No Data

9201 Japan Airlines

- 2519.5

- +24.0+0.96%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

US Stocks To Edge Lower After Thanksgiving As Investors Await Data: Analyst Expects A Santa Rally, 'Goldilocks Foundation' For Big Tech And Tesla

Three points to watch in the early session ~ It is likely that there will be buybacks in semiconductor stocks ~

In the morning session of the trading on December 2, three points will be emphasized. ■ Buybacks are likely in semiconductor stocks. ■ Keisei, upward revision of net profit for the fiscal year ending March 25 to 66.1 billion yen from 47 billion yen. ■ Key materials for the morning session: bridgestone corporation unsponsored adr, tightening of capital investment for the fiscal year ending December 25, anticipating a slowdown in Europe and the USA. ■ Buybacks are likely in semiconductor stocks. The Japanese stock market on the 2nd is expected to experience a strong stalemate despite the positive response to rising US stocks, due to the burden of yen appreciation in the foreign exchange market. The US market on November 29 is.

Bridgestone corporation unsponsored ADR, Albuck etc.

*Bridgestone Corporation unsponsored ADR <5108> narrowing down capital investment for the fiscal year ending December 2025, considering slowdown in Europe and the United States (Nikkan Kogyo Front Page) - ○ *Albuck <6728> refreshing semiconductor film forming equipment for the first time in 19 years (Nikkan Kogyo Front Page) - ○ *Hitachi <6501> Hitachi Rail to invest 10 billion yen in next-generation signaling, developing in Canada (Nikkan Kogyo Front Page) - ○ *Fuji Electric <6504> collaborating with Denso, ensuring stable supply of power semiconductors (Nikkan Kogyo Page 3) - ○ *Kansai Electric Power <9503> Orix and starting operation of a battery storage facility in Wakayama, Japan,

JAL, JAL Card, NTT Docomo, successfully acquired insights leading to regional revitalization using "Confidential Cross-Region Statistical Techniques".

(Joint press release) On December 2, 2024, Japan Airlines Co., Ltd., Jal Card Co., Ltd., NTT Docomo Japan Airlines Co., Ltd. (Headquarters: Shinagawa-ku, Tokyo, President: Mitsuko Tottori, hereinafter referred to as JAL), Jal Card Co., Ltd. (Headquarters: Shinagawa-ku, Tokyo, President: Tomohiro Nishihata, hereinafter referred to as Jal Card), NTT Docomo Co., Ltd. (Headquarters: Chiyoda-ku, Tokyo, President: Yoshiaki Maeda, hereinafter referred to as Docomo) extracted data from their shareholdings to analyze the customer preferences.

Nikkei Average Contribution Ranking (before the close) ~ The Nikkei Average fell back, with Tokyo Electron lowering it by about 27 yen from a single stock.

At the closing time on the 29th, the number of rising stocks in the Nikkei average constituent stocks was 73, the number of falling stocks was 149, and the number of unchanged stocks was 3. The Nikkei average fell. It ended the morning session of trading at 38,193.01 yen, down 156.05 yen (-0.41%) from the previous day, with an estimated volume of 750 million shares. The US market was closed for Thanksgiving holiday last night. In the foreign exchange market, trading of major currencies remained sluggish. The dollar-yen pair struggled to rise. After briefly being bought up to 151.77 yen, it dropped to 151.41 yen.

JAL and NEC are conducting a proof of concept for a solution that uses AI to analyze cabin baggage at the boarding gate and estimate its load capacity, making it the world's first.

(Joint Release) Japan Airlines Co., Ltd. (Headquarters: Shinagawa-ku, Tokyo, President and Group CEO: Mitsuko Tottori, hereinafter referred to as "JAL"), and NEC Corporation (Headquarters: Minato-ku, Tokyo, Representative Director, Executive President and CEO: Takayuki Morita, hereinafter referred to as "NEC") will automatically analyze the number and condition of carry-on luggage at the boarding gate using machine learning (AI) with the "NEC Baggage Counting Solution (NEC Baggage Counting Solution"

Comments

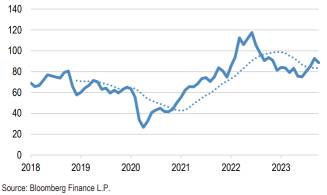

With oil prices continuing to decline, differing views on the outlook have emerged. On the one hand, the IEA believes the market will remain well supplied with the organisation expecting surpluses into next year even if OPEC+ production cuts are extended. However, with demand growth relatively robust, the expectation from

other news sources is that the cartel could actu...

Analysis

Price Target

No Data

No Data