No Data

7203 Toyota Motor

- 2887.5

- +5.0+0.17%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

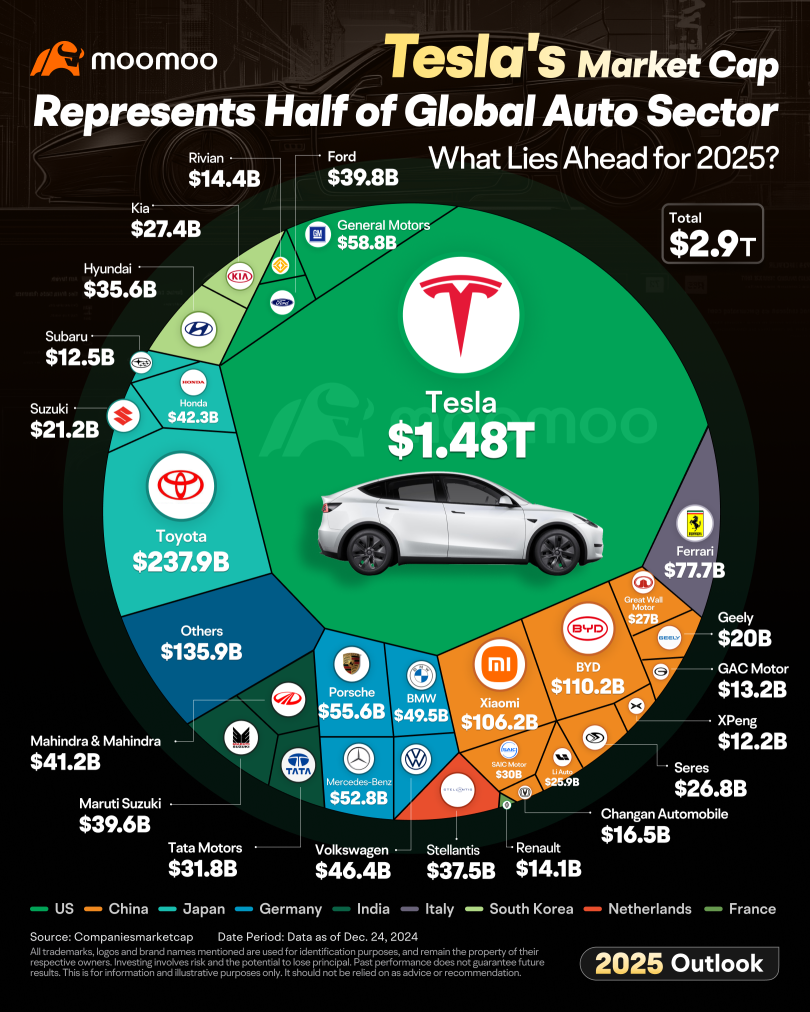

Express News | Shares of Auto-related Stocks Are Trading Lower After the White House Announced That President Trump Will Introduce New Tariffs on Auto Imports During a Press Conference on Wednesday

Express News | General Motors Down 1.9%, Ford Down 1.3%, Toyota Down 1.6%, Tesla Down 5.9%

Trump to Unveil New Auto Tariffs at 4 PM, Bloomberg Reports

Is the "Trump tariff" becoming clearer? JPMorgan suggests changing the investment strategy for U.S. stocks: stop selling on highs!

Ilan Benhamou, a member of JPMorgan's equity derivatives sales team, stated that as tariff policies clarify, market sentiment has eased, and the strategy of selling on rallies should be suspended; Wall Street's bullish sentiment towards US Stocks has rebounded, with Morgan Stanley and Blackrock both expressing optimism about the US market Stocks, but Blackstone's president, Jon Gray, advised investors to remain patient and observe the evolution of tariff diplomacy.

The Nikkei Average is about 270 yen higher, continuing to show stable price movements supported by the rise in US stocks = the morning session of the 26th.

On the morning of the 26th, the Nikkei average Stock price fluctuated around 38,050 yen, up about 270 yen from the previous day. At 9:42 AM, it rose to 38,151.39 yen, up 370.85 yen, once again surpassing 38,000 yen. On the 25th local time, the US Stock market saw both the Dow Inc and the Nasdaq Composite Index rise for three consecutive days. Concerns about the US economy due to mutual tariffs have eased, supporting stock prices. The Tokyo market also seems to have seen buying activity in response to the rise in US stocks. The yen-denominated settlement value of the Chicago Nikkei average Futures.

Winners and Losers in the European Auto Market so Far in 2025

Comments

US Market

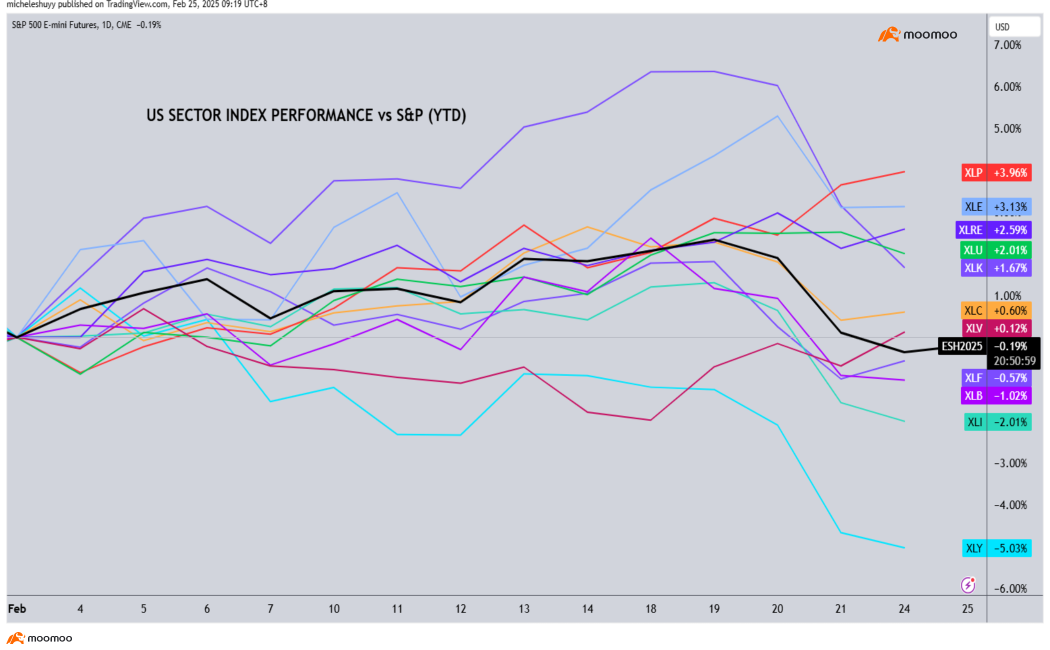

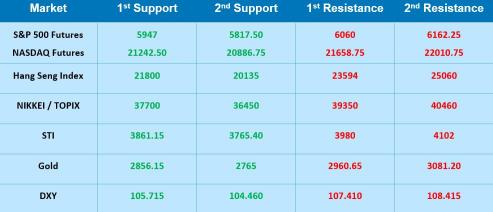

US markets ended the week lower, with the $E-mini S&P 500 Futures(JUN5) (ESmain.US)$ and $E-mini NASDAQ 100 Futures(JUN5) (NQmain.US)$ falling 1.78% and 2.50% respectively. This came after economic data revealed that consumers' long-term inflation expectations had surged to their highest level in nearly three decades. Investor sentiment took another hit as Trump threatened to impose 25%...

Lululemon Athletica Inc (LULU US) $Lululemon Athletica (LULU.US)$

Daily Chart - [BEARISH ↘ **] LULU US traded sideways before breaking down lower. With bearish divergence being posted, a further push lower below resistance at 371.88 towards 318.24 support is expected. Price is now below 34 period EMA with MACD showing a build up in bearish divergence.

Alternatively: A daily candlestick closing above 371.88 resistance will invalidate bear...

A key fa...

Cui Nyonya Kueh : Today no class, never announce.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Cui Nyonya Kueh : but thank you still !![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Trader’s Edge OP Cui Nyonya Kueh : Next week we will resume! Thank you for your support as always!![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Cui Nyonya Kueh Trader’s Edge OP :

Devip : Year-to-date, there’s been a clear capital shift away from U.S. equities and into ex-U.S. markets. Is the music stopping for U.S. equities?

View more comments...