No Data

7741 Hoya

- 17430.0

- -155.0-0.88%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

The Nikkei average fell by 93 points, marking a retreat after four days, closing at a low due to a cautious mood ahead of the FOMC on the afternoon of the 19th.

On the 19th, the Nikkei average stock price in the afternoon session fell by 93.54 yen from the previous day to 37,751.88 yen, marking a decline for the first time in four days, closing at a low for today's Trade. The TOPIX (Tokyo Stock Price Index) increased by 12.40 points to 2,795.96 points, continuing its rise for six consecutive days. Although selling started in the morning due to falling US stocks, the strong market conditions persisted, leading to a turnaround. Buying to pick up lower prices and purchasing for rights support led to a steady performance. The Bank of Japan held a monetary policy meeting before the end of the morning session.

The trend of ADRs on the 17th = Mitsubishi Corporation, Sumitomo Mitsui Trust Bank, Mizuho, etc. are high in yen equivalent.

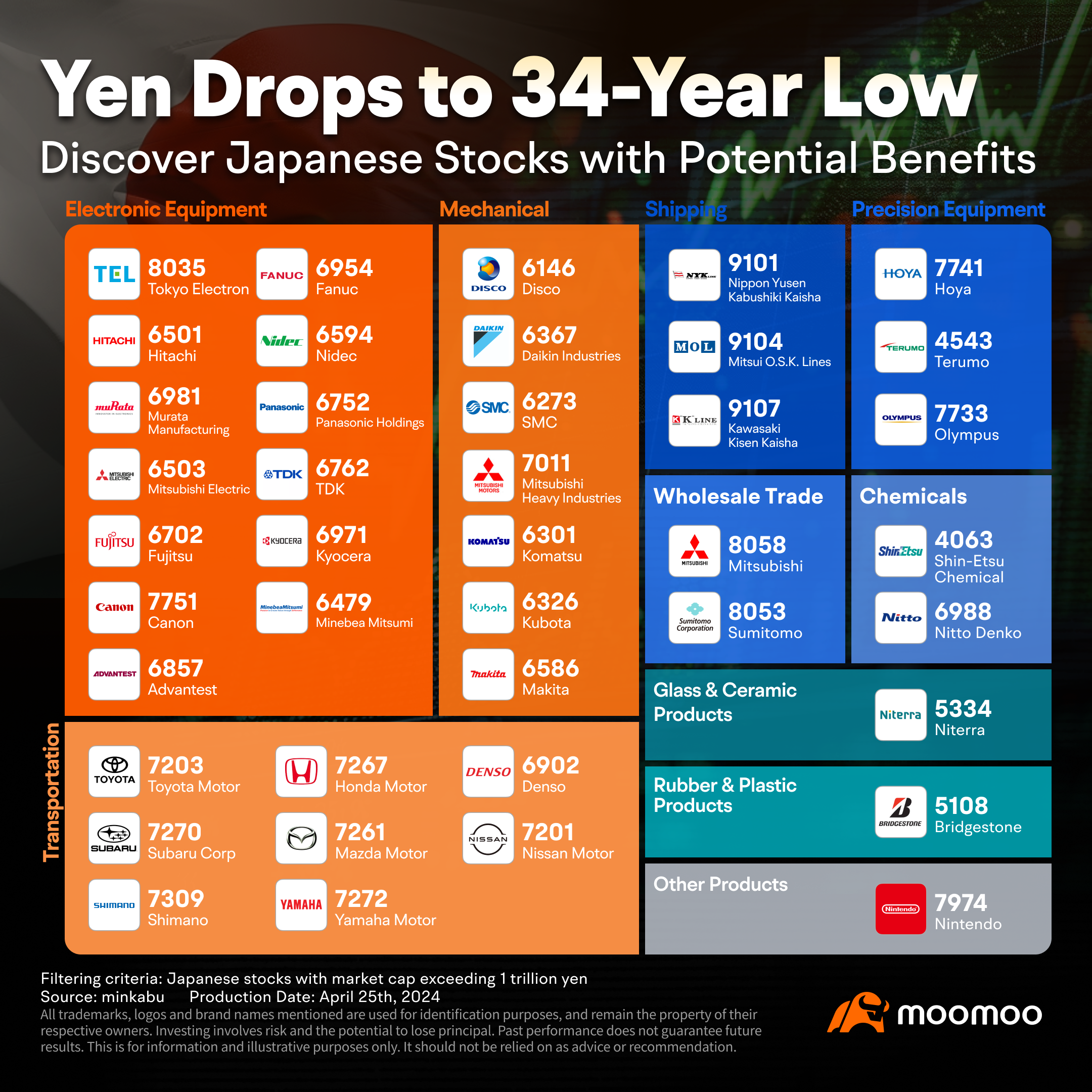

On the 17th, the American Depositary Receipts showed an overall rise compared to the Tokyo closing prices, in yen terms. In yen terms, Mitsubishi UFJ <8058.T>, Sumitomo Mitsui <8316.T>, Mizuho <8411.T>, JAL <9201.T>, and Electrical Utilities HD <9501.T> were all higher. Advantest <6857.T>, Mitsubishi Heavy Industries <7011.T>, HOYA <7741.T>, Tokyo Electron <8035.T>, and Nomura <8604.T> also performed well. Provided by Wealth Advisor.

Certified as a Health and Productivity Management Outstanding Organization for nine consecutive years (463.36KB).

Nippon Electric Glass, Japan Post Insurance, ETC (Additional) Rating

Upgraded - Bullish Code Stock Name Securities Company Previous Changed After ---------------------------------------------------------- <6807> Wireless Electronics Macquarie "Neutral" "Outperform" Target Price Change Code Stock Name Securities Company Previous Changed After ---------------------------------------------------------- <3349> Cosmos Pharma

Rating information (Target Price change - Part 1) = Kampo Life, Sumitomo etc.

◎ Daiwa Securities (5 levels: 1 > 2 > 3 > 4 > 5) Kanto Life <7181.T> -- "1" to "1", 4000 yen to 4100 yen T&D HD <8795.T> -- "1" to "1", 4300 yen to 4600 yen Dai-ichi Life HD <8750.T> -- "2" to "2", 4600 yen to 5000 yen Fukuyama Transport <9075.T> -- "3" to "3", 4000 yen to 3900 yen AZC Maruwa <9090.T> -- "3" to "3", 1550 yen to 1300 yen ◎ Mizuho Securities (3 levels.

List of stocks breaking through clouds (weekly) (part 2)

○ List of stocks that have broken above the cloud market Code Stock Name Closing Price Leading Span A Leading Span B Tokyo Stock Exchange Main Board <7003> Mitsui E&S 1823 1471.25 1649.5 <7294> Yorozu 1104 1063.25 1010.5 <7522> Watami 1065 901.25 1022.5 <7596> Uo Riki 2460 2431.5 2376.5 <7605> Fuji Corporation 2088 2019.2

Comments

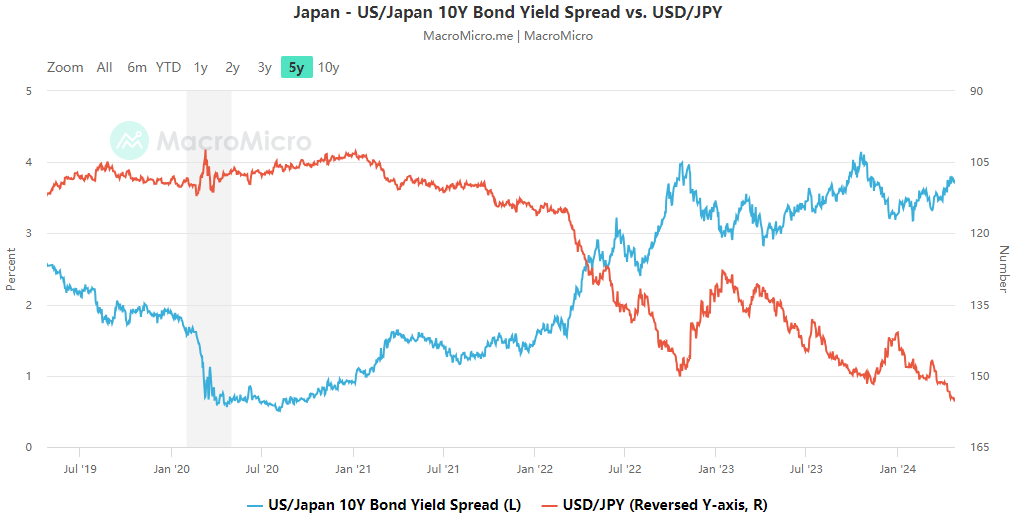

On April 24th, the Japanese yen continued its slump against the US dollar, breaching the key level of 155 fo...

The year 2023 is going to be an exciting year for the artificial intelligence industry as well as the semiconductor industry. After many years of rapid innovation and billions of dollars invested into research and development in these fields, we are now able to experience endless possibilities such as self-driving cars to personal assistants.

Companies such as OpenAI, Apple ( $Apple (AAPL.US)$ ), Microsoft ( $Microsoft (MSFT.US)$ ), Google...