No Data

6954 Fanuc

- 4201.0

- -34.0-0.80%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

FANUC CORP --- Trend reversal is likely to be recognized.

There has been a reactionary decline. Recently, the upward rebound has broken through the 25-day and 75-day lines and reached the 200-day line. However, there is resistance at the 200-day line level as well as at the 52-week line. While there is a tendency for trend reversal to be expected, the sentiment between bulls and bears is conflicting, making it necessary to observe the breakthrough of both lines. If it breaks through the 200-day and 52-week lines, the adjustment trend that peaked at 4,748 yen in May will reverse.

The New York market on the 6th was mixed [New York market - Close].

[NYDow・Nasdaq・CME (Table)] NYDOW; 42706.56; −25.57 Nasdaq; 19864.98; +243.30 CME 225; 39675; +335 (compared to Osaka Exchange) [NY Market Data] The NY market on the 6th was mixed. The Dow average ended at 42,706.56 dollars, down 25.57 dollars, while the Nasdaq finished at 19,864.98, up 243.30 points. There are reports that a limited range proposal has emerged regarding the uniform tariffs of the upcoming Trump administration.

On the 6th, the trend of ADRs showed nearly widespread increases in yen terms, with Nippon Steel, Keyence, and Tokyo Electron among the high performers.

On the 6th, the ADR (American Depositary Receipt) was almost universally higher compared to the Tokyo closing price on the same day in yen conversion. In yen terms, companies such as Nippon Steel <5401.T>, Keyence <6861.T>, Tokyo Electron <8035.T>, Sumitomo Mitsui Trust <8309.T>, and SoftBank Group <9984.T> saw increases. Rakuten <4755.T>, Advantest <6857.T>, FANUC CORP <6954.T>, Kyocera Corporation Sponsored ADR <6971.T>, and Sumitomo Mitsui <8316.T> also performed well.

FANUC Robot M-950 i A/500 won the 2024 Nikkei Excellent Product and Service Award in the Global category.

On January 6, 2025, FANUC CORP's FANUC Robot M-950iA/500 won the 2024 Nikkei Excellent Products and Services Award in the Global category. The Nikkei Excellent Products and Services Award is presented annually by the Nihon Keizai Shimbun to recognize particularly outstanding new products and services, and this year's edition marks the 43rd time. Nominations are not publicly solicited; instead, the Nihon Keizai Shimbun independently selects candidate products and services.

ADR Japanese stock rankings - general sell-off led by Japan Post Bank and a decline of 555 yen compared to Osaka, standing at 39,435 yen.

The ADR (American Depositary Receipt) of Japanese stocks, compared to the Tokyo Stock Exchange (calculated at 156.82 yen per dollar), saw declines in stocks such as Japan Post Bank <7182>, Honda Motor <7267>, Toyota Motor <7203>, Denso <6902>, Disco <6146>, Nidec <6594>, and Renesas <6723>, resulting in a general trend of selling pressure. The clearing price for Chicago Nikkei 225 Futures was down 555 yen compared to the Osaka daytime price at 39,435 yen. The US stock market continued to decline. The Dow Inc average fell by 418.48 dollars to 42,5.

As of the end of the year, a record high has been reached for the first time in 35 years.

The Nikkei average fell for the first time in four trading days. It ended the trade at 39,894.54 yen, down 386.62 yen (volume estimated at 1.6 billion 20 million shares). Reflecting the high plateau of U.S. interest rates, there was a leading Buy in the financial Sector, including Banks and Insurance. The Nikkei average started strong at 40,325.78 yen. However, amid the decline in U.S. stocks at the end of the previous week and limited market participants at the year-end, profit-taking Sell and adjustments of positions became predominant, resulting in a turn to the downside. After that, it continued to fluctuate around 0.04 million yen. It is noted that the annual figure stands at 1989.

Comments

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$ (4 Hour Chart) -[BEARISH ↘ *]We turn bearish as price is nearing 5830 resistance level. As long as price holds below 5830 resistance level, we expect price to push to resistance-turned-support level at 5720. Technical indicators have yet to indicate a bullish scenario.

Alternatively: A 4 hour candlestick closing below 5720 support level could open a dro...

In February, $Microsoft (MSFT.US)$ , OpenAI, ...

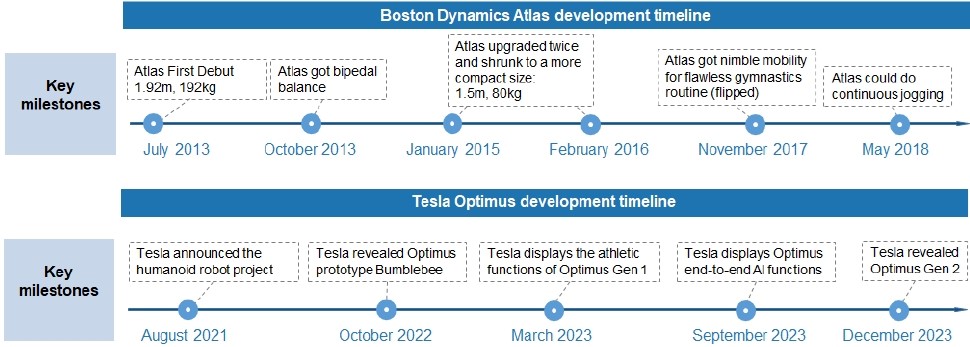

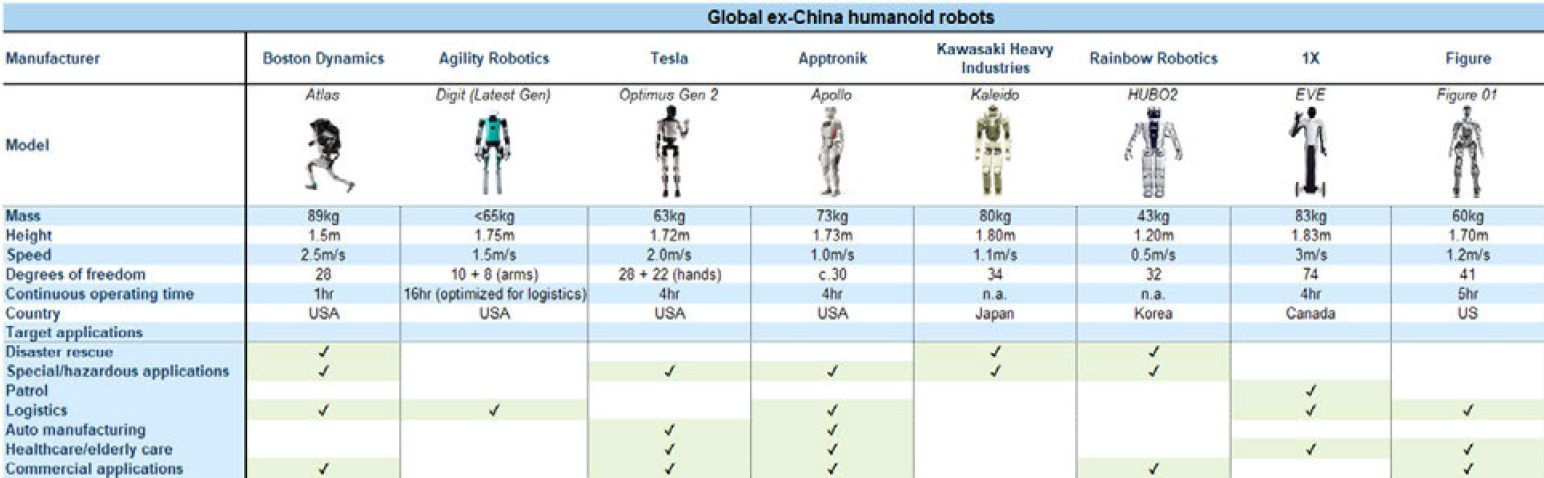

The year 2023 is going to be an exciting year for the artificial intelligence industry as well as the semiconductor industry. After many years of rapid innovation and billions of dollars invested into research and development in these fields, we are now able to experience endless possibilities such as self-driving cars to personal assistants.

Companies such as OpenAI, Apple ( $Apple (AAPL.US)$ ), Microsoft ( $Microsoft (MSFT.US)$ ), Google...

See the daily top gainer.

101550592 :