CA Stock MarketDetailed Quotes

BCE BCE Inc

- 33.130

- +0.260+0.79%

15min DelayMarket Closed Mar 31 15:45 ET

30.54BMarket Cap184.06P/E (TTM)

33.560High32.760Low1.53MVolume32.760Open32.870Pre Close50.70MTurnover46.42452wk High0.17%Turnover Ratio921.82MShares30.53852wk Low0.18EPS TTM30.50BFloat Cap58.818Historical High184.06P/E (Static)920.74MShs Float0.541Historical Low0.18EPS LYR2.43%Amplitude3.99Dividend TTM2.26P/B1Lot Size12.04%Div YieldTTM

BCE Inc Stock Forum

$BCE Inc (BCE.CA)$ with all the bad news, telecom is back? interesting.

2

1

$BCE Inc (BCE.CA)$ The earning is much lower than the dividend. BCE may cut the dividend soon.

3

1

$BCE Inc (BCE.CA)$Bell Q4 2024 earnings conference call is scheduled for February 6 at 8:00 AM ET / February 6 at 9:00 PM SGT /February 7 00:00 AM AEST. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from Bell's Q4 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what Bell's management have to say!

Disclaimer:

This presentation is for information and educati...

Beat or Miss?

What do you expect from Bell's Q4 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what Bell's management have to say!

Disclaimer:

This presentation is for information and educati...

BCE Q4 2024 earnings conference call

Feb 6 07:00

14

1

1

5

$BCE Inc (BCE.CA)$ hopeless stock one of my worst investment for 2024

2

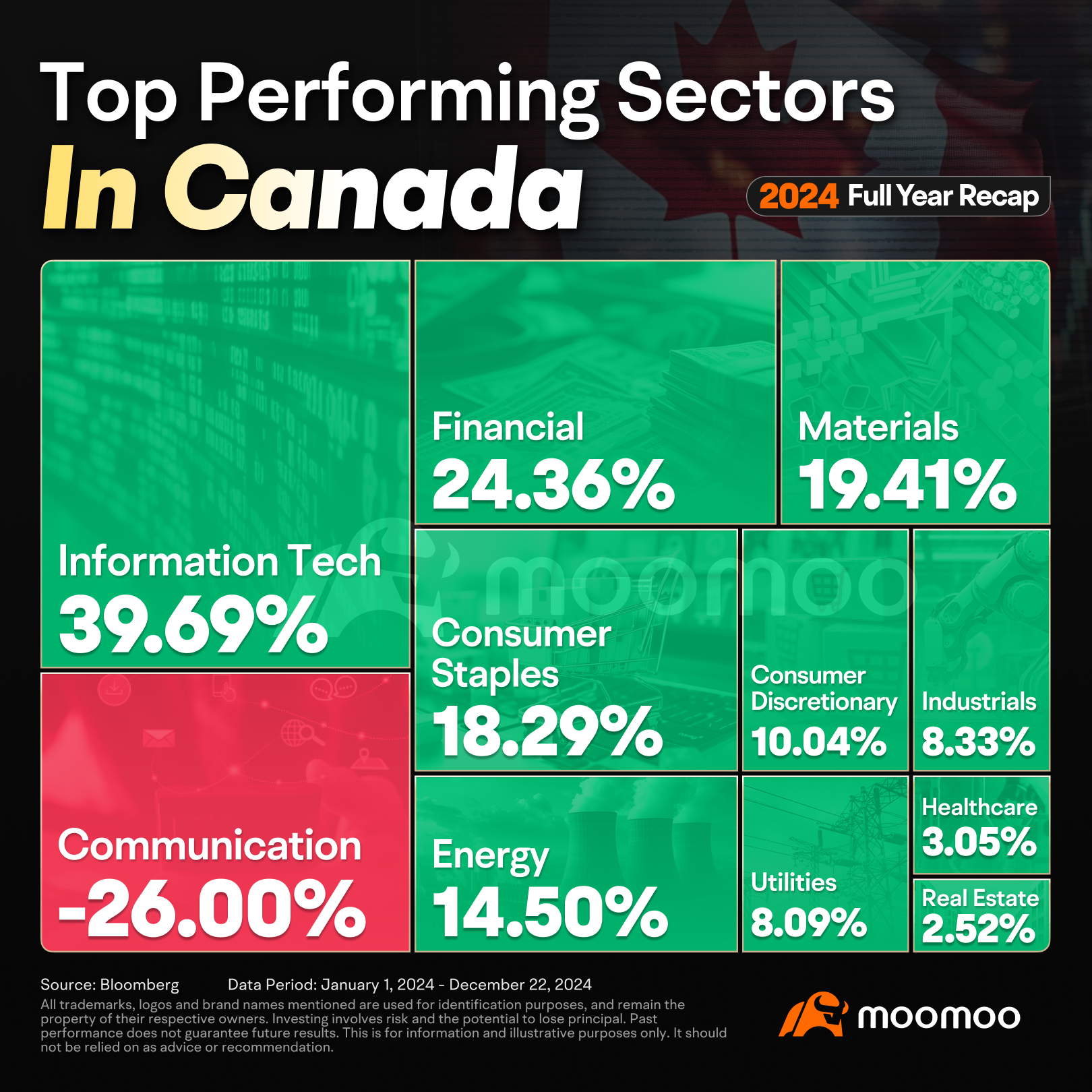

As 2024 nears its end, we've witnessed inflation rates falling in major developed countries, with Canada's inflation rate dropping from 2.9% at the beginning of the year to 1.9%. This year, the Bank of Canada took the lead in cutting interest rates, followed by the Federal Reserve. The AI sector in North America continued its rally, driving Canadian tech stocks to soar.

■ How did each sector perform in 2024?

Among all sectors in Canada, t...

■ How did each sector perform in 2024?

Among all sectors in Canada, t...

7

6

What if BCE cuts the dividend but doesn't pay down debt?

Bonuses for management again or another buying spree on companies in the US? $BCE Inc (BCE.CA)$

Bonuses for management again or another buying spree on companies in the US? $BCE Inc (BCE.CA)$

1

No comment yet

Market Insights

Dividend Kings of Canada Dividend Kings of Canada

Dividend Kings In Canada are companies that have increased their Dividend per share for the most consecutive years, reflecting a strong business model and robust financials, and are likely to outperform the market with less volatility. Dividend Kings In Canada are companies that have increased their Dividend per share for the most consecutive years, reflecting a strong business model and robust financials, and are likely to outperform the market with less volatility.

JimYo2025 : The 'Money Flow' has been green for 9 days straight!