WSB (WallStreetBets) is a Reddit community of investors and traders who follow the stock market. The WSB list includes stocks that receive a lot of media attention and have a strong sentiment from retail investors. The popularity of these stocks among retail investors combined with social media creates viral trends with a global reach and large price movements. WSB investors are attracted to "meme stocks" and popular "blue-chip" stocks due to their familiarity, volatility and momentum. Since meme stocks often experience rapid price movements, traders can potentially make quick profits as more investors rally around a stock, creating a sense of community among meme stock traders. Many people who invest in meme stocks are active participants in online forums and social media groups where they share information and insights about trading strategies, market trends, and individual stocks.

- 2519.832

- +165.903+7.05%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Nasdaq Rally: Nvidia Among Winners in Index's Strongest Day in 4 Months

Trump's Crypto Chief David Sacks Sold His Coinbase, Robinhood Stakes Pre-inauguration

N. America Box Office to Climb ~7% This Year on Improving Moviegoer Pace - Wedbush

Catalyst Watch: Nvidia Event Could Revive Animal Spirits, Fed Meeting, and Nike Earnings

Shares of Airline and Travel Stocks Are Trading Higher Despite Travel Demand Uncertainty. The Sector May Be up Amid an Overall Market Rebound Following Weakness in Recent Sessions.

'Horrific Report': Economists Warn Consumer Confidence Collapse Signals Economic Trouble

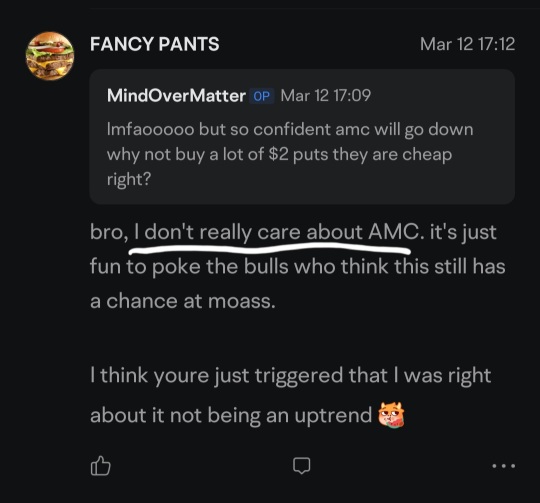

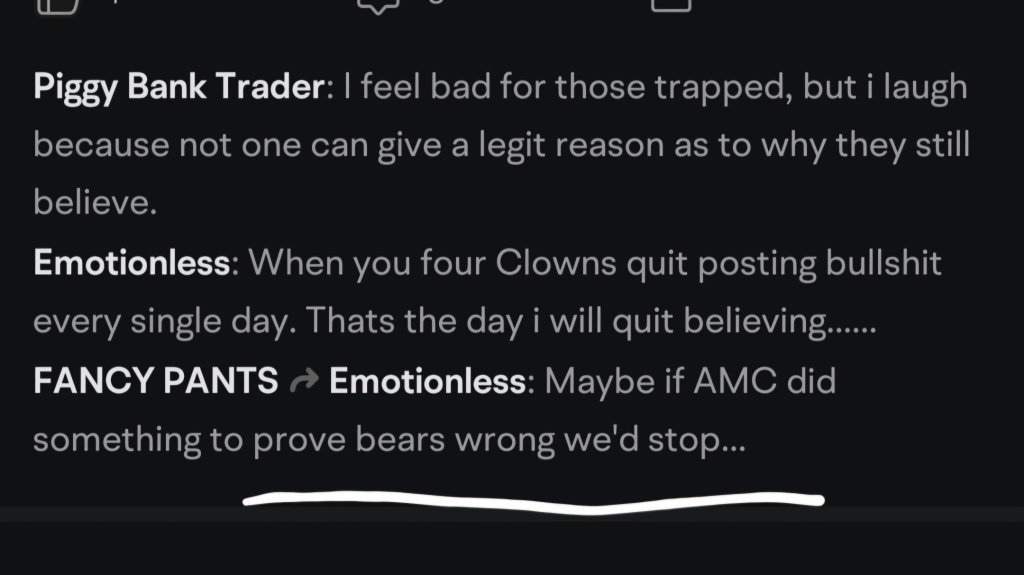

Comments