No Data

7741 Hoya

- 17305.0

- -345.0-1.95%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

The Nikkei Average is down about 15 yen, with buying prevailing but the upper levels are heavy, moving near the previous day's closing price = 5 days before the market close.

At around 10:08 AM on the 5th, the Nikkei average stock price fluctuates near 37,315 yen, down about 15 yen from the previous day. At 9:15 AM, it reached 37,178 yen, down 152 yen and 46 sen, but it is now in a range near the previous day's closing price. In the morning, the depreciation of the yen in the Foreign Exchange market was seen as a positive factor, leading to a buying advantage at the start of trading. However, it turned downward due to selling as participants awaited a rebound. On the 4th, the U.S. government imposed a 25% tariff on imports from Canada and Mexico.

List of convertible stocks (Part 1) [List of Parabolic Signal convertible stocks]

○ List of stocks with a Buy change in the market Code Stock Name Closing Price SAR Main Board <1802> Obayashi Corporation 2081 1977 <1813> Fudo Tetra 22542177 <1820> Nishimatsu Construction 49584815 <1861> Kumagai Gumi 39903750 <1873> Japan House HD 330318 <1888> Wakachiku Construction 36553375 <2002> Nisshin Flour Milling Group 16951679 <2266> Roku.

The Nikkei average fell sharply by 688 yen, with a decrease of up to 969 yen, amid concerns over Trump's tariffs and the appreciation of the yen = four days before the market close.

Four days ago, the Nikkei average price fell significantly by 688.96 yen to 37,096.51 yen compared to the previous day. The TOPIX (Tokyo Stock Price Index) also fell greatly by 32.57 points to 2,696.99 points. At 10:34 AM, the Nikkei average dropped to 36,816.16 yen, down 969.31 yen, breaking below the low from the end of the previous month. On the 3rd, U.S. President Trump stated that additional tariffs on Canada and Mexico would begin as scheduled from the 4th. This has implications for the U.S. economy.

ADR trends on the 3rd = In yen conversion, Nidec Corporation Sponsored ADR, Advantest, Nissan, and others are down.

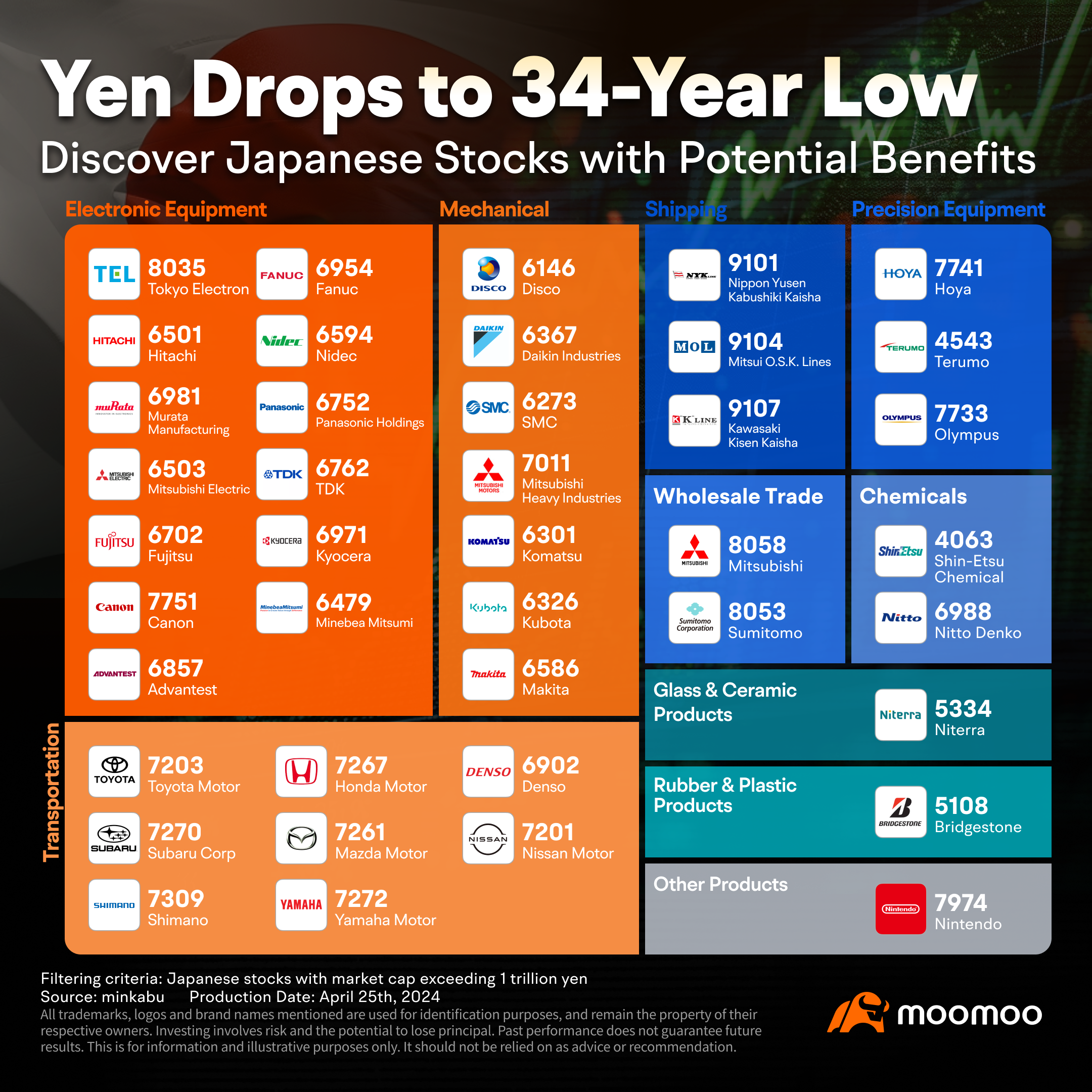

On the 3rd, the ADR (American Depositary Receipt) had a general decline compared to the Tokyo closing price on the same day when converted to yen. In yen terms, Nidec Corporation Sponsored ADR <6594.T>, Advantest <6857.T>, Nissan <7201.T>, Mitsubishi Corporation <8058.T>, and SoftBank Group <9984.T> were lower. Toyota <7203.T>, MUFG <8306.T>, Nomura <8604.T>, Hoya <7741.T>, and Fast Retailing <9983.T> also showed weakness. Provided by Wealth Advisors.

Announcement of individual stocks regarding the status of treasury stock acquisition (107KB)

The Nikkei average fell by 1,100 yen, a significant decline, marking the largest drop of the year and the biggest in five months as of the afternoon of the 28th.

On the 28th, the Nikkei average stock price in the afternoon session fell significantly by 1,100.67 yen from the previous day, closing at 37,155.50 yen. In terms of closing price, this drop exceeds the decline on the 3rd (1,052.40 yen) and marks the largest drop this year, the biggest since September 30 of last year (1,910.01 yen), making it the largest drop in five months. The TOPIX (Tokyo Stock Price Index) also dropped significantly by 54.16 points to 2,682.09 points. On the 27th local time, NVIDIA's stock price plummeted in the U.S. stock market. The SOX (Philadelphia Semiconductor Index) dropped.

Comments

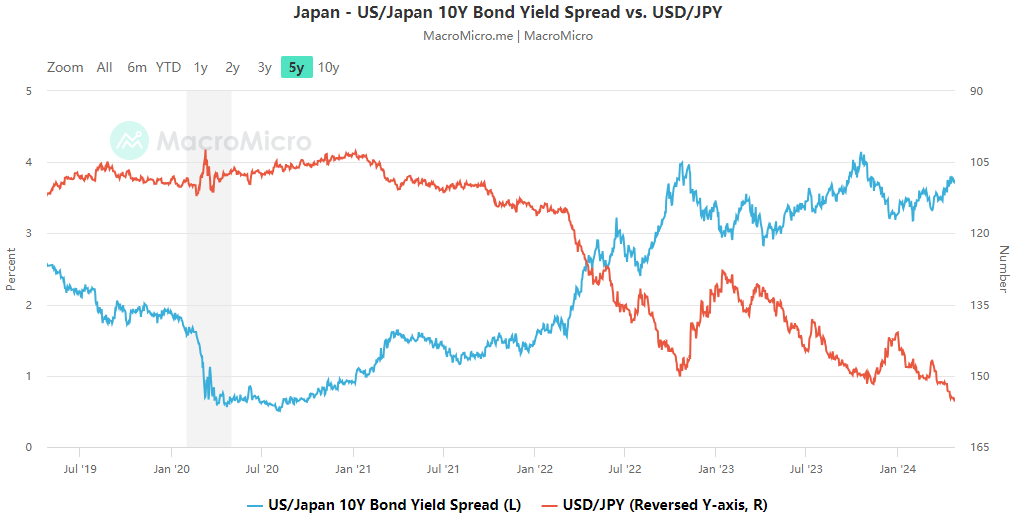

On April 24th, the Japanese yen continued its slump against the US dollar, breaching the key level of 155 fo...

The year 2023 is going to be an exciting year for the artificial intelligence industry as well as the semiconductor industry. After many years of rapid innovation and billions of dollars invested into research and development in these fields, we are now able to experience endless possibilities such as self-driving cars to personal assistants.

Companies such as OpenAI, Apple ( $Apple (AAPL.US)$ ), Microsoft ( $Microsoft (MSFT.US)$ ), Google...