The ARK Holdings selection refers to a family of exchange traded funds (ETFs) managed by ARK Investment Management LLC (ARK). ARK was founded in New York City in 2014 by Cathie Wood, a prominent investor known for her bullish stance on technology stocks. The firm's investment philosophy is centered around identifying disruptive technologies and investing in companies that are positioned to benefit from these trends. The ARK ETFs have gained attention from investors and analysts due to their strong performance and unique investment approach. ARK currently has eight ETFs: ARKK, ARKW, ARKG, ARKQ, ARKF, ARKX, PRNT, LZRL.

- 590.996

- +3.555+0.61%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

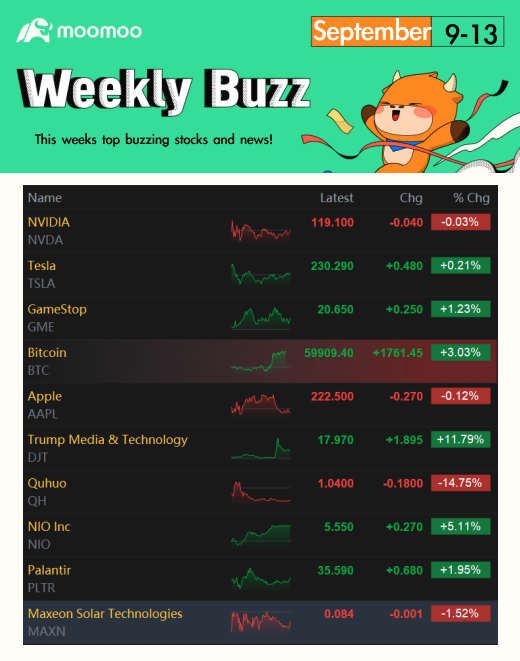

Weekly Buzz: Market Back to where September Started

Catalyst Watch: FOMC, FedEx Earnings, Electronic Arts Event, and Triple Witching Day

Robinhood Issues Invite For October 16 Event to Introduce New Trading Products

Tesla Analyst Says 'Business Before Pleasure' With Third Quarter Deliveries Report Ahead Of Robotaxi Day

4 Bullish Stocks and 2 Bearish Stocks to Watch Out for – BofA

10 Consumer Discretionary Stocks Whale Activity In Today's Session

Comments

also, for them to time the release of the filings when regular trading is closed and ppl can't get ou...

Make Your Choice

Weekly Buzz

Happy Friday, traders. The market climbed this week after a rough start in September. Wednesday, the market decline turned around by the afternoon af...