No Data

BABA250103C130000

- 0.04

- 0.000.00%

- 5D

- Daily

News

Hong Kong stock market morning report on January 3: GTJA's merger application with HAITONG SEC will be discussed next week. Institutions expect that Hong Kong stock IPO fundraising could reach 160 billion Hong Kong dollars in 2025.

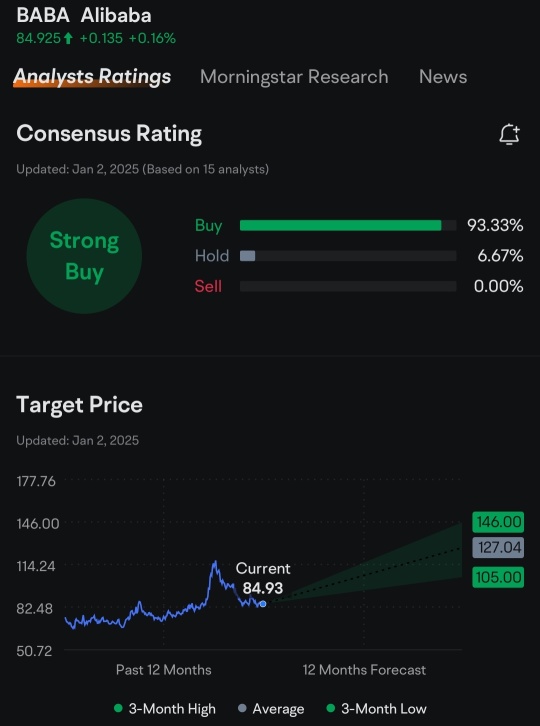

① PwC predicts that Hong Kong stock IPO fundraising could reach 160 billion Hong Kong dollars in 2025. ② GTJA's merger application with HAITONG SEC will be discussed next week. ③ Alibaba's buyback plan still has a remaining quota of 20.7 billion US dollars. ④ Last November, Hong Kong's retail sales volume decreased by 8.3% year-on-year.

Top Gap Ups and Downs on Thursday: TSLA, NVO, HSBC and More

U.S. stocks closed: the S&P and Nasdaq recorded five consecutive daily losses while Small Cap stocks saw a surge in speculative trading.

① The three major Index opened high but closed low, with the S&P and Nasdaq recording a decline for the fifth consecutive day; ② Tesla's annual delivery data has decreased for the first time in over a decade; ③ USA AI Nuclear Power Concept stocks secured a government L of 1 billion dollars; ④ "Roaring Kitty" leads the way, Small Cap thematic concept stocks gained hype.

Alibaba Options Spot-On: On January 2nd, 150.09K Contracts Were Traded, With 2.65 Million Open Interest

10 Consumer Discretionary Stocks Whale Activity In Today's Session

Gelonghui Announcement Selection (Hong Kong Stock) | Alibaba-W (09988.HK) still has 20.7 billion USD repurchase quota remaining under the share repurchase plan.

【Today's Focus】Alibaba-W (09988.HK) still has a buyback capacity of 20.7 billion USD under its share repurchase plan. Alibaba-W (09988.HK) announced that, as of the quarter ending December 31, 2024, the company repurchased a total of 0.119 billion shares of common stock at a total price of 1.3 billion USD (equivalent to 15 million American depositary shares). These repurchases were conducted in the US market under the company's share repurchase plan. As of December 31, 2024, the company had 18.517 billion shares of common stock in circulation (equivalent to 2.315 billion American depositary shares). Compared to 20.

Comments