No Data

7201 Nissan Motor

- 509.2

- -43.2-7.82%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

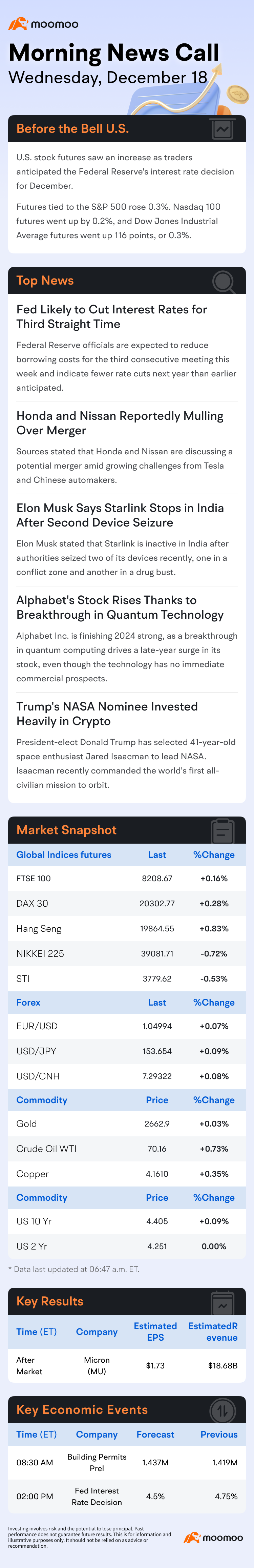

Key Deals for the Week: Honda, Nippon, Murdoch's News Corp, L'Oreal and More

Outlook for the domestic stock market: In 2025, automobile stocks and financial stocks will lead the Tokyo market.

■The rise, seen as led by Futures, has restored the Nikkei average to the 40,000 yen level for the first time in about five months. This week, the Nikkei average increased by 1,579.26 yen (+4.08%) to 40,281.16 yen. Amid the holiday closures in European and American markets, the announcement of the start of merger discussions between Honda <7267> and Nissan <7201>, along with the report that Toyota <7203> plans to double its ROE target to 20% compared to previous figures, shifted investor interest towards automobile stocks. Additionally, strong earnings from Department Stores and Nidec Corporation Sponsored ADR <

Honda CEO Struggles To Justify Potential Nissan Merger: 'That's A Difficult One'

The Trader: Subaru's Cars Have a Cult U.S. Following. The Stock Is a Bargain. -- Barron's

Stocks that moved the day before part 1: Wizus, Makino Milling Machine, DeNA, etc.

Ticker Name <Code> Closing Price on the 27th ⇒ Change from Previous Day Okamoto Glass <7746> 258 0 Increased production capacity of Glass polarizers. Became popular temporarily but lost momentum. Wizus <9696> 2420 +220 Reported that a shareholder investment fund proposed privatization. Ateam <3662> 1001 +33 Subsidiary of WCA, which handles web marketing consulting and web marketing operations. KTK <3035> 555 -19 Progress in operating profit for the first quarter versus full-year Financial Estimates.

Recovery to 0.04 million yen level due to expectations for the New Year market.

The Nikkei average rose significantly for the third consecutive day. It ended at 40,281.16 yen, up 713.10 yen (with an estimated Volume of 2.1 billion 30 million shares), recovering to the 0.04 million yen level for the first time in about five and a half months since July 19. The yen rate weakened to around 158 yen to the dollar in the previous day's Overseas market, leading to early buying focused on export stocks such as Automobiles, and the Nikkei average started to rise. Just before the midday close, it recovered to the 0.04 million yen level for the first time in about two weeks. Afterwards, Semiconductor-related stocks and other high-value stocks continued to rise.

Comments

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ **]We maintain our bullish directional bias. Price is currently near 6055 resistance level. A 4 hour candlestick closing above 6055 resistance would open push towards 6120 resistance level. Technical indicators are advocating for a bullish scenario as well.

Alternatively: A 4 hour candlestick closing below 6055 resistance would...

🔸 Chinese Stocks Surge on Return from Holidays as Euphoria Extends. Chinese stocks listed onshore jumped as trading resumed following a week-long holiday, with encouraging home sales and consumption data giving fresh impetus to a rally sparked by Beijing’s stimulus blitz. The benchmark CSI 300 Index and SSEC Index climbed almost 11% in early trading before paring its advance. The measure h...

![Chinese Stocks Surge on Return from Holidays as Euphoria Extends [CSOP Global Market Morning Report]](https://ussnsimg.moomoo.com/sns_client_feed/71451441/20241008/1728367312428-c514003b5c.jpeg/thumb?area=999&is_public=true)