Shenzhen Stock Exchange

- 1051.690

- -10.067-0.95%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

JD.com's domestic mobile phone sales have increased by 200% month-on-month, and mobile phone supply chain manufacturers are expected to release performance elasticity.

According to media reports, as of January 20th at 12:00, the national subsidy activities in Peking, Hubei, Jiangsu, Zhejiang, and Shaanxi are fully launched on JD.com, and activities in other provinces and cities are also being rolled out. Among the provinces and cities where the national subsidy is launched, smartphone sales have increased by 200% month-on-month, and tablet sales have increased by 300%.

The Steel Industry continues to feel the chill. The "top student" Hunan Valin Steel expects a maximum decline of 60% in performance for 2024 | Interpretations.

① Hunan Valin Steel expects to achieve a Net income of 1.7 billion yuan to -2.3 billion yuan attributable to the shareholders of the listed company in 2024, a year-on-year decline of 55% to 67%. ② The company announced on the same day that it intends to repurchase shares using self-owned funds or self-raised funds amounting to 0.2 billion yuan to -0.4 billion yuan, with the repurchase price not exceeding 5.80 yuan per share.

Electrolyte is trapped in a low stock price competition dilemma, with Rui Tai New Materials expecting a decline in net profit for two consecutive years | Interpretations

① Rui Tai New Material's projected Net income for 2024 is expected to decrease by about 80%, and the company will experience a decline in Net income for two consecutive years; ② The continuous release of production capacity for Battery materials has led to intensified competition in the Industry, with a noticeable decrease in product prices last year; ③ Due to substantial losses from the affiliated listed company Tonze New Energy Technology, the company expects to recognize investment losses of 0.075 billion yuan to -0.09 billion yuan.

It is expected that in 2024, the non-deductible significant reduction in losses will be achieved, and Zhengbang Technology's 2025 target for sales is aimed at 7 million heads | Interpretations

1. Zhengbang Technology expects a net income loss of 0.32 billion to -0.38 billion yuan for 2024, compared to a loss of 4.883 billion yuan in the same period last year; 2. In 2024, the average price of Hog Sale is expected to increase by 1.2 yuan per kilogram year-on-year, with the average slaughter weight increasing by about 15 kilograms per head compared to the same period last year; 3. The company anticipates an overall slaughter quantity of over 7 million heads in 2025.

Revenue has "returned to the 10 billion" target achieved. Three Squirrels Inc. expects a net profit increase of over 80% year-on-year last year | Interpretations.

① Three Squirrels Inc. expects to achieve revenue of 10.2 billion to 10.8 billion yuan in 2024, a year-on-year growth of 43.37% to 51.8%; it is expected to achieve net income of 0.4 billion to 0.42 billion yuan, a year-on-year increase of 81.99% to 91.09%; ② Following categories and channels, Three Squirrels Inc. has started to focus on building sub-brands.

The competition in the wind power industry has reached the component sector, and Tongyu Heavy Industry expects to incur losses in the peak season of Q4 last year. | Interpretations

On the evening of the 21st, Tongyu Heavy Industry announced that it expects a significant decline in performance of about 80% in 2024. According to the company's forecast data, there will be losses in the normally busy fourth quarter. The company stated that intensified competition in the wind power industry and falling product prices have greatly impacted its performance.

Comments

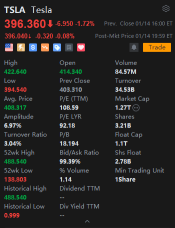

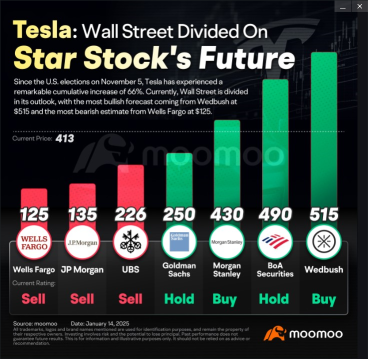

Recently, Tesla's stock price has been quite active. At the close of trading on January 14, 2025, Eastern Time in the United States, the stock price was $396.36. Compared with the previous day, it dropped by $6.95, with a decline of 1.72%. During that day, the stock price soared to a maximum of $422.64 and dropped to a minimum of $394.54. It fluctuated quite significantly.

Moreover, from the perspective of some technical in...

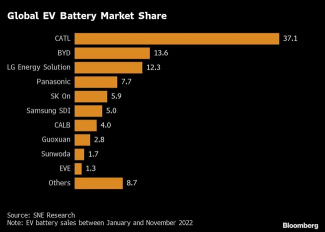

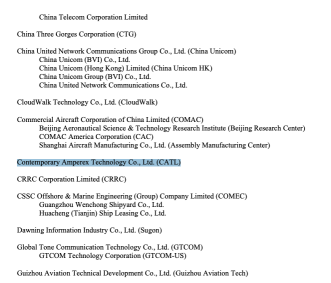

this morning $TENCENT (00700.HK)$ and $Contemporary Amperex Technology (300750.SZ)$ was hit, so tonight is the chance to take profit, it's natural .

plus $Bitcoin (BTC.CC)$ is down, so it's natural.

Tencent’s shares dropped over 7% in Hong Kong (and 8% in US trading), while CATL fell 5%. Not exactly minor hits for two global heavywei...

103998930 : Tesla seems too expensive, the rise is due to Trump buddy

Nonver 103998930 : but trump buddy drop. shd follow