No Data

7741 Hoya

- 20025.0

- -355.0-1.74%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

List of Conversion Stocks (Part 1) [List of Parabolic Signal Conversion Stocks]

○ List of stocks for Buy conversion in the market Code Stock Name Closing Price SAR Main Board <1944> Kinden 3092 3000 <1982> Hibiya Engineering 37753610 <285A> Kioxia HD 20501440 <3180> B Garage 13411270 <3402> TORAY INDS INC 1026976 <3963> Synchro Food 348316 <4331> T&G Needs 961926 <4507> Shionogi & Co., Ltd. 2214

List of breakout stocks (Part 1) [Ichimoku Kinko Hyo - List of breakout stocks]

○ List of Stocks Breaking Through the Clouds Market Code Stock Name Closing Price Leading Span A Leading Span B Tokyo Main Board <2222> 寿スピリッツ 2031 2027.75 1967.5 <2462> ライク 1419 1415.5 1418.5 <4369> トリケミカル 3290 2853 3198.5 <4658> Japan Air Conditioning 1052 1031.75 1047.5 <4971> メック 3605 3395 3542

ADR Japanese stock ranking - general Sell pressure especially on Japan Postal Bank, Chicago is down 265 yen compared to Osaka at 39,735 yen.

Japanese stocks of ADR (American Depositary Receipts) have generally declined compared to the Tokyo Stock Exchange (calculated at 158.04 yen per dollar), with heavy selling pressure on stocks like Japan Post Bank <7182>, Renesas <6723>, SMC <6273>, Tokyo Electron <8035>, Advantest <6857>, Japan Post <6178>, Disco <6146>, and others. The Chicago Nikkei 225 Futures settlement price is 39,735 yen, down 265 yen compared to daytime in Osaka. The US stock market has fallen, with the Dow Inc average down 178.20 dollars to 42,52.

The Nikkei average rebounded significantly by 776 points, recovering to 40,000, and after a round of buying, the market is expected to become heavy on the upside = afternoon of the 7th.

On the 7th, the Nikkei average stock price rose significantly by 776.25 yen to 40,083.30 yen, marking a rebound after three days. The TOPIX (Tokyo Stock Price Index) also increased by 30.19 points to 2,786.57 points. The Nikkei average recovered the psychological level of 40,000 yen for the first time in three trading days based on the closing price, since December 27 of last year. Following the continuous rise of the Nasdaq Composite Index and the surge of the SOX (Philadelphia Semiconductors Index) in the US market on the 6th, buying activity started strong from the morning. Japan time.

Nikkei average contribution ranking (before closing) - the Nikkei average rebounded significantly for the first time in three days, with Tokyo Electron contributing approximately 253 yen.

As of the market close seven days ago, the number of rising and falling stocks in the Nikkei average constituent stocks was 162 rising, 61 falling, and 2 unchanged. The Nikkei average rebounded after three days. It closed at 40,264.50 yen, up 957.45 yen (+2.44%) from the previous day, with an estimated Volume of 0.9 billion shares during the morning session. On the 6th, the U.S. stock market showed mixed results. The Dow Inc closed down 25.57 dollars at 42,706.56 dollars, while Nasdaq finished up 243.30 points at 19,864.98.

The Nikkei average is about 620 yen higher, with a backdrop of a weaker yen, testing higher levels in the market = 7 days ago.

On the 7th at around 10:04 AM, the Nikkei Stock Average was trading about 620 yen higher than the previous day, around 39,930 yen. At 9:54 AM, it reached 40,700.58 yen, recovering to the 40,000 yen level for the first time since the year-end special trading session. In the US stock market on the 6th, Semiconductors-related stocks were in demand, and the Nasdaq Composite Index and SOX (Philadelphia Semiconductor Index) rose. Following this trend, Japanese stocks also saw early buying, primarily in Semiconductors-related stocks. The exchange rate has shifted towards yen depreciation, and after-hours trading...

Comments

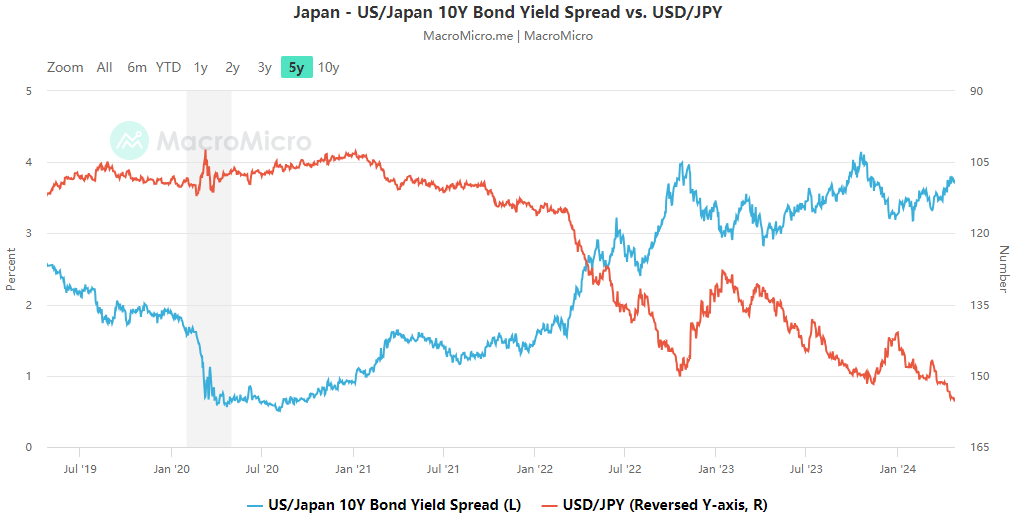

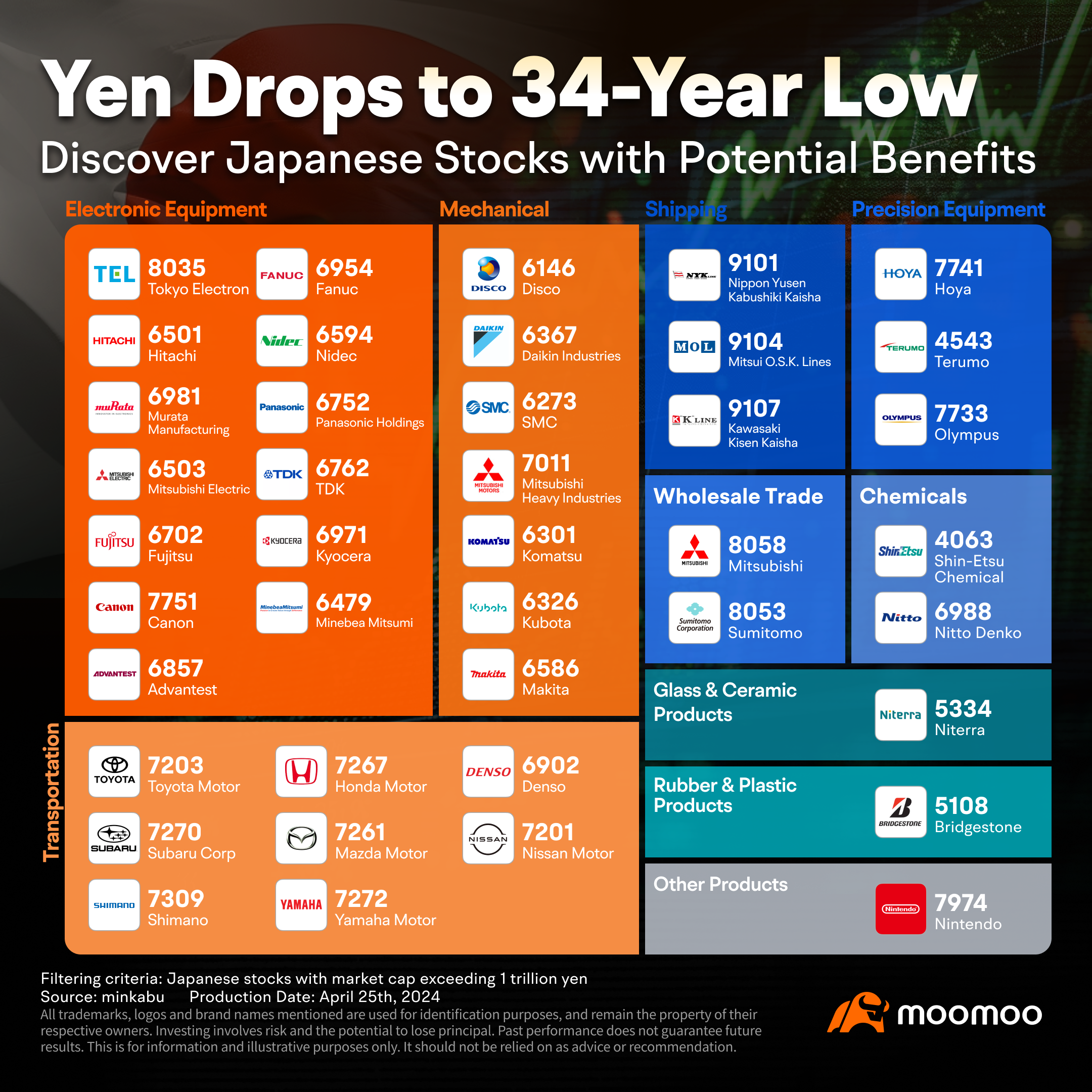

On April 24th, the Japanese yen continued its slump against the US dollar, breaching the key level of 155 fo...

The year 2023 is going to be an exciting year for the artificial intelligence industry as well as the semiconductor industry. After many years of rapid innovation and billions of dollars invested into research and development in these fields, we are now able to experience endless possibilities such as self-driving cars to personal assistants.

Companies such as OpenAI, Apple ( $Apple (AAPL.US)$ ), Microsoft ( $Microsoft (MSFT.US)$ ), Google...