No Data

6954 Fanuc

- 4045.0

- 0.00.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

No Data

Trade Overview

Capital Trend

No Data

News

List of cloud break stocks (Part 2) [Ichimoku Kinko Hyo - List of cloud break stocks]

○ List of stocks that broke below the cloud market Code Stock Name Closing Price Leading Span A Leading Span B Tokyo Main Board <1332> Nissui 907 921.5 918.5 <1375> Yukiguni Maitake 1013 1030.25 1019.5 <1860> Toda Corporation 9219 27.25 957 <1882> Toa Road 1291 1304 1340.5 <1893> Goyo Construction 621 632.75 624 <196

ADR Japanese stock rankings – mixed highs and lows, Chicago is up 100 yen compared to Osaka at 39,570 yen.

ADR Japan stock ranking - mixed highs and lows, Chicago is up 100 yen compared to Osaka at 39,570 yen - Japanese stocks of ADR (American Depositary Receipt) compared to the Tokyo Stock Exchange (based on 1 dollar = 153.66 yen), such as SoftBank Group <9984>, Mitsui Sumitomo FG <8316>, Mizuho FG <8411>, Mitsubishi Corporation <8058>, HOYA <7741> rose, while Japan Post Bank <7182>, MS&AD Insurance HD <8725>, Nidec <6594>, Japan Post <6178>.

The New York market declined on the 12th [New York market - close].

[NYDow・NASDAQ・CME (Table)] NYDOW; 43,914.12; -234.44 NASDAQ; 19,902.84; -132.05 CME225; 39,665; -145 (Compared to OSE) [NY Market Data] The NY market fell on the 12th. The Dow average decreased by 234.44 dollars to 43,914.12 dollars, and the NASDAQ ended trading down 132.05 points at 19,902.84. There are fears of an unexpected acceleration in the November Producer Price Index (PPI).

The U.S. Stocks market declined, wary of accelerating inflation (12th).

"Chicago Nikkei Average Futures (CME)" (12th) MAR24O 40080 (in USD) H 40225 L 39675 C 39790, compared to the Osaka Exchange -20 (Evening comparison +110) Vol 488 MAR24O 40005 (in JPY) H 40095 L 39550 C 39665, compared to the Osaka Exchange -145 (Evening comparison -15) Vol 4869 "Overview of American Depositary Receipts (ADR)" (12th) In the ADR market, compared to the Tokyo Stock Exchange (based on an exchange rate of 1 USD to 152.61 JPY),

Nikkei Average Contribution Ranking (Pre-close) ~ The Nikkei Average declined for the first time in three days, with Advantest dragging down by about 58 yen from a single stock.

As of the close 11 days ago, the number of rising and falling stocks in the Nikkei average consisted of 79 stocks that rose, 144 stocks that fell, and 2 stocks that remained unchanged. The Nikkei average fell for the first time in three days, ending the morning session at 39,112.80 yen, down 254.78 yen (−0.65%) from the previous day, with an estimated Volume of 0.7 billion 70 million shares. On the 10th, the US stock market continued to decline. The Dow Inc dropped by 154.10 dollars to close at 44,247.83 dollars, while the Nasdaq fell by 49.45 points to end at 19,687.24.

Three key points to watch in the afternoon session - a wait-and-see attitude strengthens ahead of the US CPI announcement.

In the afternoon trading on the 11th, I would like to focus on the following three points. • The Nikkei average fell for the first time in three days, as a wait-and-see attitude strengthened ahead of the U.S. CPI announcement. • The dollar-yen exchange rate is soft, with yen buying prevailing. • The biggest contributor to the decline was Advantest <6857>, and the second was Fast Retailing <9983>. ■ The Nikkei average fell for the first time in three days, and the wait-and-see attitude strengthened ahead of the U.S. CPI announcement. The Nikkei average fell by 254.78 yen (−0.65%) from the previous day to 39,112.80 yen (estimated Volume 0.7 billion yen).

Comments

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$ (4 Hour Chart) -[BEARISH ↘ *]We turn bearish as price is nearing 5830 resistance level. As long as price holds below 5830 resistance level, we expect price to push to resistance-turned-support level at 5720. Technical indicators have yet to indicate a bullish scenario.

Alternatively: A 4 hour candlestick closing below 5720 support level could open a dro...

In February, $Microsoft (MSFT.US)$ , OpenAI, ...

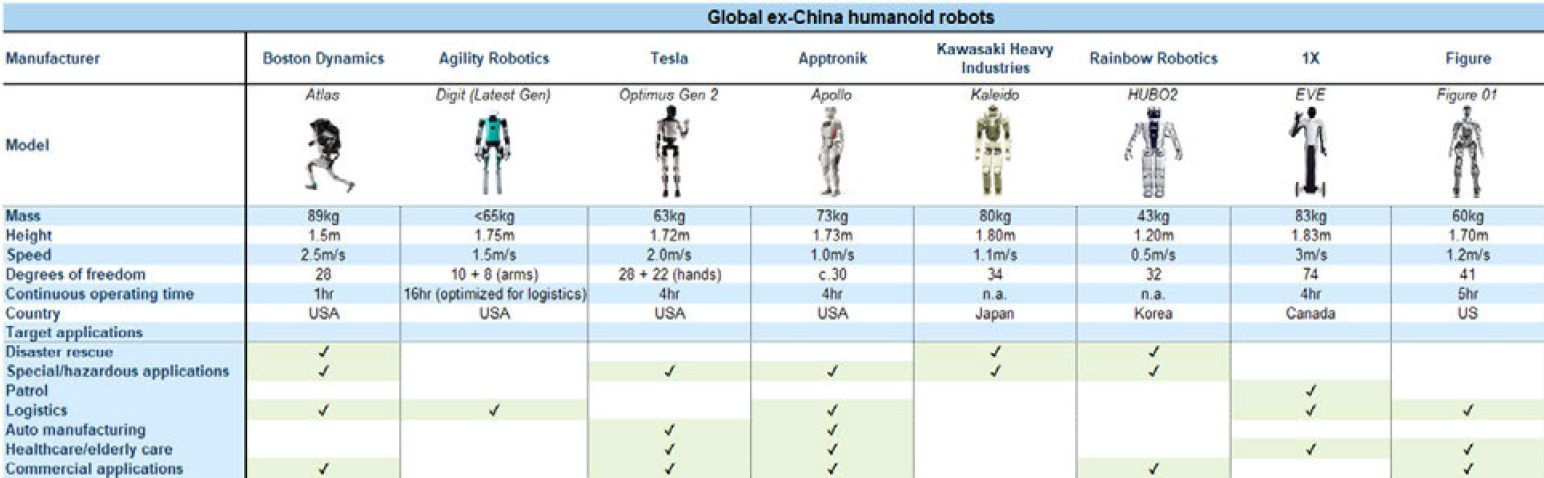

The year 2023 is going to be an exciting year for the artificial intelligence industry as well as the semiconductor industry. After many years of rapid innovation and billions of dollars invested into research and development in these fields, we are now able to experience endless possibilities such as self-driving cars to personal assistants.

Companies such as OpenAI, Apple ( $Apple (AAPL.US)$ ), Microsoft ( $Microsoft (MSFT.US)$ ), Google...

101550592 :