No Data

ASML241206C1010000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

The Nasdaq index reached a new high, French stocks rose, the south korea etf narrowed after a 7% drop, and the offshore yuan briefly fell below 7.31 yuan.

South Korean President Yoon Suk-yeol abruptly declared a state of emergency, boosting safe-haven assets such as U.S. Treasury bonds, Japanese yen, and gold, while cryptos on the South Korean exchange plunged. The South Korean parliament quickly passed a resolution to lift the state of emergency, with the Ministry of Finance and the central bank actively working on market rescue measures. After a 2.7% drop to a two-year low, the won’s decline was cut in half, South Korean etfs fell by 1.6%, and the yield on 10-year U.S. Treasury bonds turned to increase after hitting a new low in over a month. France is set to vote on dissolving the government as early as Wednesday, with French stocks following European markets upward, although they had previously declined during the day. The Dow Jones, small cap stocks, and semiconductor indices fell, while the China concept index once rose by 1.9%. The yuan hit a new low in a year during the day, and U.S. oil rose nearly 3% testing the $70 mark.

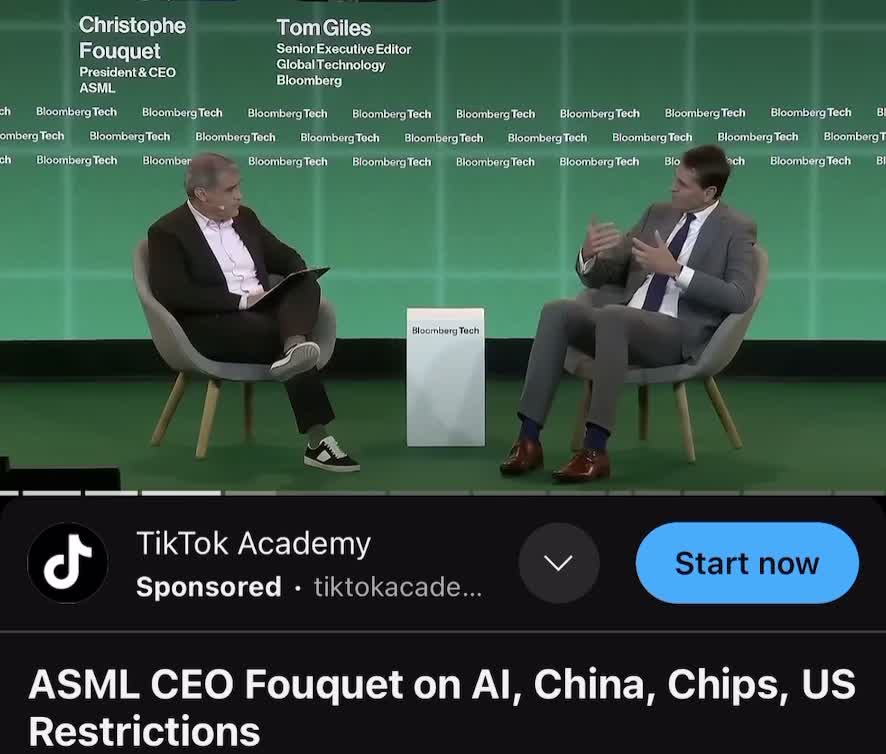

ASML (ASML) Exceeds Market Returns: Some Facts to Consider

European stock markets are rising, and the Germany DAX index has broken through the 20,000 point mark.

Germany's major stock index broke through 20,000 points for the first time, European stock markets rose for the fourth consecutive trading day, investors are bearish on French political risks. The Stoxx 600 index closed up 0.4%, marking the longest consecutive daily gain since August. The French CAC 40 index rose by 0.3%. Construction and retail stocks outperformed the large cap, while defensive sectors such as telecom, real estate, and the csi sws food & beverage index performed the worst. In terms of individual stocks, ASML Holding rose after reiterating its forecast for net sales in 2025. Concerns about potential US tariffs, geopolitical risks, and sluggish regional economies have weighed on European stock markets since they peaked in September.

Industry associations collectively call on domestic companies to be cautious in purchasing usa chips. Institutions provide this analysis as overseas semiconductor giants have repeatedly increased their investment in the china market.

① China has become the most important application market for the global IC industry. Institutions analyze that the new round of export controls by the usa has fractured the global semiconductor market and may also limit the development of usa's own enterprises; ② In the past two years, several overseas semiconductor companies have chosen to increase their investment in the china market and value the growth opportunities of chinese customers.

Market Whales and Their Recent Bets on ASML Options

Today's Analyst Rating | Roth MKM Upgrades Tesla to Buy, Netflix Price Target Raised to $950 by Evercore