No Data

6954 Fanuc

- 4397.0

- +36.0+0.83%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Announcement of individual stocks regarding the certification of "Excellent Health Management Corporation 2025."

On March 25, 2025, FANUC CORP was certified as a "Health Management Excellent Corporation 2025" (in the large corporation category) by the Ministry of Economy, Trade and Industry on March 10, 2025, as part of the certification system for excellent health management corporations. This system recognizes corporations, especially large and small to medium-sized enterprises, that practice particularly excellent health management based on initiatives addressing regional health issues and health promotion efforts promoted by the Japan Health Conference. Our company declares commitment to health management.

The uncertainty surrounding Trump's tariffs is leading to a sense of stagnation.

The Nikkei average fell slightly for three consecutive trading days, ending at 37,608.49 yen, down 68.57 yen (Volume approximately 1.6 billion 50 million shares). Initially, buying began due to the rise in U.S. stocks at the end of last week, but after peaking at 37,841.68 yen at the open, the market showed a strong sense of stagnation. Uncertainty surrounding the Trump administration's tariff policies became a burden, leading to a slight movement as it ended at today's low. In the Main Board of the Tokyo Stock Exchange, the number of falling stocks exceeded 1,100, accounting for more than 60% of the total.

The Nikkei average is down about 7 yen, with negative contributions coming mainly from KDDI, FANUC CORP, and SECOM CO.

As of 12:50 PM on the 24th, the Nikkei Stock Average is around 37,670 yen, down about 7 yen compared to the previous weekend. Although the latter part of the session started with Buy being predominant, it turned downward under pressure from selling as traders waited for a rebound. The foreign exchange market is continuing to hover around 149.70 yen to the dollar. The contributions of the stocks included in the Nikkei Stock Average show that KDDI <9433.T>, FANUC CORP <6954.T>, and SECOM CO <9735.T> are in the top positions for negatives. For positives, Softbank Group <9984>.

Stock News Premium = Machinery orders, outlook improved - attention also on Trump's tariffs.

Orders for Machinery have been stable. The total amount for January-February reached 234.3 billion yen, a 4% increase compared to the same period last year, with monthly figures expanding for five consecutive months until February. Manufacturers' outlook has also shown an improving trend. On the other hand, it is necessary to monitor the impact of the USA's high tariff policies. The confirmed figures for February announced by the Japan Machine Tool Builders' Association on the 19th indicated a total of 118.2 billion yen, a 4% increase compared to the same month last year. Domestic demand was 33.8 billion yen (a 4% increase), and external demand was 84.4 billion yen (a 3% increase). By region, external demand from Asia was ...

Reflecting the depreciation of the yen, buying sentiment has strengthened, recovering to the 37,000 yen range.

The Nikkei average rebounded, gaining 263.07 yen to close at 37,053.10 yen (estimated Volume of 1.9 billion 10 million shares), recovering the 37,000 yen level for the first time in four days. In the morning, sales reflecting the decline in US stocks from the previous day led to an early drop to 36,594.04 yen. However, the yen weakened to the mid-148 yen range against the dollar, and the performance of US stock index Futures in Extended hours trading also improved investor sentiment, leading to a widening of the gain during the latter half of the session.

The Nikkei average is up about 300 yen, with Advantest, FANUC CORP, and Tokyo Electron being the top contributors.

As of 12:49 PM on the 14th, the Nikkei average stock price is around 37,090 yen, up about 300 yen from the previous day. The afternoon session started with a buying trend. At 12:48 PM, it reached a high of 37,123.77 yen, up 333.74 yen, placing it in today's high range. The exchange rate is fluctuating around 148.30 yen per dollar. The contribution of the stocks included in the Nikkei average shows positive results from Advantest <6857.T>, FANUC CORP <6954.T>, and Tokyo Electron <8035.T>.

Comments

$E-mini S&P 500 Futures(JUN5) (ESmain.US)$ (4 Hour Chart) -[BEARISH ↘ *]We turn bearish as price is nearing 5830 resistance level. As long as price holds below 5830 resistance level, we expect price to push to resistance-turned-support level at 5720. Technical indicators have yet to indicate a bullish scenario.

Alternatively: A 4 hour candlestick closing below 5720 support level could open a dro...

In February, $Microsoft (MSFT.US)$ , OpenAI, ...

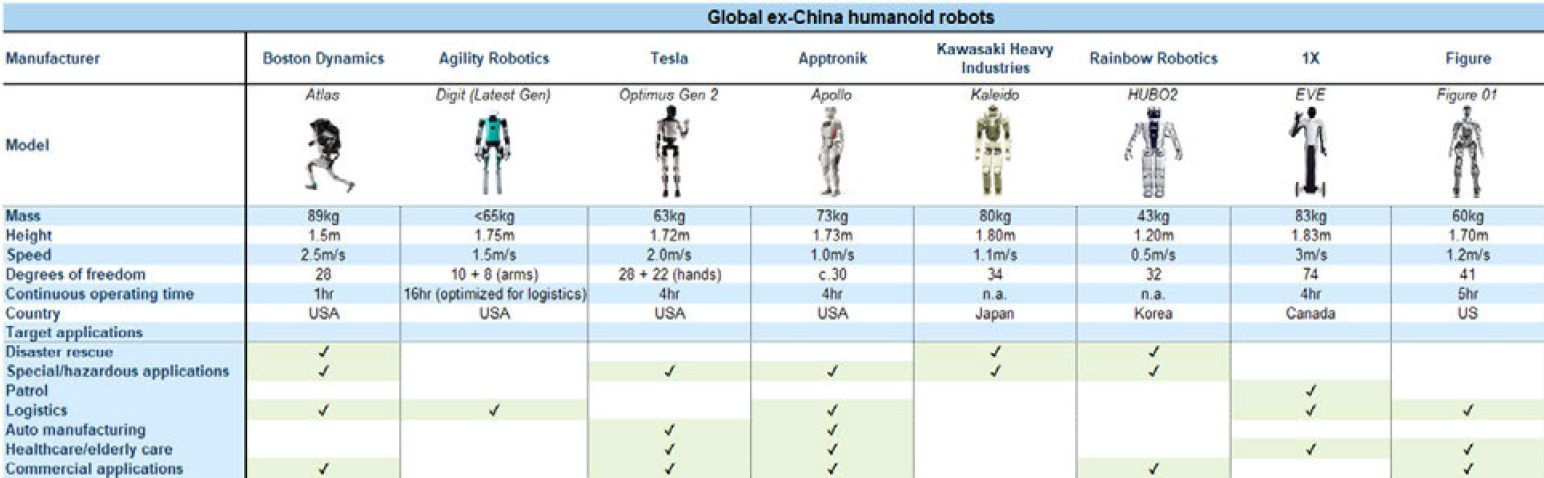

The year 2023 is going to be an exciting year for the artificial intelligence industry as well as the semiconductor industry. After many years of rapid innovation and billions of dollars invested into research and development in these fields, we are now able to experience endless possibilities such as self-driving cars to personal assistants.

Companies such as OpenAI, Apple ( $Apple (AAPL.US)$ ), Microsoft ( $Microsoft (MSFT.US)$ ), Google...

101550592 :