No Data

7267 Honda Motor

- 1450.0

- +19.5+1.36%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

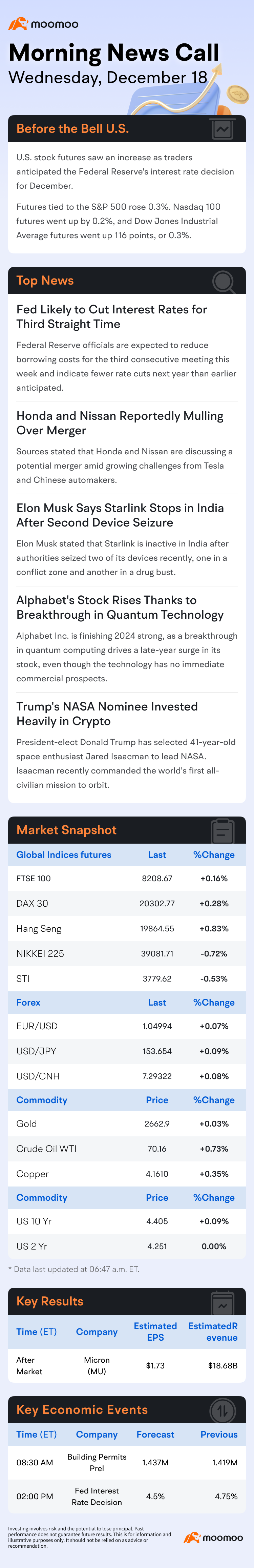

Foxconn Forecasts Strong 2025 Growth on AI Server Demand

Trends in ADR on the 13th = Fujifilm, Sony Group Corp, Olympus, etc. are low in yen-denominated values.

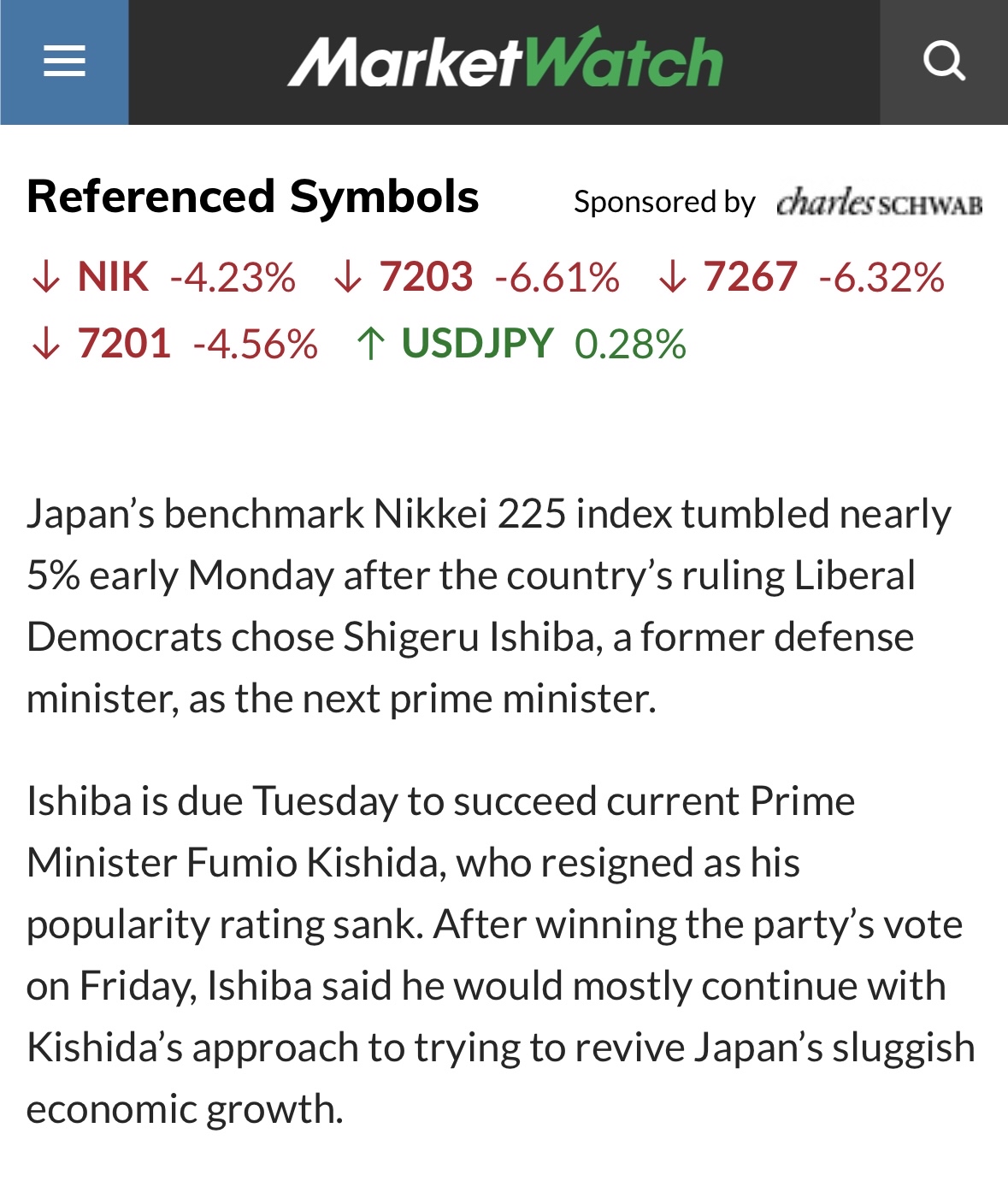

On the 13th, the ADRs (American Depositary Receipts) showed a nearly widespread decline compared to the Tokyo closing prices on the same day, when converted to yen. In yen terms, Fujifilm <4901.T>, Sony Group Corp <6758.T>, Olympus <7733.T>, Asics <7936.T>, SoftBank Group <9984.T>, etc. were down. Denso <6902.T>, Murata Manufacturing <6981.T>, Honda <7267.T>, ORIX <8591.T>, Japan Airlines <9201.T>, etc. also showed weakness. Provided by Ue.

The Nikkei average fell by 29 points, weighed down by selling on the wait for a rebound and the strengthening of the yen = 13th afternoon session.

On the 13th, the Nikkei average stock price in the afternoon session fell slightly by 29.06 yen to 36,790.03 yen compared to the previous day, while the TOPIX (Tokyo Stock Price Index) rose by 3.45 points to 2,698.36 points, continuing its upward trend. In the morning, following the rise in the Nasdaq Composite Index, which has a high ratio of tech stocks, and the SOX (Philadelphia Semiconductor Index) which has a significant impact on Japan's semiconductor-related stocks, buying started to take precedence. However, afterwards, it was pressured by profit-taking selling that awaited a rebound.

Cui Dongshu: In February, the Autos market showed a trend of strong passenger vehicles and weak commercial vehicles, with total sales of 2.113 million units, a year-on-year increase of 33%.

At the beginning of February, the car market showed signs of fatigue after being overdrafted. After the policies were released and implemented, Consumers gradually lifted their wait-and-see attitude, and the market's activity quickly increased.

The Nikkei index is up 390 yen, continuing its strong performance after an initial buy trend = 13 days into the morning session.

On the 13th at around 10:07 AM, the Nikkei Average was trending at approximately 37,210 yen, up about 390 yen from the previous day. At 9:28 AM, it reached 37,326.27 yen, up 507.61 yen. In the U.S. stock market on the 12th, although the Dow Inc fell due to concerns over trade friction, the Nasdaq Composite Index rebounded for the first time in three days as inflation concerns eased following a drop in February's CPI (Consumer Price Index). Japan's semiconductor-related stocks are susceptible to the effects of the SOX.

List of breakout stocks (Part 1) [Ichimoku Kinko Hyo - List of breakout stocks]

○ List of stocks breaking through the clouds Market Code Stock Name Closing Price Leading Span A Leading Span B Tokyo Main Board <1605> INPEX 1963 1903.25 1959.5 <1803> Shimizu Corporation 1321 1315.75 1262.5 <2181> Persol HD 2392 233.5 235.5 <2212> Yamazaki Bread 2920 2825.25 2864.5 <2288> Maruha Nichiro 1703 16

Comments

Polaris, Honda, Kawasaki, CanAm, etc. Pinnacle off-road toy makers.

they won't build affordable electric ATVs because they are scared of the Tesla ATV, e-bike companies, e- scooter companies doing it better, so they instead turn to OVER PRICED UTVs

E- bike, scooter, Tesla, etc won't build one !

why?

They are scared that the Pinnacle off-road toy companies w...

A federal judge ruled Google holds an illegal monopoly in the search and text advertising markets. The decision focused on Google’s exclusive search arrangements on Android and Apple devices, which the court said reinforced its dominance.

“Google is a monopolist, and it has acted as one to maintain its monopoly,” Judge Amit Mehta wrote in the decision. The ruling stems from combined antitrust suits filed by the Department of Justice and several states...