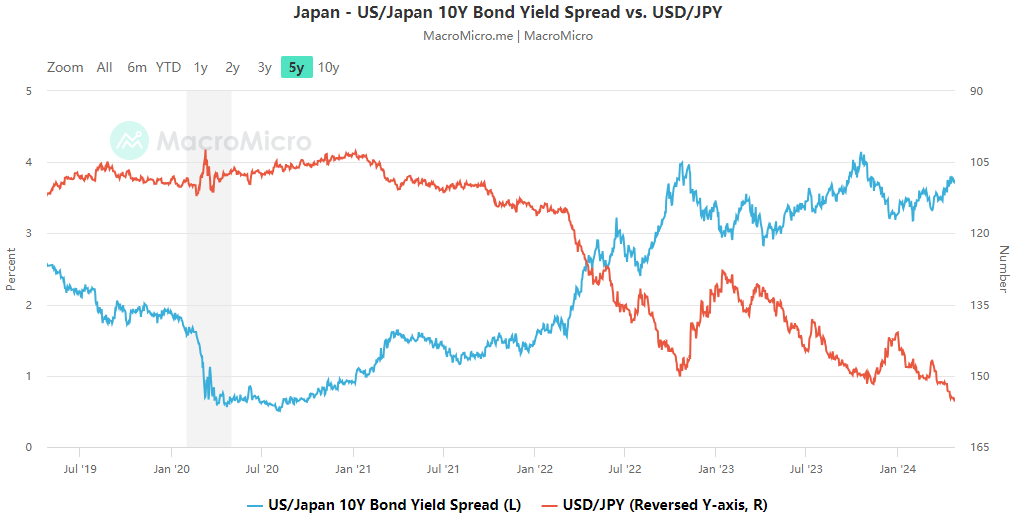

The structural pressure of the yen depreciation has become clear, and the dollar-yen exchange rate has risen to the upper 150 yen range per dollar. The Auto Parts Sector, which is expected to benefit from improved trading conditions, seems to be gradually developing resistance against the concerning Trump tariffs. Considering Toyota Motor's <7203.T> strong business performance, it would be desirable to mark strong stocks. <Aisan Kogyo, significant presence in the engine field> Aisan Kogyo <7283.T> is a Toyota-affiliated fuel parts manufacturer, involved in the business acquisition from Denso <6902.T>.

The Nikkei average rose by 138 points, rebounding to change direction due to rights acquisition - TOPIX rose for the seventh consecutive time = the early session of the 21st.

On the 21st, the Nikkei average stock price in the morning session rebounded by 138 yen and 54 sen from the previous trading day's close, reaching 37,890 yen and 42 sen. The TOPIX (Tokyo Stock Price Index) rose by 18.19 points to 2,814.15 points for the seventh consecutive day. If it maintains a positive range in the afternoon session, it will mark the first time since the eight-day winning streak that ended on January 15, 2024. In the morning, there was a lead in selling due to a slight decline in the NY Dow and Nasdaq composite index in the US stock market on the 20th. However, aggressive selling movements were limited, along with the March Dividends rights.

The Nikkei average is up by 220 yen, remaining strong after the Buy conversion = Morning session on the 19th.

On the 19th at 10:06 AM, the Nikkei average stocks rose by about 220 yen, fluctuating around 38,065 yen. At 9:56 AM, it reached 38,097.95 yen, an increase of 252.53 yen. In the local US stock market on the 18th, with the content of the FOMC (Federal Open Market Committee) and the subsequent press conference by Chairman Powell of the Federal Reserve approaching, a wait-and-see attitude became stronger, leading to a decline in both the NY Dow and Nasdaq Composite Index for the first time in three days. In the morning, Japanese stocks also dropped in reaction to the fall in US stocks.

The domestic Stocks management institutions of GPIF have selected the "Excellent Integrated Report" and the "Highly Improved Integrated Report."

The "Integrated Report 2024" issued by Denso Corporation has been selected as an "Excellent Integrated Report" and "Highly Improved Integrated Report" by the investment institutions entrusted with managing domestic Stocks by the Government Pension Investment Fund (GPIF). In the selection process, GPIF requests each investment institution to choose up to 10 integrated reports. As a result, for fiscal year 2024, 78 companies were recognized as "Excellent Integrated Reports" and "Improved Reports".

On the 11th, the ADR trends show that Fujifilm, Nidec Corporation Sponsored ADR, Advantest, ETC are all down in yen conversion values.

On the 11th, the ADRs (American Depositary Receipts) were broadly lower compared to the Tokyo closing prices on the same day when converted to yen. In yen terms, Fujifilm <4901.T>, Nidec Corporation Sponsored ADR <6594.T>, Advantest <6857.T>, Honda <7267.T>, SoftBank Group <9984.T>, etc., were down. Takeda Pharmaceutical <4502.T>, Panasonic <6752.T>, Denso <6902.T>, Murata Manufacturing <6981.T>, and Tokyo Electron <8035.T> were also weak. Provided by Wel.

Comments

On April 24th, the Japanese yen continued its slump against the US dollar, breaching the key level of 155 fo...

Alongside Buffett, Wall Street giants like Goldman Sachs Asset Management are eyeing Japan, favorin...