The list includes stocks closely associated with business dealings, political actions, or events related to Kamala Harris. These stocks may benefit from Harris's potential win in the 2024 US presidential election.

- 1904.087

- +24.685+1.31%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

MicroStrategy Buys 18.3K Bitcoins for $1.11B

Oracle Quietly Gains Momentum While Nvidia, Meta Dominate AI Spotlight

Billion-Dollar Marijuana Giant Buys Another Brewery From Molson Coors, Expands Great Lakes Footprint

Microsoft Hires Former GE CFO Carolina Dybeck Happe As COO To Boost Cloud And AI Focus

How do you view the recent "hawkish" stance of the Bank of Japan executives? Goldman Sachs: The next interest rate hike may still have to wait until January next year.

Goldman Sachs believes that when evaluating the timing of interest rate hikes, it is important to consider financial market stability and inflation trends. The bank predicts that January next year will be the best time to determine whether Japan's inflation will rebound, and based on this, determine that Japan will raise interest rates in January. However, if there is significant turmoil in the financial markets, the timing of the rate hike may become uncertain.

Trump Coin Launch Odds Jump On Crypto Betting Platform Polymarket After World Liberty Financial Gets A Launch Date

Comments

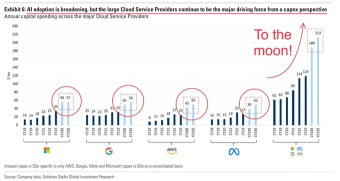

$Microsoft (MSFT.US)$ $Alphabet-C (GOOG.US)$ $Amazon (AMZN.US)$ $Meta Platforms (META.US)$

Biden admin announces crackdown on Chinese e-commerce platforms

The administration of United States President Joe Biden announced on Friday that it was taking new actions to address the "significant increased abuse of the de minimis exemption," emphasizing Chinese e-commerce platforms and urging for congressional action.

The de minimis loophole allows shipments with a value of less than $800 to enter the US without...

$Trump Media & Technology (DJT.US)$ $Kamala Harris (BK22990)$ $Donald Trump (BK22962)$

Until a few months ago, I think it's fair to say that not many people thought of Rivian as a software company. That certainly changed when Volkswagen admitted it needed outside help to deal with its endless software woes and inked a USD5 billion deal with Rivian to co-develop software and electrical architectures. That was a huge coup for the American startup and a much-needed financial lifeline as it ...

Awuhsawj :