No Data

BBJP JPMorgan BetaBuilders Japan ETF

- 55.910

- -0.260-0.46%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Buy aiming for autonomous rebound against recent decline.

The Nikkei average rebounded for the first time in four days, closing at 38,642.91 yen, up 107.21 yen (volume approximately 2.108 million shares). In the U.S. market on the 14th, although the major stock price indices fell, there was buying aimed at autonomous rebound after dropping nearly 1,000 yen in the previous three days, and the yen depreciated to the mid-156 yen level against the dollar, providing a tailwind to export-related stocks. In addition, mega banks such as Mitsubishi UFJ <8306>, which announced good performance prospects and share buybacks, remained solid.

Express News | Reported Earlier, Japan Industrial Production (MoM) For September 1.6% Vs. 1.4% Est.; 1.4% Prior

Express News | Reported Earlier, Japan Gross Domestic Product (YoY) Preliminary For Q3 0.9% Vs. 2.2% (Revised) Prior

Active and newly listed stocks during the morning session.

Macromill <3978> 971k - CVC Capital aims for complete subsidiary by TOB. EM Systems <4820> 640k - Significantly raises performance and dividends forecast. Net Protech HD <7383> 441k - First half sees rapid recovery beyond expectations, with upward revision of full-year estimates. Oisix La Terre <3182> 1412 +2057 - Expect further expansion of profit growth rate in September term. Giftee <4449> 1092 +150 - Third quarter turns to operating income growth.

Takasago fever, medley, etc. (additional) Rating.

Upgrade - Bullish code stock name Securities company traditional changes after ----------------------------------------------- <6481> THK Daiwa "3" "1" Downgrade - Bearish code stock name Securities company traditional changes after ----------------------------------------------- <7951> Yamaha City "1" "2" Target price change code stock name Securities company traditional changes after--

November 15 [Today's Investment Strategy]

[Fisco Selected Stocks]【Material Stocks】Net Protections Holdings <7383> 361 yen (11/14) provides a post-payment settlement solution. The financial estimates for the fiscal year ending March 2025 have been revised upward. The operating profit is estimated to be 1.7 billion yen. This is approximately a 57% increase from the previous estimate. The previous year reported a loss of 0.627 billion yen. The operating revenue is progressing as planned. Cost control through improvements in credit activities and billing operations for each service, as well as streamlining selling, general and administrative expenses.

Comments

What do you think is the primary cause of this week's stock market dips?

That's all for today, and always remember to DYODD (Do your own due diligence) when making any kind of investment.

Thank you and Godspeed!

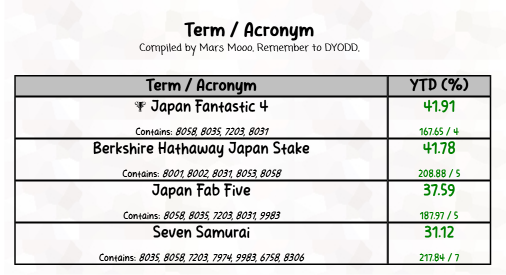

A short overview of equal weighted Seven Samurai (*1), Berkshire Hathaway Japan Stake, the Fab Five, and the Fantastic 4 YTD performance, rounded to 2 decimal places.

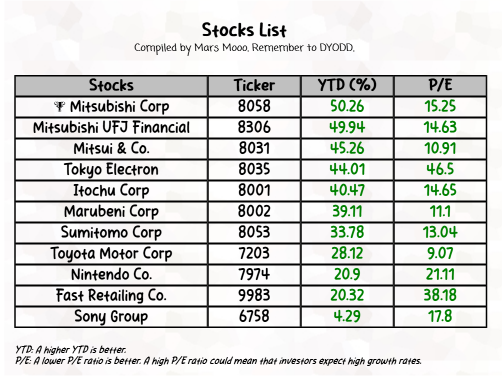

A quick overview of the stocks and their YTD performance inside them is provided below.

Do you think their YTD will continue to rise next week

That's all for today, and always remember to DYODD (Do your own due diligence) when makin...

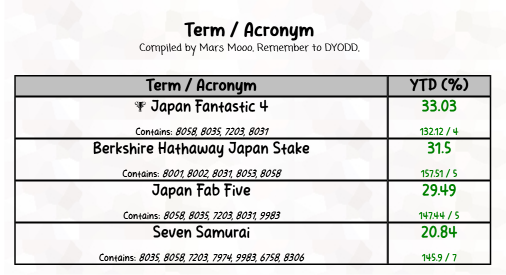

A short overview of equal weighted Seven Samurai (*1), Berkshire Hathaway Japan Stake, the Fab Five, and the Fantastic 4 YTD performance, rounded to 2 decimal places.

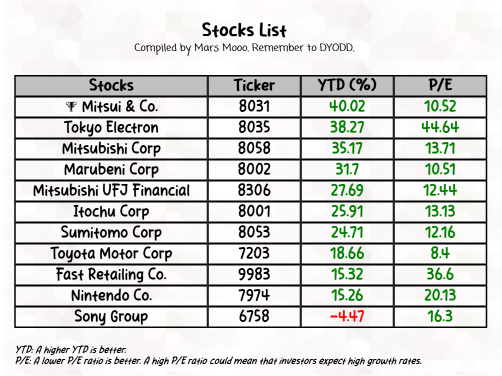

A quick overview of the stocks and their YTD performance inside them is provided below.

Do you think their YTD will continue to rise next week

That's all for today, and always remember to DYODD (Do your own due diligence) when mak...

A short overview of equal weighted Seven Samurai (*1), Berkshire Hathaway Japan Stake, the Fab Five, and the Fantastic 4 YTD performance, rounded to 2 decimal places.

A quick overview of the stocks and their YTD performance inside them is provided below.

Do you think their YTD will continue to rise next week

That's all for today, and always remember to DYODD (Do your own due diligence) when maki...

A short overview of equal weighted Seven Samurai (*1), Berkshire Hathaway Japan Stake, the Fab Five, and the Fantastic 4 YTD performance, rounded to 2 decimal places.

A quick overview of the stocks and their YTD performance inside them is provided below.

Do you think their YTD will continue to rise next week

That's all for today, and always remember to DYODD (Do your own due diligence) when maki...

熊猫猪墩儿 : The probability of the Democratic Party being re-elected declined, and future political uncertainty increased, so Wall Street, led by the Democratic Party, chose to sell off and stop making a profit.

Mars Mooo OP 熊猫猪墩儿 :

Cui Nyonya Kueh : eh you USD why you come seahum

Cui Nyonya Kueh : I think it's us unemployment + chip.

Cui Nyonya Kueh : can buy card for me![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

View more comments...