Trump-Election Stocks refer to securities closely associated with business dealings, political actions, or events related to Donald Trump. These stocks may benefit from Trump's potential win in the 2024 US presidential election.

- 1459.480

- +5.839+0.40%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Bitcoin Surges Towards $100,000: Who's Driving the Rally and What's Next

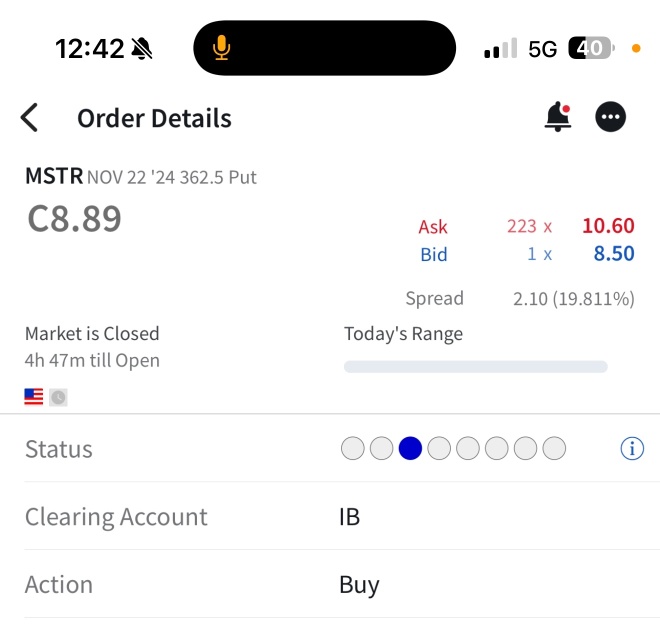

MicroStrategy Sinks After Citron Research Shorts 'Overheated' Stock

MSTR - the most successful "investment bank" in financial history, or the most reckless?

Bitcoin has reached a new high again, but MSTR has experienced a terrifying moment of plummeting. Analysis indicates that over the past five years, MSTR's stock price has surged by 3000%, but its symbiotic relationship with bitcoin casts shadows of a 'Ponzi scheme'. Now, as a test arises, will the company announce a timely exit in victory, or will it continue this high-risk 'financial game'?

With Gary Gensler Preparing To Quit In 2025, SEC's Crypto Cases Likely To 'Quietly Go Away' Amid Trump's Pro-Bitcoin Stance, Says Pantera Capital's Katrina Paglia

Tesla CEO Elon Musk Tries To Lower Expectations Of $30K Optimus Or Cybercab

Bitcoin's Path To $100K 'Inevitable' But Crypto Community Is 'Leveraged To The Gills,' Warns Galaxy's Mike Novogratz, Predicts Correction To $80K Ahead