No Data

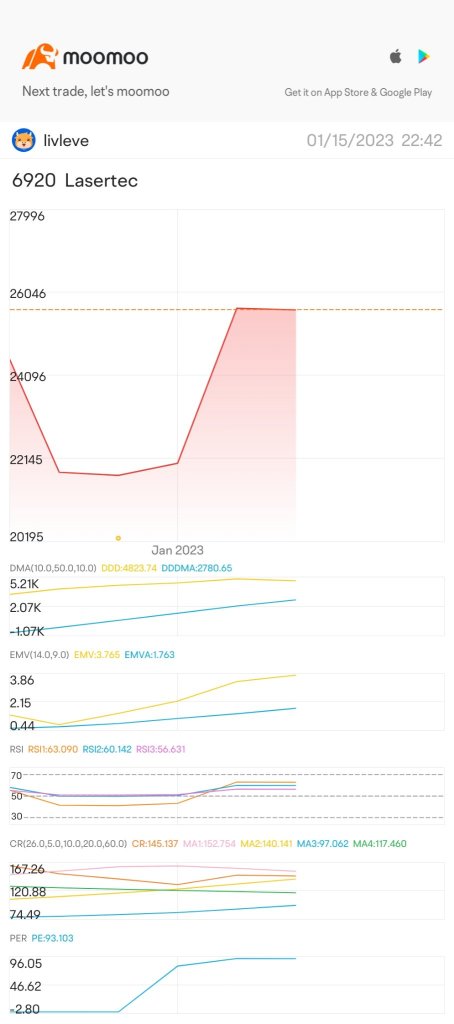

6920 Lasertec

- 15870.0

- 0.00.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

No Data

Trade Overview

Capital Trend

No Data

News

JP Movers | Tokyo Electron Rose 11.25%, Leading Nikkei 225 Components, Tokyo Electron Topped Turnover List

Market sentiment was high today as Nikkei 225 components generally rose, with Tokyo Electron(8035.JP) being the top gainer today, rising 11.25% to close at 27100.0 yen. In addition, the top loser was NEXON(3659.JP),falling 2.92% to end at 2227.5 yen.

Stocks that moved or were traded in the first half of the session.

*Fujitsu General Ltd. <6755> 2769 +496 Paloma is conducting a TOB to fully become a subsidiary.* KOKUSAI ELECTRIC <6525> 2414.5 +241.5 due to an increase in sales at Hon Hai Precision, leading to a Buy on Semiconductors-related stocks.* Tokyo Electron Ltd. Unsponsored ADR <8035> 26925 +2565, related stocks are favored due to the rise in U.S. semiconductor stocks.* Japan Micronics <6871> 4295 +405, buying also directed towards smaller Semiconductors-related companies.* Asteria <

In the afternoon session, the Nikkei average started up 861 points, with Fujitsu and KOKUSAI, among others, rising.

[Nikkei Stock Average・TOPIX (Table)] Nikkei Average; 40168.42; +861.37 TOPIX; 2788.11; +31.73 [Afternoon Session Opening Overview] The Nikkei Average in the afternoon session started at 40168.42 yen, up 861.37 yen compared to the previous day, slightly narrowing the increase from the morning close (40264.50 yen). During lunch time, the Nikkei 225 Futures traded in a weak range of 40140 yen - 40320 yen. The dollar-yen exchange rate is 1 dollar = 158.20-30 yen since around 9 AM.

Nikkei average contribution ranking (before closing) - the Nikkei average rebounded significantly for the first time in three days, with Tokyo Electron contributing approximately 253 yen.

As of the market close seven days ago, the number of rising and falling stocks in the Nikkei average constituent stocks was 162 rising, 61 falling, and 2 unchanged. The Nikkei average rebounded after three days. It closed at 40,264.50 yen, up 957.45 yen (+2.44%) from the previous day, with an estimated Volume of 0.9 billion shares during the morning session. On the 6th, the U.S. stock market showed mixed results. The Dow Inc closed down 25.57 dollars at 42,706.56 dollars, while Nasdaq finished up 243.30 points at 19,864.98.

Three key points to pay attention to in the latter half of the market - Semiconductors stocks lead the recovery of the 40,000 yen level.

In the afternoon trading on the 7th, attention should be focused on the following three points. ・The Nikkei Stock Average rebounded for the first time in three days, driven by Semiconductors, recovering to the 40,000 yen level. ・The dollar-yen exchange rate is stable, rising above 158 yen. ・The top contributor to the price increase is Tokyo Electron Ltd. Unsponsored ADR <8035>, and second is Advantest <6857>. ■The Nikkei Stock Average rebounded for the first time in three days, driven by Semiconductors, recovering to the 40,000 yen level. The Nikkei Stock Average rebounded for the first time in three days, rising by 957.45 yen (+2.44%) to 40,264.50 yen (Volume approximately...

The Nikkei index rebounded for the first time in three days, driven by Semiconductors stocks, recovering to the 40,000 yen range.

The Nikkei Average rebounded for the first time in three days. It ended the morning session at 40,264.50 yen, up 957.45 yen (+2.44%) from the previous day (estimated Volume 0.9 billion 90 million stocks). On the 6th, the U.S. stock market was mixed. The Dow Inc closed down 25.57 dollars at 42,706.56 dollars, while the Nasdaq ended up 243.30 points at 19,864.98. Following reports of a limited scope proposal regarding the uniform tariffs of the Trump administration, buying increased due to a sense of relief, leading to a significant rise after the opening.

Comments

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$ (4 Hour Chart) -[NEUTRAL]We turn neutral as price is currently between 5740 resistance level and 5710 support level. We lean towards a bearish scenario as we expect price to drift lower towards 5710 support level. Technical indicators are displaying a bearish scenario as well.

Alternatively: A 4 hour c...

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ *]We maintain a bullish directional bias as price continues to hold above 5810 support level. We expect prices to push towards 5940 resistance level. Technical indicators are mixed, with MACD advocating for a bullish scenario.

Alternatively: A 4 hour candlestick closing below 5810 support could open next drop towa...

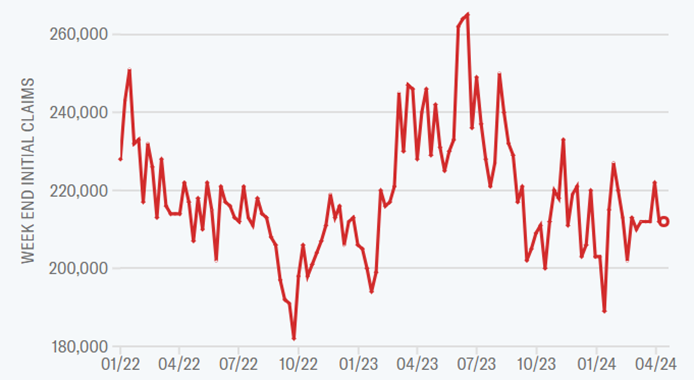

All three major U.S. stock indexes wavered throughout the session, with weakness in the chip sector weighing the Nasdaq down the most. The Nasdaq fell 0.52% on Thursday. 10-year US Treasury yields fell, with the yield rising from a low of 4.52% on April 18th to a peak of 4.6...

Cui Nyonya Kueh :

SS5GG Cui Nyonya Kueh : How did this emoji come about?

Buy n Die Together❤ :

Cui Nyonya Kueh Buy n Die Together❤ :

172727077 :