No Data

6954 Fanuc

- 4378.0

- -36.0-0.82%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Stock News Premium = Machinery orders, outlook improved - attention also on Trump's tariffs.

Orders for Machinery have been stable. The total amount for January-February reached 234.3 billion yen, a 4% increase compared to the same period last year, with monthly figures expanding for five consecutive months until February. Manufacturers' outlook has also shown an improving trend. On the other hand, it is necessary to monitor the impact of the USA's high tariff policies. The confirmed figures for February announced by the Japan Machine Tool Builders' Association on the 19th indicated a total of 118.2 billion yen, a 4% increase compared to the same month last year. Domestic demand was 33.8 billion yen (a 4% increase), and external demand was 84.4 billion yen (a 3% increase). By region, external demand from Asia was ...

Reflecting the depreciation of the yen, buying sentiment has strengthened, recovering to the 37,000 yen range.

The Nikkei average rebounded, gaining 263.07 yen to close at 37,053.10 yen (estimated Volume of 1.9 billion 10 million shares), recovering the 37,000 yen level for the first time in four days. In the morning, sales reflecting the decline in US stocks from the previous day led to an early drop to 36,594.04 yen. However, the yen weakened to the mid-148 yen range against the dollar, and the performance of US stock index Futures in Extended hours trading also improved investor sentiment, leading to a widening of the gain during the latter half of the session.

The Nikkei average is up about 300 yen, with Advantest, FANUC CORP, and Tokyo Electron being the top contributors.

As of 12:49 PM on the 14th, the Nikkei average stock price is around 37,090 yen, up about 300 yen from the previous day. The afternoon session started with a buying trend. At 12:48 PM, it reached a high of 37,123.77 yen, up 333.74 yen, placing it in today's high range. The exchange rate is fluctuating around 148.30 yen per dollar. The contribution of the stocks included in the Nikkei average shows positive results from Advantest <6857.T>, FANUC CORP <6954.T>, and Tokyo Electron <8035.T>.

List of cloud penetration stocks [Ichimoku Kinko Hyo - List of cloud penetration stocks]

○ List of stocks that break through the cloud market Code Stock Name Closing Price Leading Span A Leading Span B Tokyo Main Board <1801> Taisei Corporation 6610 6463.25 6573.5 <1888> Wakachiku Construction 3850 3595 727.5 <1929> Nittoku Construction 1042 1037.75 1030 <2220> Kameda Seika 4045 3996.25 4010 <2267> Yakult 3033 2853.75 3032.

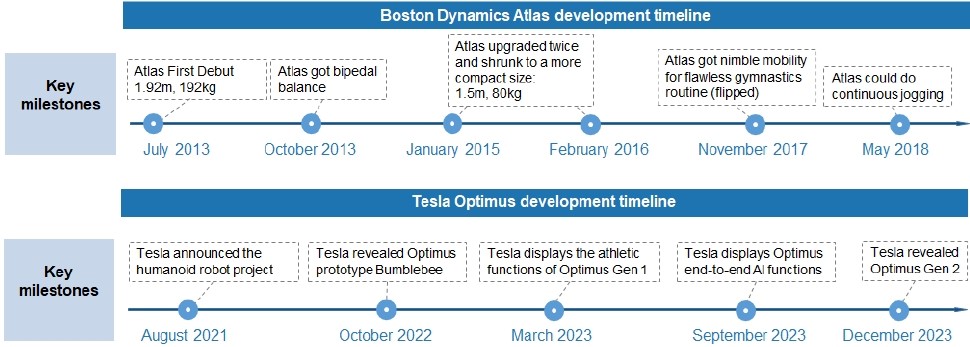

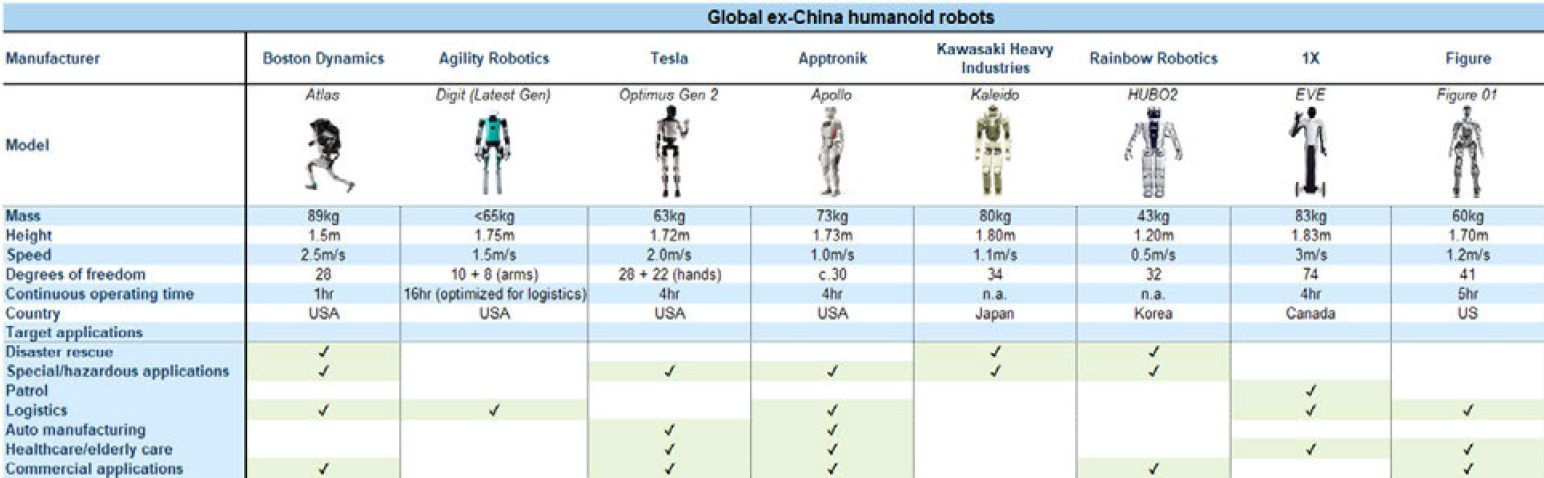

A humanoid equipped with AI intelligence has begun full-scale operations in the warehouse.

As the demand for new types of robots rises globally, the costs associated with manufacturing seem to be decreasing due to mass production and lower component costs. Equally important is that since the emergence of new types of Artificial Intelligence (AI) such as ChatGPT, a type of AI that has reshaped the priorities of tech companies and governments, robots are now being able to move in ways that were impossible just a few years ago. <6758> Sony Group Corp <4826>

Awarded the "Clarivate Top 100 Global Innovators 2025", selected as one of the top 100 companies in the world for four consecutive years due to technological innovation and Global Strategy.

On March 13, 2025, FANUC CORP has received the 'Clarivate Top 100 Global Innovators 2025' award from Clarivate Plc, a global information services company. This is the fourth consecutive year and the sixth time that the company has received this award. This award honors the top 100 innovative companies/institutions in the world, selected annually based on a unique evaluation method using patent data held by Clarivate Plc.

Comments

$E-mini S&P 500 Futures(JUN5) (ESmain.US)$ (4 Hour Chart) -[BEARISH ↘ *]We turn bearish as price is nearing 5830 resistance level. As long as price holds below 5830 resistance level, we expect price to push to resistance-turned-support level at 5720. Technical indicators have yet to indicate a bullish scenario.

Alternatively: A 4 hour candlestick closing below 5720 support level could open a dro...

In February, $Microsoft (MSFT.US)$ , OpenAI, ...

The year 2023 is going to be an exciting year for the artificial intelligence industry as well as the semiconductor industry. After many years of rapid innovation and billions of dollars invested into research and development in these fields, we are now able to experience endless possibilities such as self-driving cars to personal assistants.

Companies such as OpenAI, Apple ( $Apple (AAPL.US)$ ), Microsoft ( $Microsoft (MSFT.US)$ ), Google...

101550592 :