ESG stands for Environment, Social Responsibility, and Corporate Governance. The ESG concept includes the top 100 US-listed companies in terms of ESG rankings.

- 1323.001

- +3.148+0.24%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

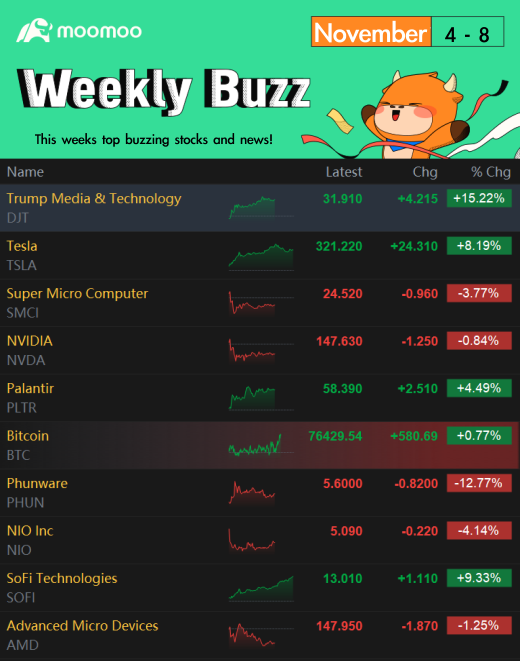

Investors Elect to Accelerate Market on Election Week | Weekly Buzz

Friday Market Finished with Records | Wall Street Today

Merck Announces That Canada's Drug Agency Has Recommended WINREVAIR For Reimbursement In Combination With Standard Pulmonary Arterial Hypertension Therapy, For The Treatment Of Adults With World Health Organization Group 1 PAH And Functional Class II...

What the Options Market Tells Us About Apple

Bristol-Myers Squibb Leads Biopharma Recovery With Almost 25% Growth In Market Cap, But Novo Nordisk And Lilly Suffer Market Setbacks

Looking Into Cheniere Energy's Recent Short Interest

Comments

Make Your Choice

Weekly Buzz

It was an extreme week in the U.S. stock market: a match-up months in the making that culminated Tuesday night. In an extremely close race and with a relatively furious pace of vote counting, Former Pr...

HuatLady : With Trump's recent victory, the market surged with DJI and S&P 500 soaring. However stock markets often defy the prevailing news narrative, moving in unexpected directions. Numerous factors can emerge to test investors' wisdom and intuition.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

For short-term gains, I am considering investing in the oil and gas sectors given Trump's support for domestic production. This makes companies like $Exxon Mobil (XOM.US)$ and $Chevron (CVX.US)$ worth a closer look. Meanwhile, I could lock in some profits and park partial funds in Cash Plus Fund on Moomoo's.

Despite these short-term opportunities, I am committed to staying focused on a long-term strategy of diversifying into high quality stocks.

102362254 : With the GOP now in Congress and Trump in the presidency, I’m sticking to my long-term investing approach. Market shifts are expected, but I’ll focus on diversification, especially through ETFs, to capture potential growth across sectors while managing risk. ETFs remain a great choice for exposure to various sectors without the need to constantly adjust positions

HuatEver : Now that the election results are clear, I'm staying focused on my Regular Savings Plan (RSP). Contributing consistently helps me build wealth over time without trying to time the market. The RSP’s disciplined approach keeps me on track, taking advantage of market fluctuations and compounding, which supports my long-term goals regardless of political shifts![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

ZnWC :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

View more comments...