Electric Vehicles

- 1383.667

- -39.773-2.79%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

What kind of week will this be? Global stock markets are facing a "tariff storm," and U.S. Treasury bonds are back in focus.

Since this quarter, U.S. Treasury bonds have outperformed Stocks, with a cumulative increase of more than 2%, while the S&P 500 Index has declined by about 5%. Analysis suggests that the 'reciprocal tariff' policy may impact the stock of Industries such as Autos, chips, and Pharmaceuticals, while the outlook of economic downturn and declining stock market will continue to elevate U.S. Treasury bonds as a safe haven Assets.

Rating [Securities companies rating]

Downgrade - Bearish Code Stock Name Brokerage Firm Previous After-----------------------------------------------------<4026> Kamisha Ichiyoshi "A" "B" <2678> Askul Iwai Koss Corp "A" "B+" <7203> Toyota CLSA "Hold" "Under P"

Mitsubishi HC Capital, Mitsubishi Corporation, ETC.

*Mitsubishi HC Capital <8593> is converting all domestic locations to renewable energy and utilizing non-fossil certificates (NIKKAN KOGYO, Page 1) -○ *Panasonic HD <6752> has started a 100% renewable energy demonstration at its German office (NIKKAN KOGYO, Page 3) -○ *Kansai Paint <4613> is relocating its Tokyo office to Yokohama, compressing fixed assets to invest in growth through sales profit (NIKKAN KOGYO, Page 4) -○ *Mitsubishi Electric Corp. Unsponsored ADR <6503> is accelerating the creation of new businesses, aiming for growth through collaboration with emerging companies and internal recruitment of ideas (NIKKAN KOGYO, Page 4) -○ *Mitsubishi Corporation <80

List of convertible stocks (Part 5) [List of stocks with Parabolic Cigna Corp signals]

○List of stocks transitioning to Sell Market Code Stock Name Closing Price SAR Tokyo Main Board <6616> Trex Co. 1258 1322 <6644> Ohsaki Electric 8248 75 <6718> Aihon 2668 2748 <6741> Nisshin Signal 9079 24 <6763> Teito Engineering 2471 2570 <6768> Tamura Manufacturing 5355 62 <6770> Alps Alpine 1571 1650 <6787> Meiko 70807

List of cloud breakout stocks (Part 2) [Ichimoku Kinko Hyo - List of cloud breakout stocks]

○ List of stocks breaking through the clouds Market Code Stock Name Closing Price Leading Span A Leading Span B Tokyo Main Board <5208> Arisawa Manufacturing 1411 1436.5 1463.5 <5261> Risol 5130 5332.5 5237.5 <5331> Noritake 3575 3687.5 3782.5 <5333> Japan Gaishi 1903 1920.25 1947 <5631> Nippon Steel 5547 5691.56

Due to concerns over Trump tariffs, temporarily fell below 37,000 yen.

The Nikkei average significantly continued to decline, closing down 679.64 yen at 37,120.33 yen (estimated Volume of 1.9 billion 30 million shares). The decline was influenced by the negative sentiment from the previous day in the USA market, following President Trump's announcement of a 25% additional tariff on imported Autos. The Nikkei average opened with a drop of over 400 yen and dipped below the key 37,000 yen level during the mid-morning session. Although there were moments to pick up on dips afterward, in the afternoon session, stocks like Tokyo Electron <8035> and Advantest <6857> were affected.

Comments

• Aussie markets: Gold, silver hit brand new record all time highs ahead of Australian inflation data next week. Australian election date set of May 3, bringing key stocks into focus.

• Stocks to watch: GM, Ford, Ferrari, De Grey, Ramelius Resources,, ...

Alignment Healthcare Inc (ALHC US) $Alignment Healthcare (ALHC.US)$

Daily Chart - [BULLISH ↗ **] ALHC US is on an uptrend and has recently shaped a bullish breakout. With price holding above 16.25 support, price is expected to push towards 20.00 resistance level. Technical indicators are advocating for a bullish scenario as well.

Alternatively: A daily candlestick closing below support at 16.25 will open a drop towards ...

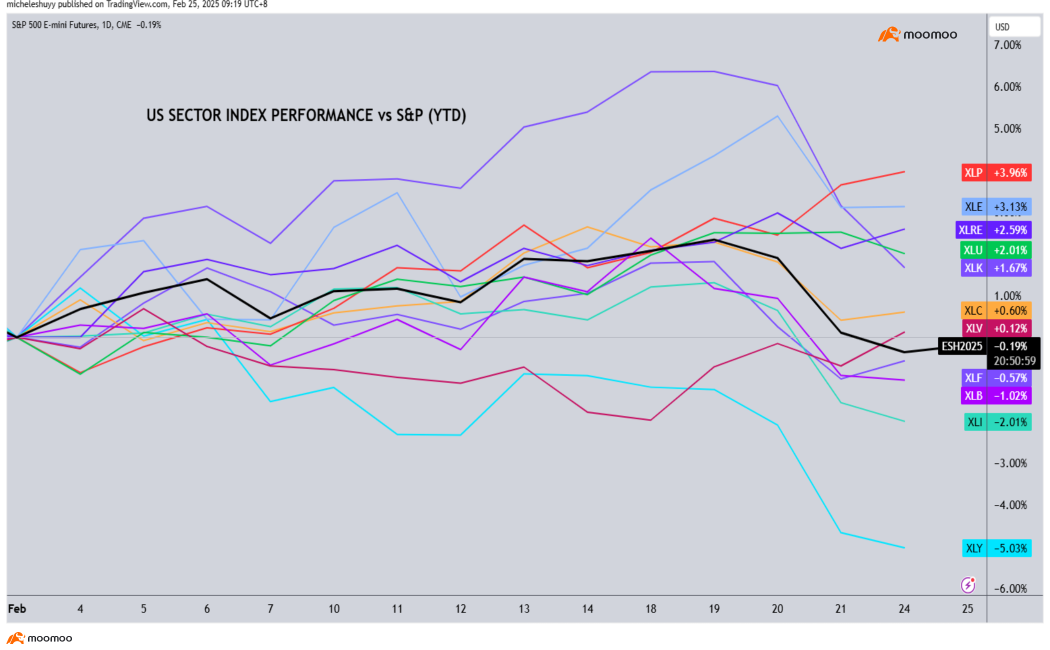

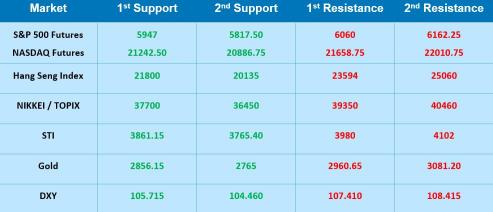

US Market

US markets ended the week lower, with the $E-mini S&P 500 Futures(JUN5) (ESmain.US)$ and $E-mini NASDAQ 100 Futures(JUN5) (NQmain.US)$ falling 1.78% and 2.50% respectively. This came after economic data revealed that consumers' long-term inflation expectations had surged to their highest level in nearly three decades. Investor sentiment took another hit as Trump threatened to impose 25%...

Lululemon Athletica Inc (LULU US) $Lululemon Athletica (LULU.US)$

Daily Chart - [BEARISH ↘ **] LULU US traded sideways before breaking down lower. With bearish divergence being posted, a further push lower below resistance at 371.88 towards 318.24 support is expected. Price is now below 34 period EMA with MACD showing a build up in bearish divergence.

Alternatively: A daily candlestick closing above 371.88 resistance will invalidate bear...

151453268 witso : I knew you would come around, spot on we dont want power handouts and negligable tax cuts,we want action and intelligent change not woke glaringly obvious pork barrelling. strength to the beautiful bondi strategist

Billy Ada : i love it