Investment ThemesDetailed Quotes

Kamala Harris

Watchlist

The list includes stocks closely associated with business dealings, political actions, or events related to Kamala Harris. These stocks may benefit from Harris's potential win in the 2024 US presidential election.

- 1899.248

- -1.343-0.07%

Trading Sep 18 12:25 ET

1905.407High1891.348Low

1899.250Open1900.591Pre Close89.17MVolume7Rise48.81P/E (Static)4.72BTurnover--Flatline0.35%Turnover Ratio3.48TMarket Cap14Fall2.94TFloat Cap

Constituent Stocks: 21Top Rising: GM+2.20%

Intraday

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Constituent Stocks

SymbolStock Name

Latest PriceChg% ChgVolumeTurnoverOpenPre CloseHighLowMarket CapFloat CapSharesShs Float5D % Chg10D % Chg20D % Chg60D % Chg120D % Chg250D % Chg% Year-to-dateDiv YieldTTMTurnover RatioP/E (TTM)P/E (Static)AmplitudeIndustry

WatchlistPaper Trade

GMGeneral Motors

48.5651.045+2.20%4.13M200.33M47.72047.52048.82047.70054.58B54.39B1.12B1.12B+8.72%+0.49%+5.89%+1.20%+9.48%+47.89%+36.30%0.86%0.37%5.466.632.36%Auto Manufacturers

ENPHEnphase Energy

120.2251.695+1.43%1.33M160.17M118.590118.530121.670118.59016.28B15.76B135.42M131.09M+8.71%+6.29%+2.77%+11.30%+0.35%-3.02%-9.02%--1.02%129.2739.032.60%Solar

TLRYTilray Brands

1.8300.020+1.10%8.42M15.29M1.8101.8101.8401.7901.54B1.53B842.96M837.12M+6.40%+10.24%-2.14%+10.24%-26.21%-25.91%-20.43%--1.01%LossLoss2.76%Drug Manufacturers - Specialty & Generic

TGTTarget

153.6121.652+1.09%661.32K101.55M152.490151.960154.180152.40070.77B70.54B460.67M459.18M+4.29%+0.74%+7.26%+3.42%-10.76%+31.77%+10.26%2.86%0.14%15.8717.181.17%Discount Stores

FFord Motor

11.0030.103+0.94%15.77M173.12M10.93010.90011.03010.91543.74B42.81B3.98B3.89B+5.29%+0.48%+3.02%-8.64%-13.40%-4.56%-4.72%5.45%0.41%11.4610.191.06%Auto Manufacturers

MSTRMicroStrategy

132.2600.990+0.75%6.74M883.05M130.440131.270134.180128.51026.80B24.13B202.63M182.43M+2.31%+5.94%-1.07%-3.61%-31.08%+296.62%+109.40%--3.69%Loss50.064.32%Software - Application

WMTWalmart

78.8650.265+0.34%4.11M322.87M78.64078.60078.98078.280633.94B341.24B8.04B4.33B+0.03%+2.10%+5.80%+14.79%+30.71%+46.30%+51.54%1.01%0.10%41.0841.290.89%Discount Stores

COSTCostco

896.450-0.820-0.09%282.03K252.91M899.940897.270900.180894.000397.43B396.36B443.34M442.15M-0.44%+0.72%+2.31%+5.84%+22.83%+63.65%+36.42%0.47%0.06%55.5863.310.69%Discount Stores

COINCoinbase

162.130-0.320-0.20%1.37M222.09M161.540162.450164.850160.90040.29B32.39B248.48M199.79M+3.17%-0.67%-17.80%-23.64%-36.84%+111.46%-6.78%--0.68%28.85438.192.43%Financial Data & Stock Exchanges

AMZNAmazon

186.460-0.420-0.22%7.95M1.48B186.450186.880187.410185.0601.96T1.75T10.50B9.36B+1.05%+7.58%+4.24%+0.48%+3.69%+37.82%+22.72%--0.09%44.5064.301.26%Internet Retail

FSLRFirst Solar

239.100-0.880-0.37%853.68K206.03M240.000239.980245.740237.40025.59B24.20B107.05M101.20M-0.31%+11.00%+8.58%-8.49%+42.79%+41.28%+38.79%--0.84%21.3530.893.48%Solar

RUNSunrun

20.200-0.110-0.54%3.02M60.90M20.32020.31020.62019.9004.52B4.17B223.54M206.40M+5.48%+2.90%+5.81%+48.75%+54.20%+41.65%+2.90%--1.46%LossLoss3.55%Solar

PHMPulteGroup

139.680-0.780-0.56%490.39K68.42M140.830140.460141.020138.73028.99B28.74B207.52M205.77M+6.42%+9.03%+12.14%+24.14%+18.74%+83.98%+35.99%0.54%0.24%10.6611.921.63%Residential Construction

NXTNextracker

37.085-0.255-0.68%958.04K35.66M37.34037.34037.85036.7305.32B5.30B143.44M143.00M+3.62%-1.00%-6.35%-28.45%-36.08%-12.18%-20.84%--0.67%9.8111.003.00%Solar

DHID.R. Horton

193.495-1.855-0.95%544.39K105.41M195.500195.350195.695192.67063.09B62.76B326.04M324.35M+4.50%+5.05%+7.73%+34.55%+19.86%+72.34%+28.06%0.59%0.17%13.0214.001.55%Residential Construction

MARAMARA Holdings

15.710-0.160-1.01%11.14M175.82M15.83015.87016.04515.4954.63B4.58B294.47M291.27M-0.50%+5.58%-4.32%-15.94%-28.82%+69.11%-33.12%--3.83%17.4614.823.47%Capital Markets

RDYDr. Reddy's Laboratories

78.600-0.930-1.17%25.67K2.02M78.85079.53079.24078.59513.09B9.43B166.59M119.98M-0.83%-3.83%-5.51%+9.67%+9.33%+15.92%+13.62%--0.02%19.7619.720.81%Drug Manufacturers - Specialty & Generic

LENLennar Corp

187.060-2.300-1.21%424.78K79.71M190.000189.360190.125186.44051.37B45.82B274.60M244.94M+4.98%+4.91%+7.51%+24.60%+11.77%+62.69%+26.78%0.94%0.17%12.7513.621.95%Residential Construction

TEVATeva Pharmaceutical Industries

17.615-0.235-1.32%1.60M28.37M17.88017.85017.94017.58519.96B19.84B1.13B1.13B-1.92%-7.09%-3.59%+6.82%+22.07%+64.63%+68.73%--0.14%LossLoss1.99%Drug Manufacturers - Specialty & Generic

RIVNRivian Automotive

12.895-0.205-1.56%8.14M106.11M13.14013.10013.26012.87013.00B9.30B1.01B721.14M-7.43%-2.90%-2.31%+17.12%+17.33%-42.43%-45.03%--1.13%LossLoss2.98%Auto Manufacturers

LCIDLucid Group

3.650-0.130-3.44%11.22M41.44M3.7603.7803.7803.6308.46B3.27B2.32B896.91M-8.29%-4.45%+12.65%+42.58%+22.90%-33.03%-13.30%--1.25%LossLoss3.97%Auto Manufacturers

News

General Motors Boosts EV Charging Access: 17,800 Tesla Chargers Now Open For All GM Drivers With New Adapter

Single-Family Housing Starts Are Up As Mortgage Rates Decline, Fed Eyes Lower Rates

Amazon (AMZN) Yield Shares Purpose ETF Raises Dividend to CAD 0.35

$100 Invested In Amazon.com 10 Years Ago Would Be Worth This Much Today

IBKR's 25 Most Actively Traded Stocks Ranked by SA's Quant Metrics

Wells Fargo Sees Further Rally in Home Improvement Stocks If Fed Sets Measured Guidance

Comments

$Ford Motor (F.US)$ I do want those 11.5 calls for 9 days out cheap right now

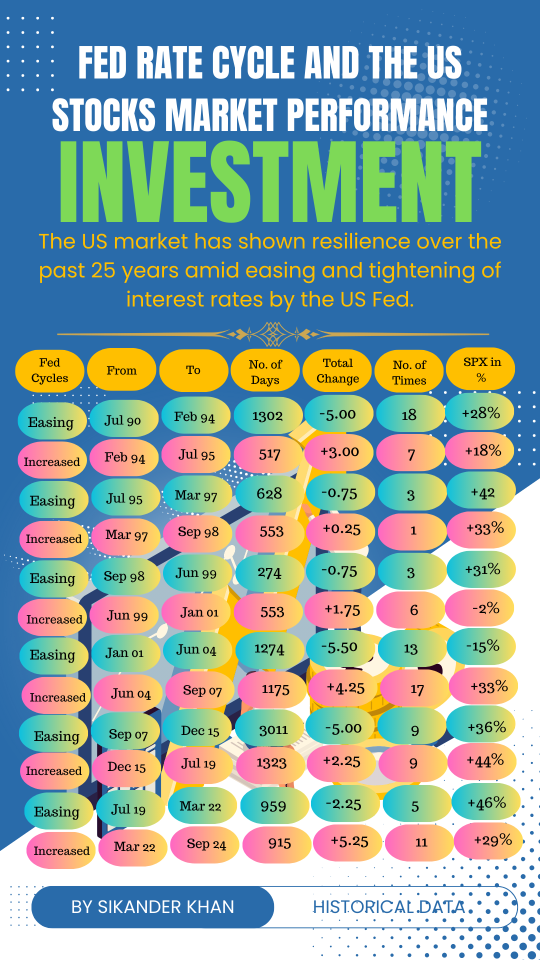

The Fed’s rate decision on Sept 18 is important, with potential cuts of 25 or 50 bps likely having predictable impacts. A 25 bps cut would signal a cautious approach, leading to modest stock gains, slight drops in bond yields, and a weaker dollar. A 50 bps cut, on the other hand, would indicate strong economic support, potentially causing a more significant stock rally, a notable decline in bond yields, and further weakeni...

Read more