Trump-Election Stocks refer to securities closely associated with business dealings, political actions, or events related to Donald Trump. These stocks may benefit from Trump's potential win in the 2024 US presidential election.

- 1342.644

- +21.935+1.66%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Trump Returns To Site Of Assassination Attempt, Urges Voters To Vote: 'Our Movement To Make America Great Again Stands Stronger'

Regeneron Co-founder Warns of Harms From Weight-loss Drugs: FT

Nvidia's Blackwell GPU, Musk's OpenAI Accusations, Tesla's Robotaxi Event, And More: This Week In AI

Earnings Week Ahead: JPMorgan, Wells Fargo, PepsiCo, Delta Air Lines, and More

What to Expect in the Week Ahead (CPI Index and Fed Officials' Speaks; Earnings From PepsiCo and JPMorgan)

Over Half of the S&P 500 Companies That Reported Earnings This Week Beat Estimates-Earnings Scorecard

Comments

1. descending triangles break outs, OR

2. support/resistance flipping into strength

Using this opportunity to share some of my findings with everyone;

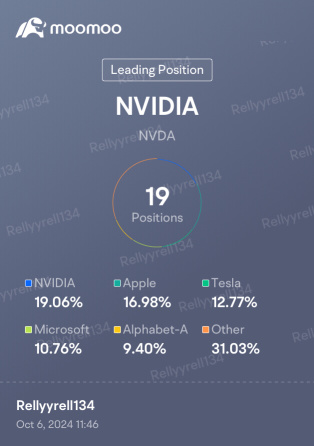

Stocks: $TSLA $NVDA $CART $PYPL $ASTS $SOFI $CRM

$Tesla (TSLA.US)$ , $NVIDIA (NVDA.US)$ , $Instacart(Maplebear) (CART.US)$ , $PayPal (PYPL.US)$ , $AST SpaceMobile (ASTS.US)$ , $SoFi Technologies (SOFI.US)$ , �������...

MicroStrategy Inc. (MSTR): Among the Best WallStreetBets Stocks to Buy Right Now

👆🏻💸💸💸. Look at the last 30 days 😎.